US manufacturing is booming.

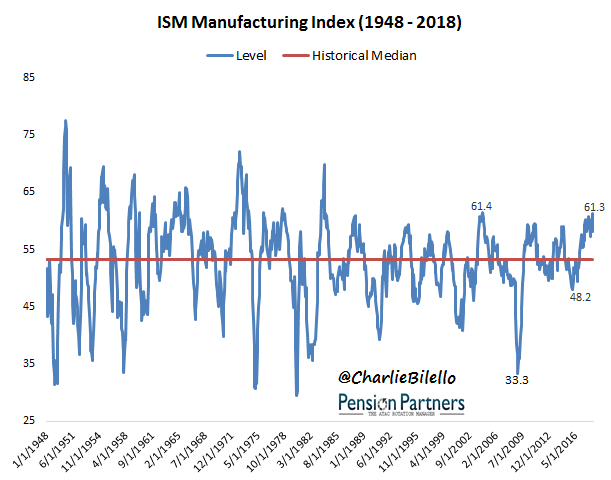

In a report released this week, the ISM Manufacturing Index moved up to 61.3, the second-highest level in the last 30 years.

Data Source for all charts/tables herein: FRED, Bloomberg

Many are saying that’s great news for the stock market because increased manufacturing activity is evidence of a stronger economy. This seems logical but does the data support such a conclusion? And is it prudent to use manufacturing indicators to time your exposure to stocks?

Let’s take a look…

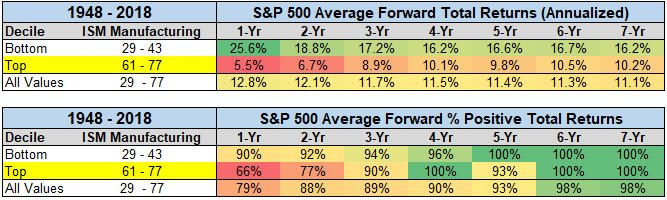

1) Is there evidence of outperformance in stocks following the highest ISM Manufacturing levels?

If we sort the ISM Manufacturing Index (going back to 1948) into deciles and compare the highest and lowest 10% of readings, we find above-average returns following the weakest readings and below-average returns following the strongest readings (highlighted row).

Over the subsequent year, the weakest ISM readings were followed by an average S&P 500 return of 25.6% versus a return of 5.5% for the strongest ISM readings. There is simply no evidence to justify a more bullish outlook on stocks following the strongest ISM readings.

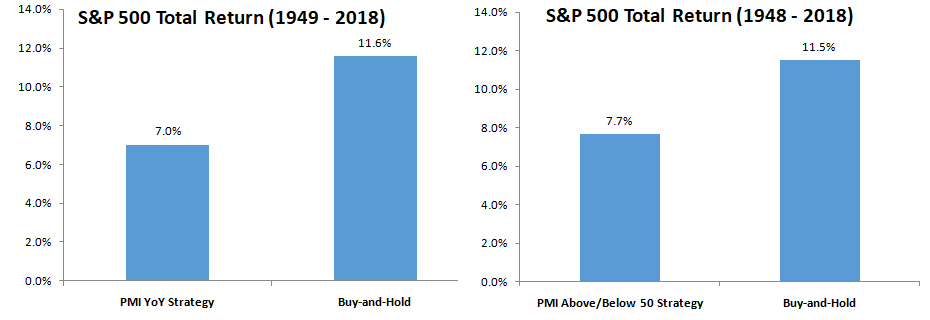

2) Should you use ISM Manufacturing levels to time your exposure to stocks?

ISM Manufacturing readings above 50 indicate increased manufacturing activity while readings below 50 are said to indicate a contraction in activity.

Some pundits say you should only own stocks when ISM is above 50. Others say that you should look at the rate-of-change, and only own stocks when the ISM is positive year-over-year.

Going back to 1948/1949, how would these two strategies have fared versus a simple buy-and-hold? In both cases, far worse.

Note: in the “PMI YoY Strategy” you are buying the S&P 500 when PMI is positive year-over-year and selling the S&P 500 when it is negative year-over-year. In the “PMI Above/Below 50 Strategy” you are buying the S&P 500 when PMI is above 50 and selling the S&P 500 when PMI is below 50. For simplicity, this analysis ignores commissions, slippage, and taxes.

Leave A Comment