The dollar headed for its worst weekly loss since February following slowing inflation data out of the US and amid bets that other major central banks will start to normalize monetary policies, helping global stocks extend their lead as the MSCI All-Country World Index gained 0.3%.

The bout of dollar weakness helped the MSCI Asia Pacific index extend its rebound from the worst run of losses in 16 years, while stocks in Europe gained along with S&P500 futures as renewed prospects for U.S.-China trade talks and a desperate rate hike action by Turkey (which again prompted Erdogan’s angry rebuke) to support its currency, fostered a positive mood.

In Europe, the Stoxx 600 Index increased 0.2% to the highest in more than a week; Germany’s DAX Index jumped 0.4% also to a one week high, and leading the way in European equities, driven by Infineon, which benefited from broad-based IT sector strength after yesterday’s outperformance in the US. The SMI was the laggard and weighed on by Roche’s announcement of a “moderate” sales growth in 2019.

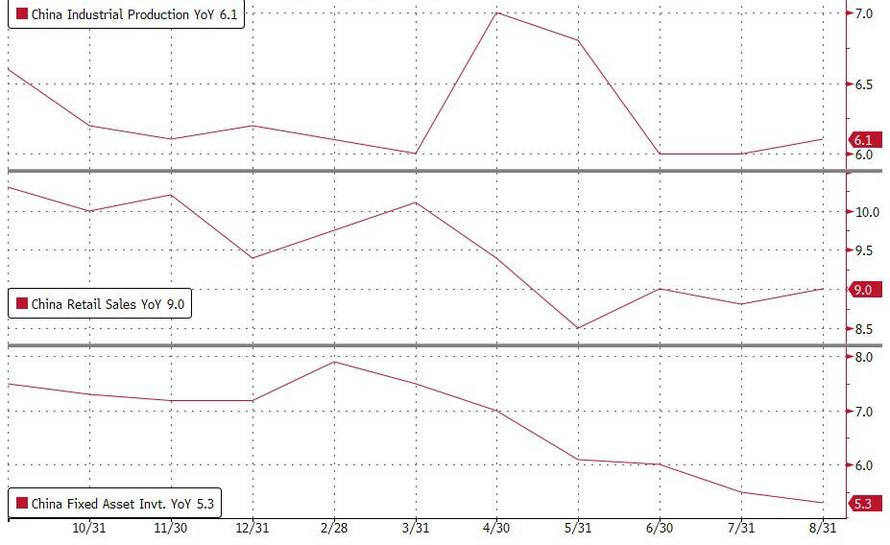

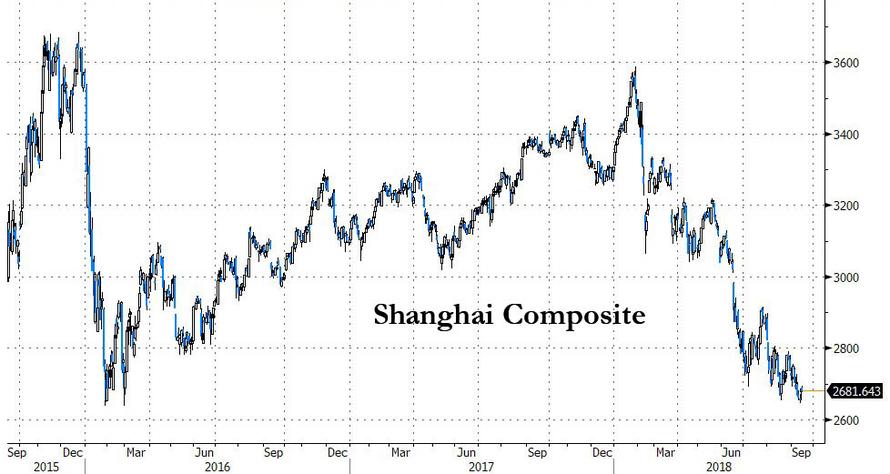

Asia’s cheer was limited, however, as China shares again underperformed after overnight’s Chinese economic data dump showed that fixed-asset investment fell dropped to 5.3%, missing expectations and hitting a new record low, even as retail sales surprised modestly to the upside.

The yuan stayed lower as the PBOC added net 150 billion of repo liquidity; the Shanghai Composite closed down 0.2%, and just off the lowest print since the bursting of the 2014/2015 stock bubble.

Offsetting China’s weakness, markets in Japan, South Korea, and Hong Kong climbed as Asian equities ended the week on a high after enduring the longest daily losing streak since 2002.

Emerging-market stocks and currencies extended a rally following Turkey’s larger-than-expected rate increase, the kiwi outperformed on a manufacturing uptick, the yen reversed early weakness after Abe’s policy exit comment, saying QE can’t last forever; India’s rupee gained from recent record low prints while India’s 10-year yield falls five basis points to 8.08% on slower inflation.

In G-10 FX, the euro rose to its strongest level versus the dollar in more than two weeks amid improving risk appetite and dollar weakness after soft U.S. inflation data on Thursday, and after the ECB said it expects to phase out new bond purchases by the end of the year. The Bloomberg Dollar Spot Index headed for its worst weekly performance since mid-February as the U.S. curve flattened and euro-area stocks rose.

“The rally in the euro post the ECB meeting and the easing of trade tensions are weakening the dollar,” said David Forrester, FX strategist at Credit Agricole CIB in Hong Kong. “The soft U.S. CPI overnight is also holding the dollar back”

Elsewhere, the krona led losses among G-10 peers as Swedish inflation missed estimates, while emerging-market currencies extended their recent advance. The British pound headed for a six-week high and gilts fell after Bank of England Governor Mark Carney told lawmakers that a no-deal Brexit would see interest rates rise rather than fall.

10-year Treasuries dropped, with the yield rising above 2.98%.

One day after central bank “Super Thursday”, the Russian Central Bank also surprised markets when it hiked its key rate Sep 7.50% vs. Exp. 7.25% (Prev. 7.25%). The bank said they will consider the necessity of further rate hikes taking into account inflation and economic dynamics against the forecast. They added the increase of key rates will help maintain real interest rates on deposits in the positive territory, which will support the attractiveness of savings and the balanced growth in consumption.

Investors will be happy to close the busy week on a positive note, following numerous, often conflicting reports, including cooling U.S. inflation to central-bank meetings in Europe, the U.K., and Turkey. And while the Russian central bank unexpectedly hiked rates moments ago to 7.50% with most expecting an unchanged 7.25% print, all eyes will be on American retail sales.

Speaking to Bloomberg, Robert Shiller said that while U.S. equities are now “highly priced,” they could still go “a lot higher,” and adding that “the U.S. is just doing great right now in terms of the strength of the economy and the stock market,” with Trump’s tax cuts and deregulation moves helping stoke sentiment. Of course, sooner or later the hangover from the sugar high will come…

In geopolitical news, North Korea said US sanctions over cyber-attack is a smear campaign against North Korea and that the US is misleading as if North Korea were behind the Sony hack, while it warned that sanctions could impact implementation of US agreement.

Elsewhere:

never correct and that we will see the results of central bank independence after the rate hike

The oil market is languishing around yesterday’s lows after the previous sessions losses of over 2%. Brent and WTI are both set for gains of over 1.5% this week, as weather reports remain in focus, with Hurricane Florence set to make landfall in North Carolina today. In the metals scope, gold is currently benefitting from a softer USD and is currently up 0.5% on the day. LME copper has remained stable around two-week highs as traders remain wary of trade talks, after US President Trump said the US “are under no pressure to make a deal with China, they are under pressure to make a deal with us” in Thursday’s session.

Leave A Comment