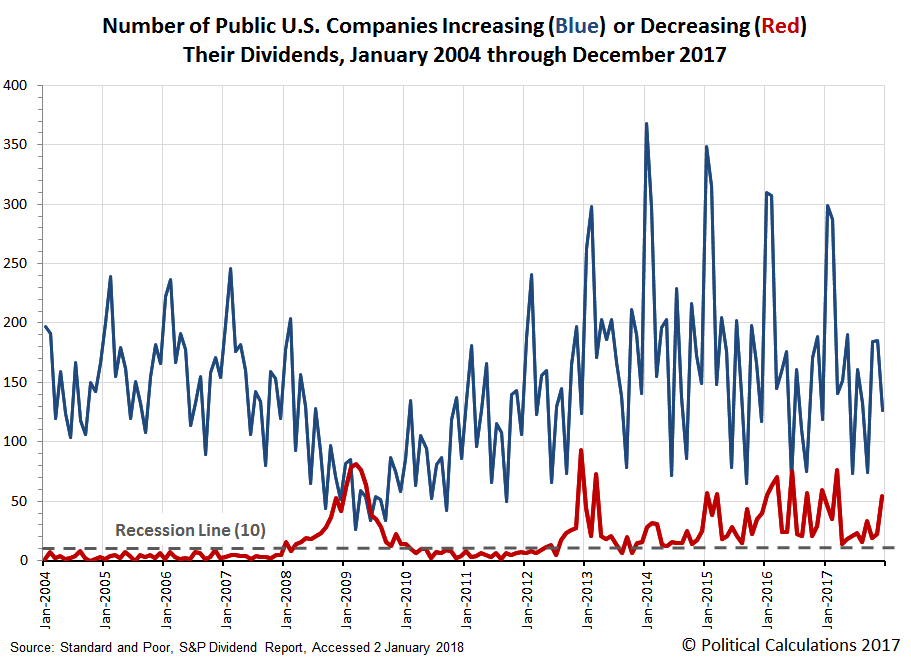

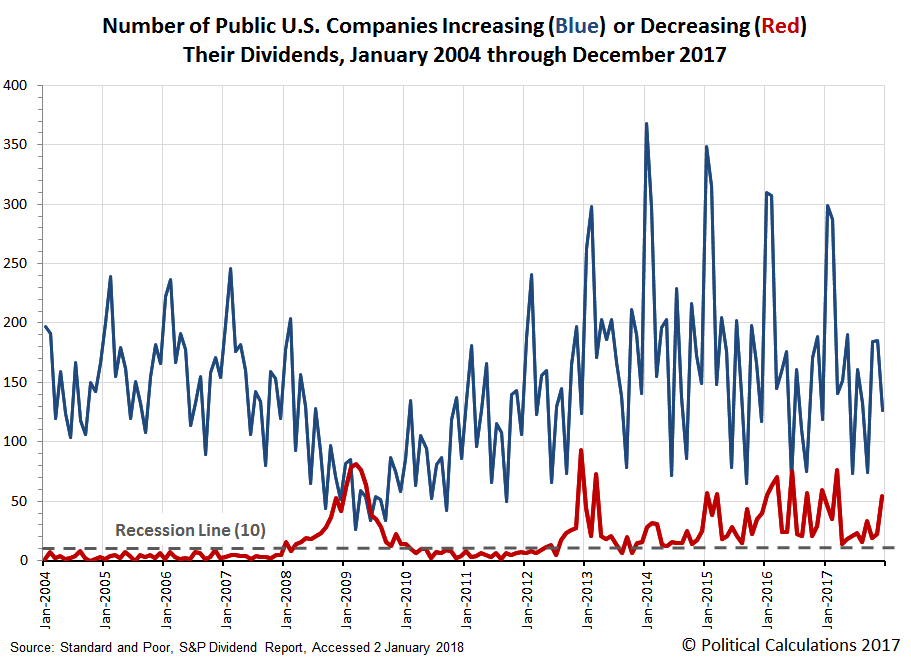

2017 marked something of a turnaround for the fate of dividends paid by publicly-traded companies throughout the year. What had been a multi-year declining trend for the U.S. stock market since mid-2014 appeared to bottom out between March and June 2017, before reversing into an improving trend throughout the rest of the year.

Let’s drill down into December 2017’s numbers, before we comment on some unique developments in the last month of the year that was.

4,506 publicly-traded U.S. firms issued some kind of declaration regarding their dividends in December 2017, the most on record for data that extends back to January 2004. That figure was up from 3,518 in November 2017, and also from the 4,252 that declared their dividends back in December 2016.

144 U.S. companies announced that they would pay an extra, or special, dividend payment to their shareholders in December 2017, up from 109 a month earlier, but down from the 162 that did in December 2016. The greatest number of extra dividends on record was in December 2012, just ahead of the so-called “Fiscal Cliff” tax hike crisis, where 483 U.S. firms went out of their way to pay out a special dividend to their shareholders to minimize their taxes as part of what we call the “Great Dividend Raid”.

December 2017 was a lackluster month for dividend increases being announced, with just 126 U.S. firms boosting their dividends. That figure was down from the 185 firms that hiked their dividends in November 2017, and up slightly from the 119 that raised their dividends in December 2016.

December 2017 also seemed to be a disappointing month for shareholders hoping to avoid cuts in their expected dividend payments, where 54 companies acted to cut their dividends. That was up from 22 in the previous month, but the apparent silver lining is that figure was down from the 59 firms that announced dividend cuts in December 2016.

Finally, 7 firms omitted paying dividends in December 2017, up by one from the 6 that omitted paying dividends in November 2017, and up sharply from the 2 firms that took that action in the previous year’s month of December.

Leave A Comment