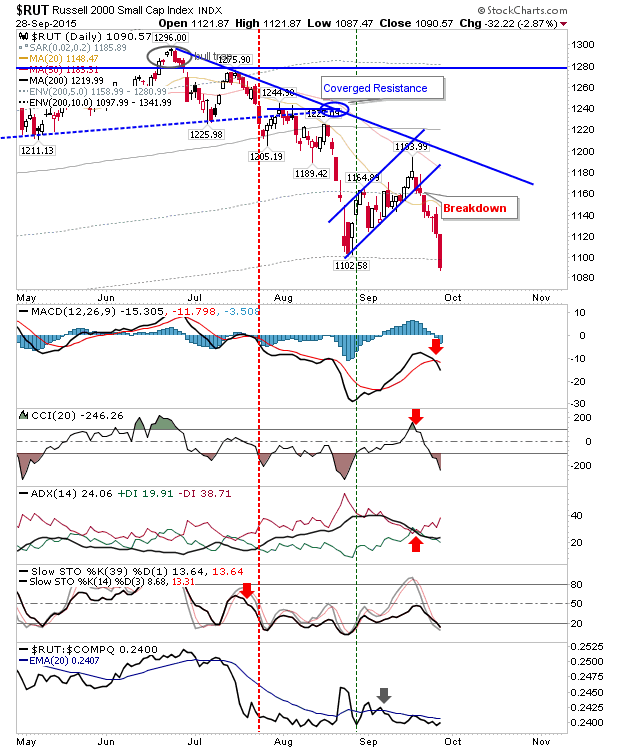

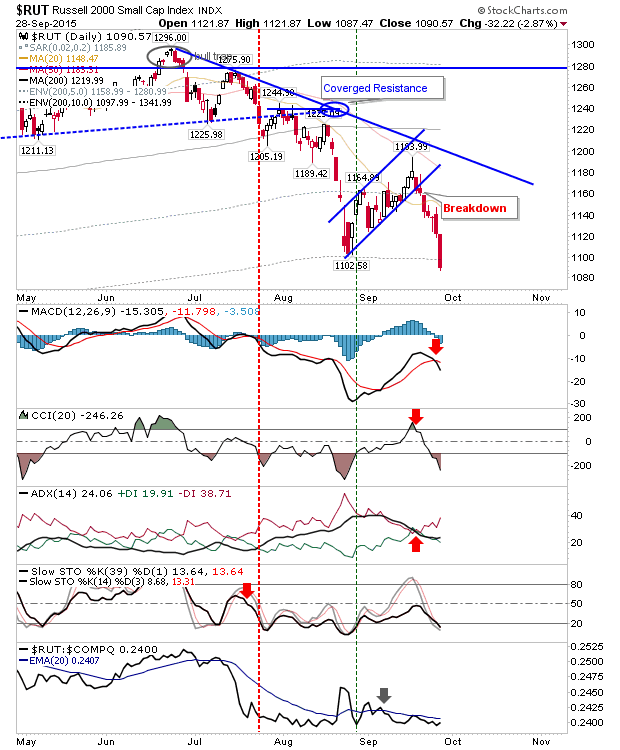

No doubt who controlled market action today, and Bears weren’t stopping at August lows either. The Russell 2000 experienced the biggest hit, undercutting the August low. Next up is the October 2014 low.

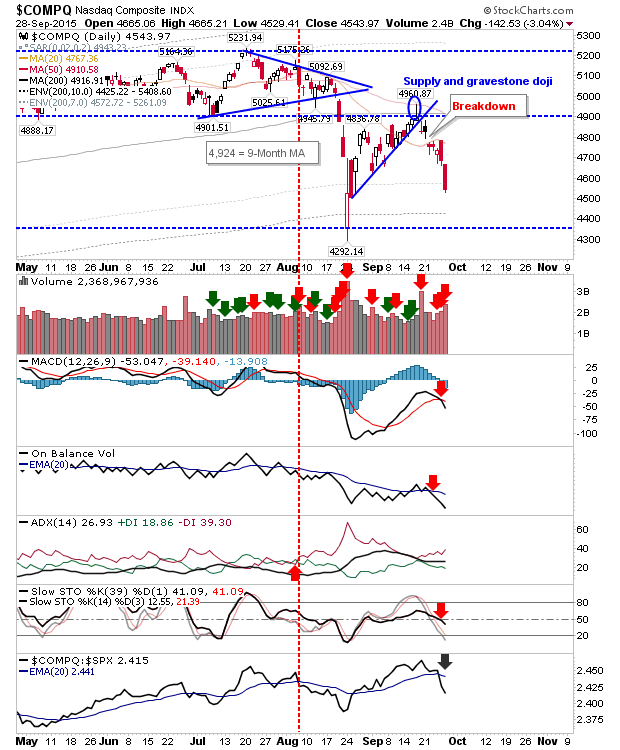

In percentage terms, the Nasdaq took the largest hit. However, it remains some distance from the August low. Shorts may look to chase this down as other indices extend beyond August lows, but a recovery in other indices could set up a decent short covering rally.

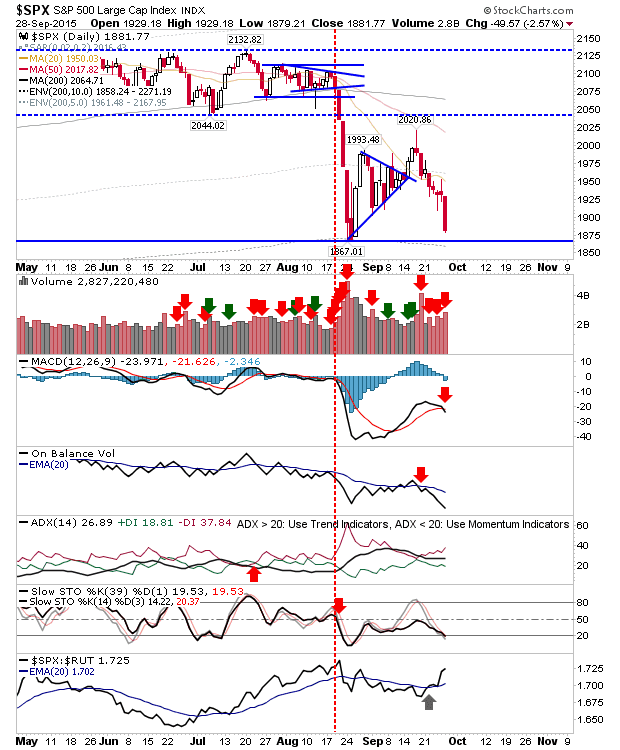

The S&P finished with a MACD trigger strong ‘sell’ and is only a few points from lows. The rate of today’s selling suggests August lows won’t be much of a block. Although pre-market action may offer more of a guide; an open below the August low could be a cue for a rally.

Tomorrow may offer bulls a chance to finally push a squeeze. A short covering rally will be quick and sharp. Look to 50-day MAs as an upside target for a bounce.

Leave A Comment