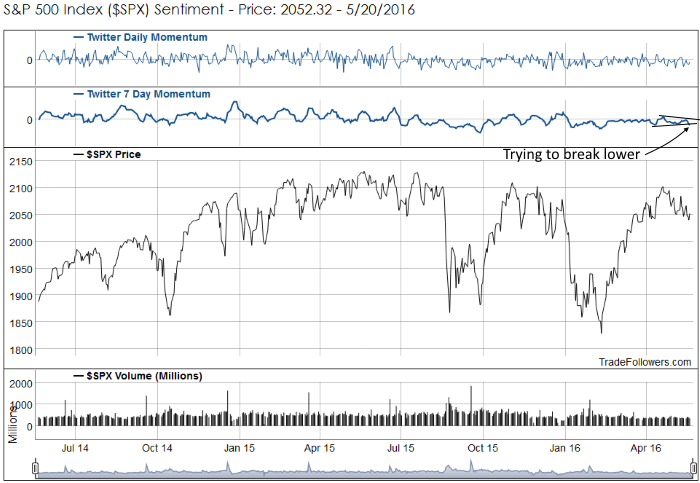

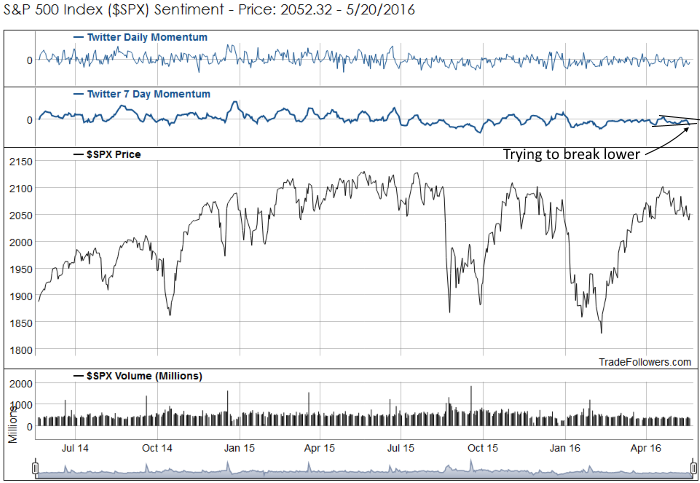

Over the past week, sentiment calculated from the Twitter stream for the S&P 500 Index (SPX) suffered some deterioration. Daily prints were mostly negative and 7 day momentum is trying to break the lower bounds of its triangle. A break lower will likely bring with it heavy selling.

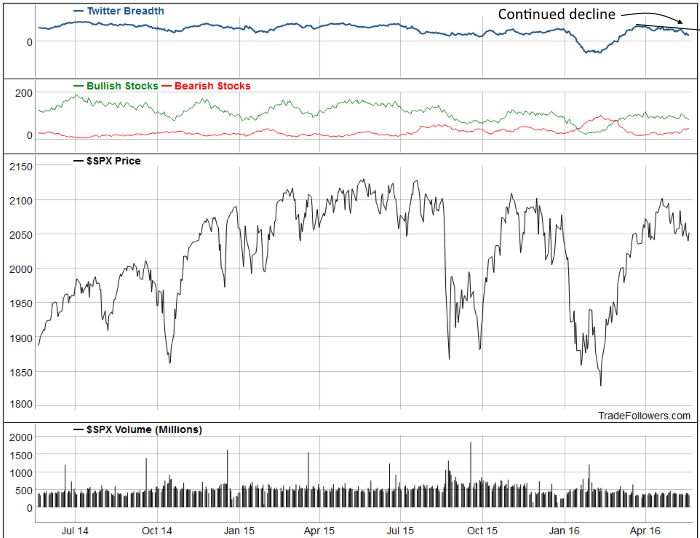

Breadth continued its decline as well. Bulls want to see breadth turn up if the market rallies.

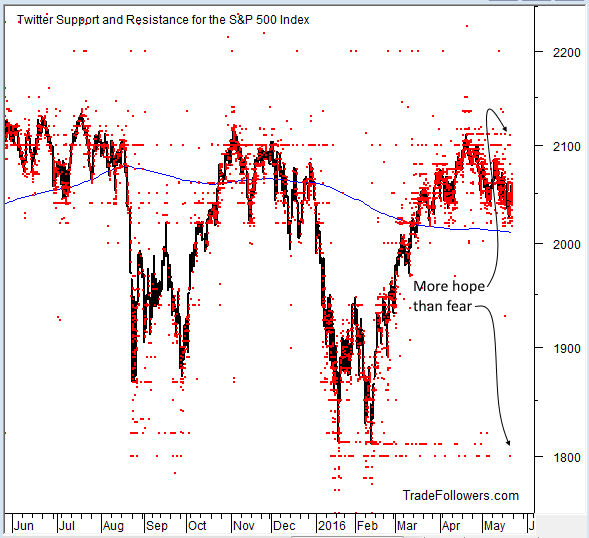

On the bright side, tweets for substantially lower prices dried up. The calls for a trip back to the February lows are almost non existent. Most of the tweets this week had price targets between 2020 and 2040. Both of those areas are now critical support. If those levels are broken to the down side (along with the 200 dma near 2011) we should expect an acceleration of the selling. If however, the market can hold 2040 this coming week it will bode well for the bulls.

Conclusion

Although sentiment deteriorated, fear dried up. The most important things to watch this next week will be the 2020 to 2040 area on SPX and 7 day momentum. If 7 day momentum breaks lower it will probably signal a resumption of the down trend that will crash through 2020 quickly.

Leave A Comment