Zacarias Pereira da Mata/Shutterstock

The global economic slump is accelerating.

The signs of deflation are now flashing all over the globe. In our estimation, the possibility of an associated financial crisis is now dangerously high over the next few months.

As we’ve been saying for a while, our preferred model for how things are going to unfold follows the Ka-Poom!Theory as put out by Erik Janszen of iTulip.com.

That theory states that this epic debt bubble will ultimately burst first by deflation (the “Ka!”) before then exploding (the “Poom!”) in hyperinflation due to additional massive money printing efforts by frightened global central bankers acting in unison.

First an inwards collapse, then an outwards explosion. Ka-Poom!

We’ve been tracking the deflationary impulse for a while, and declared deflation the winner back in July of this year.

A Failed Strategy

What exactly do we mean by deflation? Back in 2008 the central banks of the developed world, as well as China, had a choice:

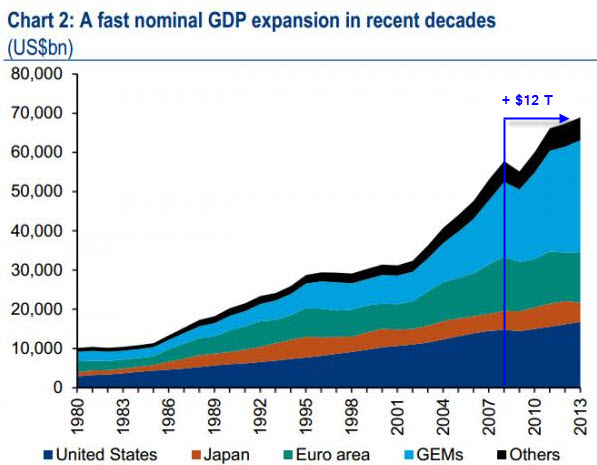

As we all know, they chose option #2. And so here we are, just 8 years later, with nearly $60 trillion in new debt piled on top of the prior mountain — while GDP grew by only $12 trillion over the same time period:

(Source)

[Note: Global nominal GDP is projected to be $68.6 trillion in 2015, virtually unchanged from 2013]

In other words, instead of saying to ourselves: Hmmm…. it was probably a terrible idea to pile up debt at 2x the rate of income growth, what the world did instead was to double down on that terrible idea and pile on more debt at 5x the rate(!) of nominal GDP growth.

Talk about not learning from your past mistakes….

At any rate, what all of that money printing, lower interest rates and new debt creation did was force capital over the globe to look for some place to go. Absent any really good and creative ideas, that money primarily chased yield. It piled into risk assets like stocks and junk bonds, often in bubble-like fashion (meaning, in haste), and without proper due diligence.

The only way the central bank “strategy” (and we use that word very loosely) could have worked was if very rapid economic growth emerged to justify the accumulated levels of debt, comprised of both old and new borrowing. Central banks were indeed hoping such growth would materialize and lesson the burden of servicing the interest on all that debt.

But that growth, quite predictably (as forecasted by us among many others), did not emerge.

Perhaps Japan’s experience should have tipped the central bankers off as to why not. For several decades now, Japan has served as a warning: too much debt is the malady, not the cure.

So here we are. What are we to make of it all? It’s our view that the financial markets are important to monitor because they will signal to us when sentiments has shifted, and events start unfolding at a faster pace.

Judging from the market action over the past month, we think that shift has happened. And we’re increasingly concerned that this next ‘correction’ could be pretty rough for a lot of folks.

Leave A Comment