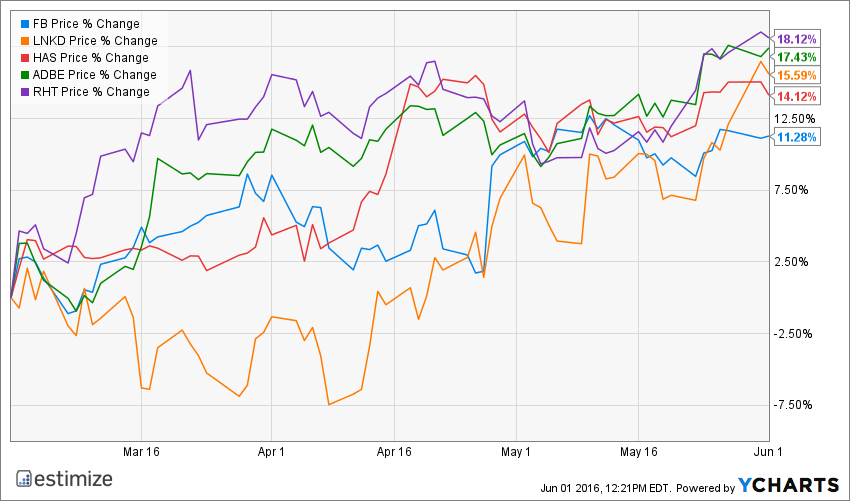

With over 90% of companies having reported earnings for Q1, this quarter can largely be deemed a disappointment. Despite a number of companies beating on both the top and bottom line, earnings growth from a year earlier still came in negative. This marked the first time the S&P 500 recorded four consecutive quarters of year over year declines in earnings since 2009. However, it hasn’t been so bad for everyone and ahead of Q2 earnings a number of companies are poised to impress investors. They include, Facebook (FB), LinkedIn (LNKD), Hasbro (HAS), Adobe (ADBE), and Red Hat (RHT). According to the Estimize data these names have been on the move, signified by consistent year over year growth, heavy upward revisions, and a history of beating expectations. The combination of these factors have typically led to substantial out performances and a pop in share prices.

Facebook (FB) Information Technology – Internet Software & Services

Lately, there are only a few names that can do no wrong in the eyes of Wall Street, and Facebook is one of them. The social media giant unsurprisingly bested its first quarter earnings with a user base that hasn’t stopped growing. The quarter featured double digit gains in monthly and active users with ad revenue growth skyrocketing over 50%. Active users should sustain their current growth levels but Facebook is more than just a social media company at this point. The company’s acquisitions of WhatsApp, Instagram and Oculus Rift have already exhibited robust growth. With Oculus prepared to hit the market in the next few months, Facebook have a new source of revenue.

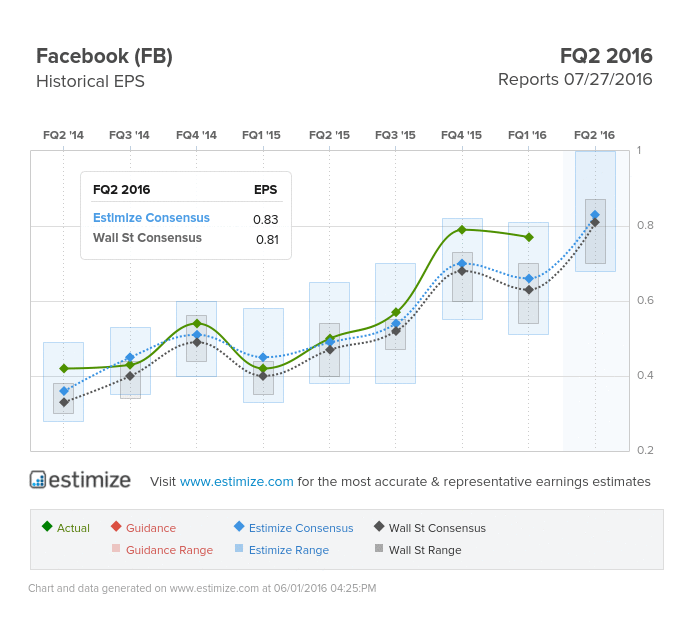

Estimize is high on Facebook to maintain its success into the second quarter. The consensus data is looking for earnings per share of 83 cents on $6.01 billion in revenue, 2 cents higher than Wall Street on the bottom line and $20 million on the top. Compared to a year earlier this reflects a 64% increase in profitability and 49% revenue growth. In the last month, per share estimates have increased 16% and should continue to rise as we near its report date. For shareholders, strong earnings have contributed to the 50% gains in the stock.

Leave A Comment