The end of an empire is a dramatic but also drawn out event with very few willing to face the facts. As the end is getting closer, denial is at its peak. We can probably figure out how it will end but not quite when. Looking at the facts, the beginning of the end is here. The signs are clear. Here we have a country that for the last 27 years has doubled debt every eight years and the trend continues uninhibited. This is a country that for decades has been living above its means by borrowing unlimited amounts. Well, it is not a Banana Republic, nor Argentina or Venezuela but the biggest economy in the world – the soon not so great USA.

The US economy is just like Humpty Dumpty, big, fat and unlikely to recover from the coming fall for a very long time.

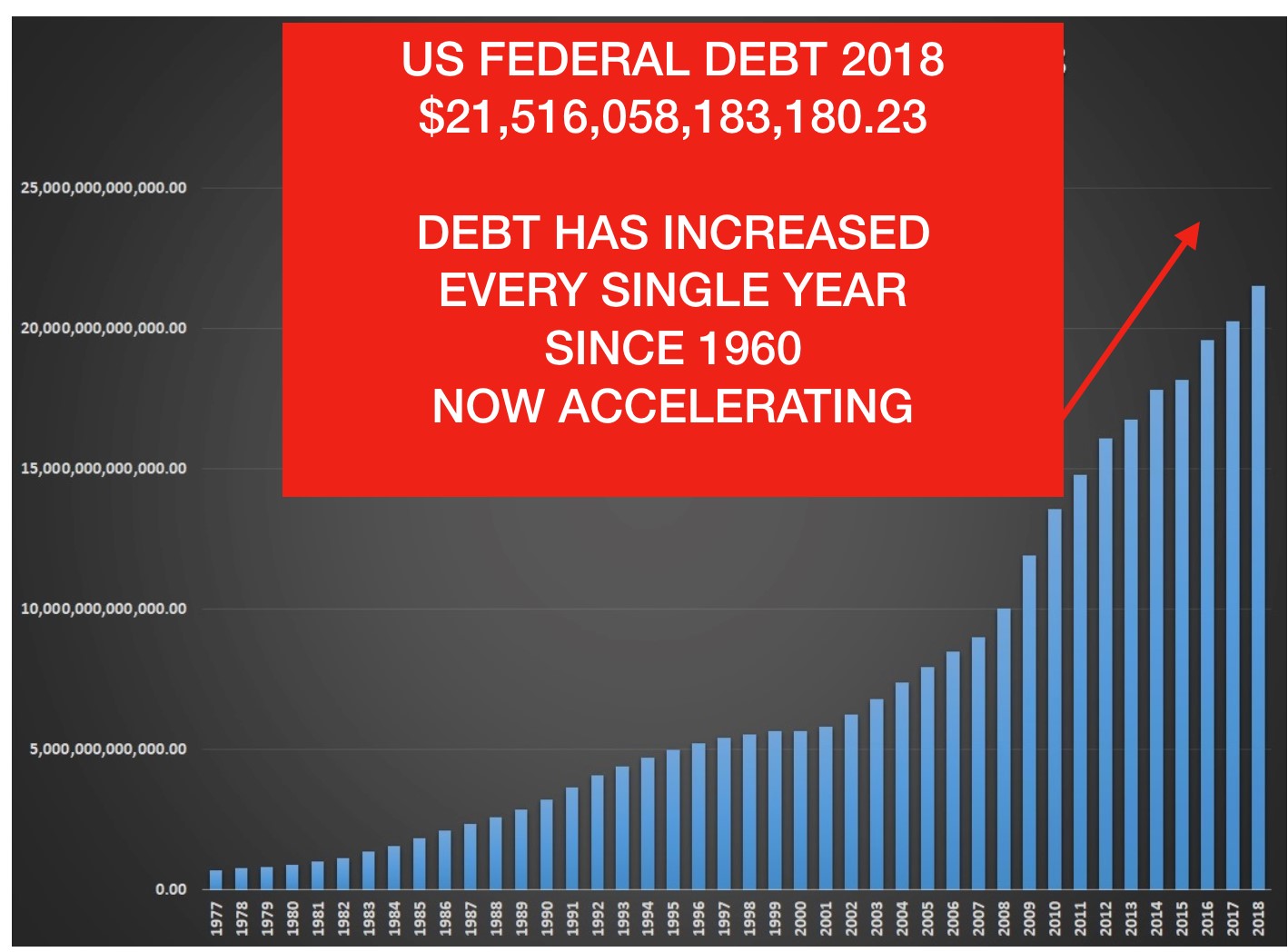

US DEBT HAS INCREASED 58 YEARS IN A ROW

The road to perdition normally takes many turns. But not in the case of the US. This has been a straight road to what will be the most spectacular fall in economic history. Since 1960 US debt has increased every single year without fail. There are some who are under the illusion that the debt went down in the 1990s due to surpluses in the Clinton years. But these were fake surpluses and the debt continued to rise also during that period.

In 1960 the debt was $286 billion and it reached $1 trillion when Reagan become president in 1981. This much admired president managed to almost treble US debt during his reign. No wonder he was popular, especially since he also managed to send the Dow up 2.5 times after a decade of sideways markets. He was a hero and that was certainly deserved. But being a hero involves a great deal of luck in timing. Both Reagan and Thatcher were instruments of their time. After a long period of high inflation, high rates, and low economic growth, these two individuals were the right leaders to steer their countries towards better times.

BORROW AND SPEND – BORROW AND SPEND

But sadly that also involved spending money that you don’t have. This was Keynesian economics at its best. Borrow and spend and then borrow some more and spend that too. This is when the era of the rich getting richer started in earnest with wealth concentration benefitting an ever decreasing part of the population. At the same time, ordinary workers have experienced a massive 55% decline in real wages since 1974.

Leave A Comment