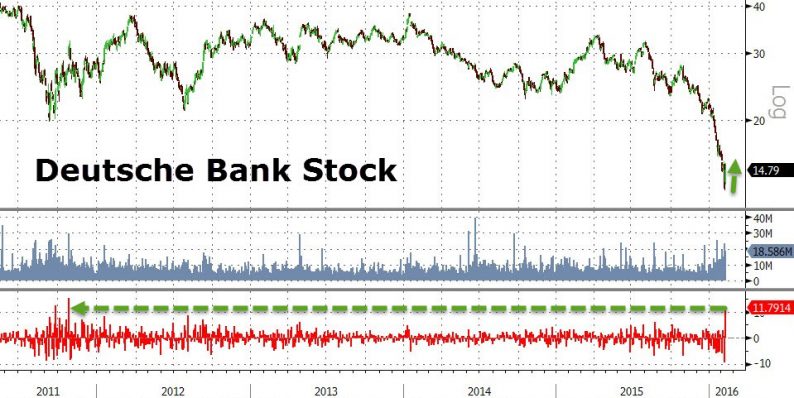

Rumors of ECB monetization (which would be highly problematic in the new “bail-in” world) and old news of the emergency debt-buyback plan have sparked an epic ramp in Deutsche Bank’s stock this morning (+11% – the most since Oct 2011). This extreme volatility is, however, eerily reminiscent of 2007/8 when headline hockey sparked pumps and dumps on a daily basis in Lehman stock… until it was all over.

“Deutsche Bank is fixed”?

Or is it?

Things are already fading…

We suspedct every bounce will be met by opportunistic selling as an inverted CDS curve has seldom if ever reverted back to life.

Leave A Comment