When it comes to leveraged ETFs, two of the more popular myths are as follows:

“They all go to 0 over time.”

“If you hold them for more than a few days, you will lose money.”

Fact or Fiction?

You be the judge…

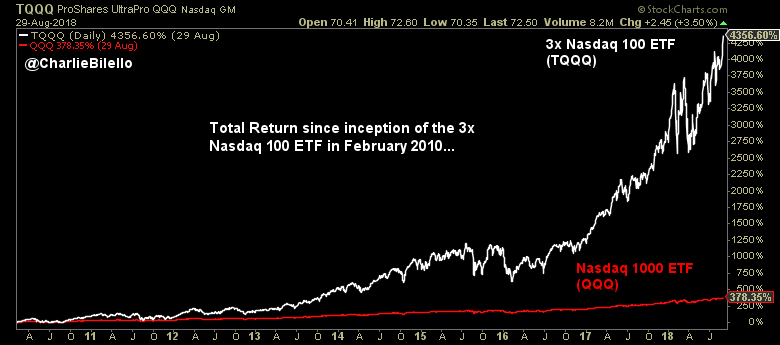

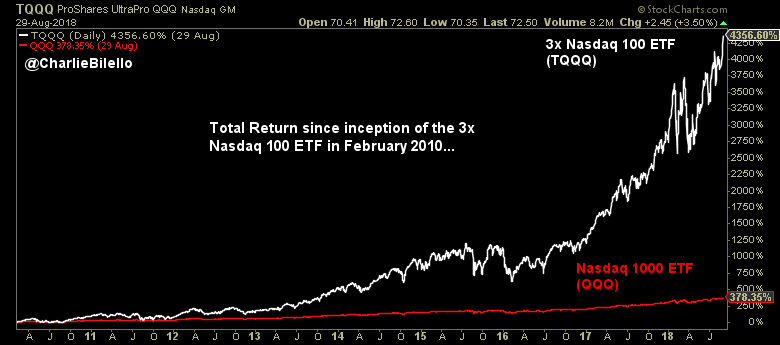

The 3x Long Nasdaq 100 ETF (TQQQ) was launched in February 2010, over 8 years ago. Since its inception it has advanced 4,357% versus a gain of 378% for the unleveraged Nadaq 100 ETF (QQQ).

From this one chart we can say two things:

That’s not to say that leverage is without risk – there is much risk in using 3x leverage – just that the source of that risk does not come from some inherent decay.

What does cause significant problems for constant leverage over time? Volatility.

Daily re-leveraging (to 2x, 3x, etc.) combined with high volatility creates compounding issues, often referred to as the “constant leverage trap.” When the path of returns is not trending but alternating back and forth between positive and negative returns (seesawing action), the act of re-leveraging is mathematically destructive. The reason: you are increasing exposure (leveraging from a higher level) after a gain and decreasing exposure (leveraging from a lower level) after a loss, again and again.

The opposite of this harmful scenario is an environment that is friendly to leverage: uptrends with streaks in performance and low volatility.

As we illustrated in Leverage for the Long Run, these concepts are related. When the Nasdaq 100 is in an uptrend (ex: above its 200-day moving average), it tends to have lower volatility and more streaks in performance (consecutive up days). These factors are helpful when using leverage.

Leave A Comment