Heading into another election year, the sentiment appears to be somber as the candidates reflect on the many data points that suggest an economy that is still growing subpar and wage growth that is still stagnant. And seeing that the most recent bear markets of 2000 and 2008 happened to fall on an election year, investors are on edge about the uncertainty and the level of volatility that it may bring.

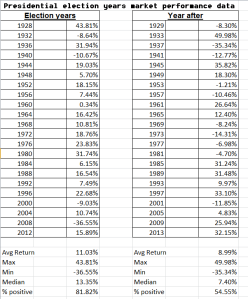

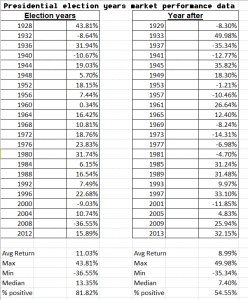

I decided to take a look at the historical data of S&P 500 returns for election years and the following year, since 1928, to see if maybe we are overweighting the most recent experiences.

I have to admit the answers were a little surprising to me. In totality there doesn’t appear to be any discernable pattern. Which goes to show you that markets don’t trade in a vacuum, the situations surrounding each event are almost never the same. And the real components surrounding investment returns have more to do with recession odds, yield curve, corporate profits etc., than they have to do with quantifiable statistics.

However in each case, presidential year and following year, the volatility remained the same (Max to Min return between +50% to -36%). Average returns were similar although presidential elections years showed a better overall return.

The biggest thing that stuck out to me was the overall decrease in volatility during the election years as opposed to the following years. Without doing this study I would have guessed it would have been the other way around, with volatility increased during the election years due to the uncertainty of who would be chosen for the office and what their policies may mean for the economy.

Over 80% of election years ended with a positive S&P 500 return as opposed to the 50/50 coin flip of positive returns for the year following an election.

So we still have no guarantee whether 2016 will be part of the 20% of election years that end negative or part of the 80% of election years that end positive, but the history suggests that the outcome may not be a gloomy as others will lead you to believe.

Leave A Comment