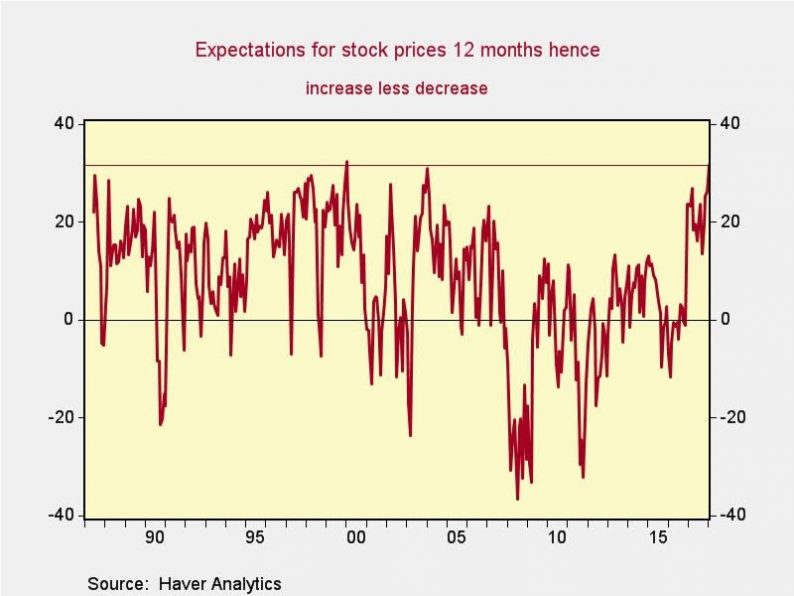

Consumers Were Confident About Stocks

It’s interesting to see the amazing Conference Board consumer confidence survey after the recent two day selloff in stocks. The survey’s cutoff date was January 18th which means it doesn’t include the latest selloff. This recent report was historically optimistic which shows us that the sell off might continue. As you can see from the chart below, the last time this many consumers thought stocks would increase rather than decrease over the next 12 months was January 2000. That’s quite the comparison as that was right before the peak of the biggest bull market ever. I’m not saying the next bear market will start this year, but I think a 10%-15% correction which scares some of the bulls makes sense. It doesn’t matter if the consumers are more informed about stocks than in 2000 because of the advancement of the internet. They still don’t have the emotional checks that separate the successful pros from the unsuccessful retail investors.

The rest of the Conference Board survey was equally fantastic (which might be a bad thing). The overall index was up 2.3 points to 125.4. This was driven by the boost in the expectations index from 100.8 to 105.5. This is different from the University of Michigan survey which was down 1.6% in January. I ascribed the December expectations weakness from this survey to the consumers’ negative opinion on the tax cut. It doesn’t matter much now because we know the consumer spending in December was strong regardless of what the sentiment reading said.

Inflation Expectations Increasing

The stock market is very flippant. Last year, there were negative headlines about how inflation was decelerating. Now that inflation expectations have perked up, as you can see in the chart below, the stock market is selling off. That’s counter-intuitive. There’s clearly a reason to sell off if inflation gets too hot because it forces the Fed to raise rates quicker. However, I don’t think we’re near that point yet. The inflation expectations were higher in 2014 and stocks did well. Therefore, I think those blaming the sell off on rates are looking for an excuse. The reality is the market was extremely overbought which led to a minor cooling off period.

Leave A Comment