January was a tough month for some…

The S&P 500 just posted its least volatile January in at least 55 years. Avg high-low intraday range of 0.55%, smallest since at least 1961 (@CallieBost)

January was good for gold again – the 4th positive January in a row for Gold (and 8th positive January in the last 11 years)

The Dow managed to cling to gains for the month (the first positive January for The Dow since 2013)…

The last two days have seen the biggest drop in The Dow since September 26th.

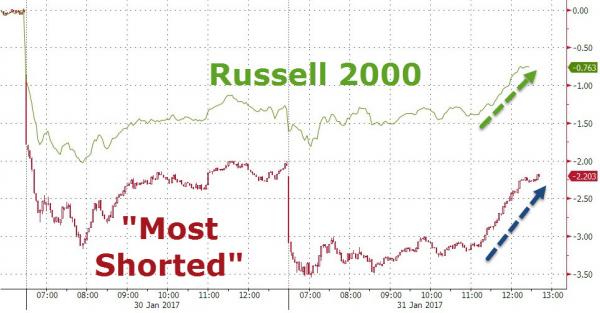

The panic bid in Small Caps saved them from 4th January in a row of losses…

All thanks to yet another short-squeeze…

Dow 20k seems like a long way away again now…

VIX was once again the ramp-igniting ammo…

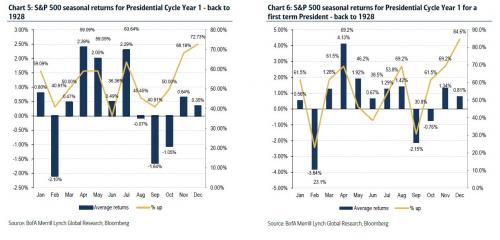

All of which is interesting given that the Presidential cycle signals Feb as a big loser…

Energy stocks were January’s biggest losers, banks broke-even, and tech led the way but faded most in the last 3 days…

Breadth remains ugly…

Notably S&P bank stocks underperformed Russell today… (As Bloomberg notes – blame The REITs)

As Bloomberg’s Michael Regan noted earlier, it’s tempting to blame Trump’s latest statements for everything going on in the markets, but some big-name earnings make it obvious that equities would have struggled even if the President had taken today off. UPS showed the risk from the surging dollar last quarter and spoke of “continued softness in industrial production,” while Exxon Mobil’s $2 billion writedown shows that all the shoes from the oil bear market have yet to drop. Then there is Under Armour and Harley Davidson, which may not be sending any macro signals but are ugly stories regardless. About two-fifths of the way into the earnings season, the rate at which S&P 500 companies are beating estimates has slowed to 2.7% and the growth rate is 4%. A blockbuster earnings season may have helped the market look past the volatility in the White House, but at the moment it’s not providing enough of a distraction.

Leave A Comment