My last article, One Dozen Thoughts on Dealing with Risk in Investing for Retirement, was a mashup of two of my older articles Managing Money for Retirement and From Stream to Shining Stream. I wrote as a submission to a Society of Actuaries request for essays on the topic of Post Retirement Needs And Risk Committee Managing Retirement In Light Of Diverse Risks. I added more material, chopped out some of the weaker stuff, and tried to rewrite it to have a consistent tone, etc. As Susan Weiner, our go-to person on investment writing says, “The best writing is rewriting.” Given some of the responses I got, the article was well received. Hopefully the folks at the SOA will like it as well, but it will probably be the least technical essay they receive. It also still has some typos. Oops. So it goes.

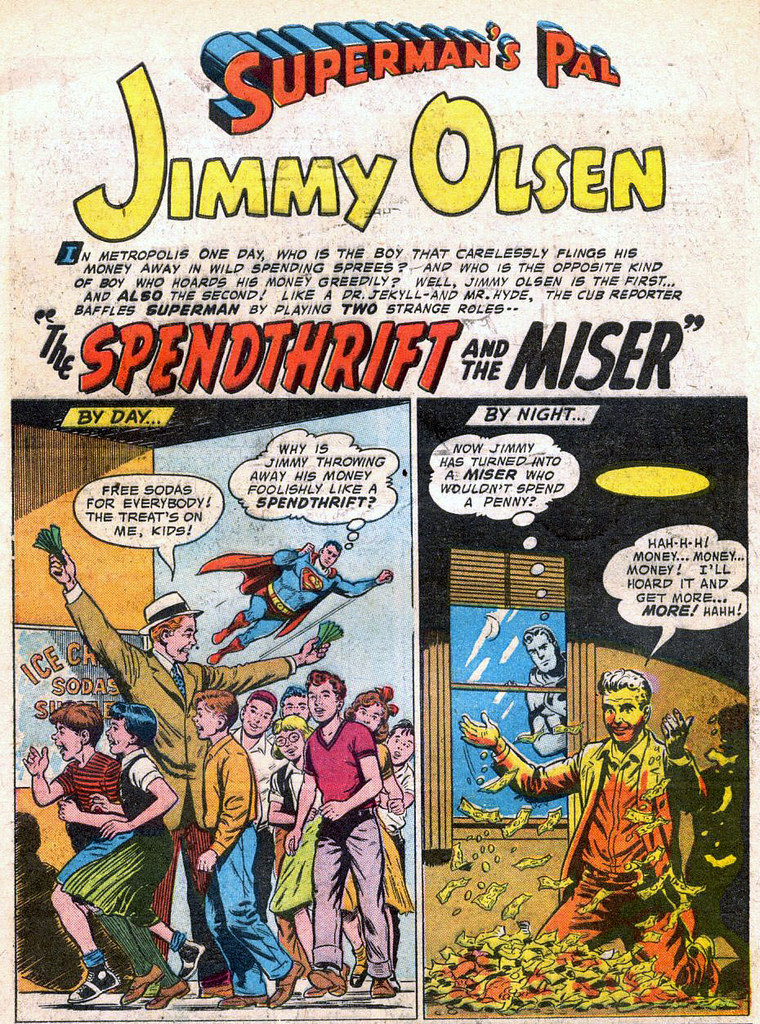

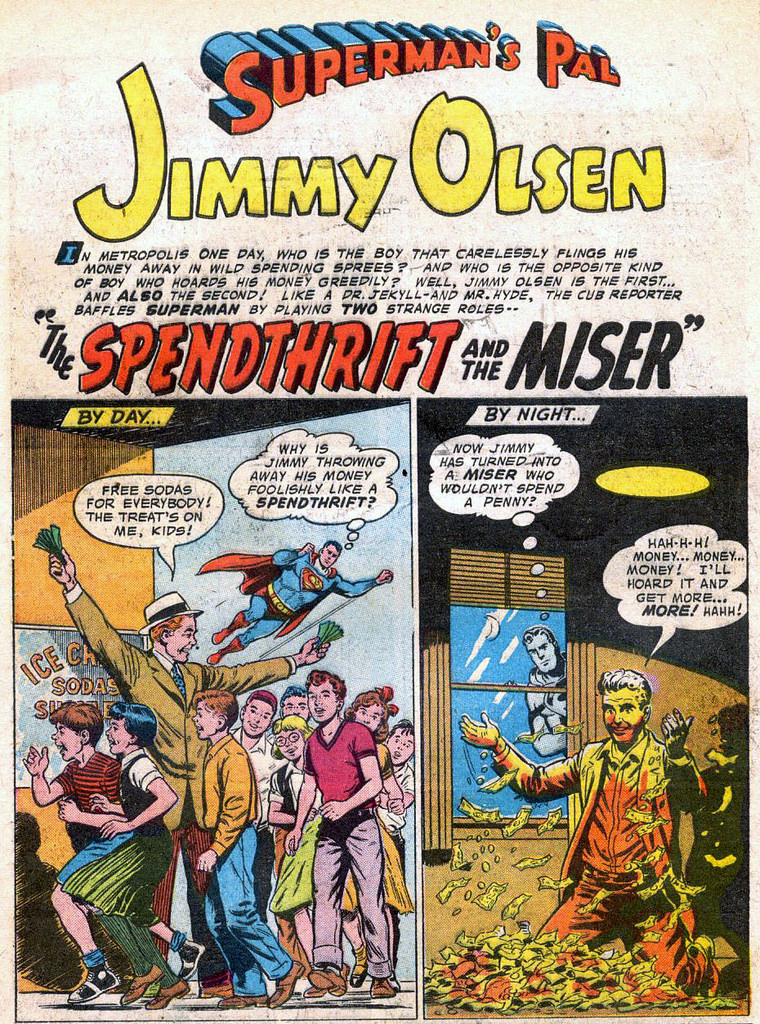

Picture Credit: Tom Simpson || As Aristotle might say, the middle way is best

There was one comment on the article that I would like to highlight. Here it is:

The other thing to watch for with retirement spending is not spending enough of your investments, especially in early retirement. Many studies have shown that actual spending in retirement decreases by around 50% from age 55 to age 80. One study in Germany showed that people’s wealth actually started increasing again in their 70’s as their pension incomes exceeded their lifestyle costs, with the resultant increase in savings.

People need to think about this in how they structure their retirement spending. It may make complete sense for someone with a $1 million portfolio and a standard government pension to spend $800,000 of that $1 million by age 80, leaving a $200,000 cushion for the lower cost part of their lives as most of their day-to-day living expenses will be covered by their pension.

People need to spend their money when they are active and mobile and able to enjoy it. I think the financial press needs to talk about this more, so people are not scared into not spending their money until it is too late.

The author of the book that I most recently reviewed, Carlos Sera, gave one of his sayings on page 97 of his book:

“There is a fine line between over-saving and under-living.”

Leave A Comment