The last 2 weeks in markets…

And to all those who took Cramer’s advice to buy the dips…

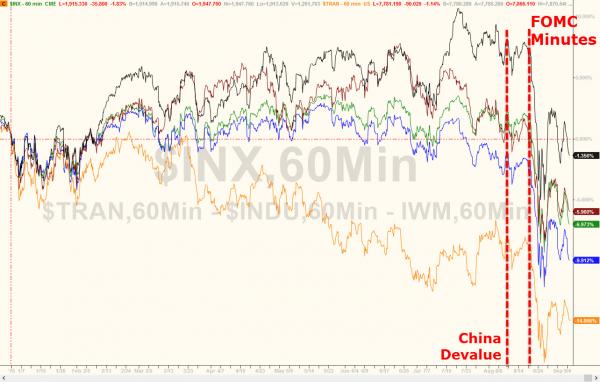

Some big moves this week…

So before we start, Japan was really ugly…

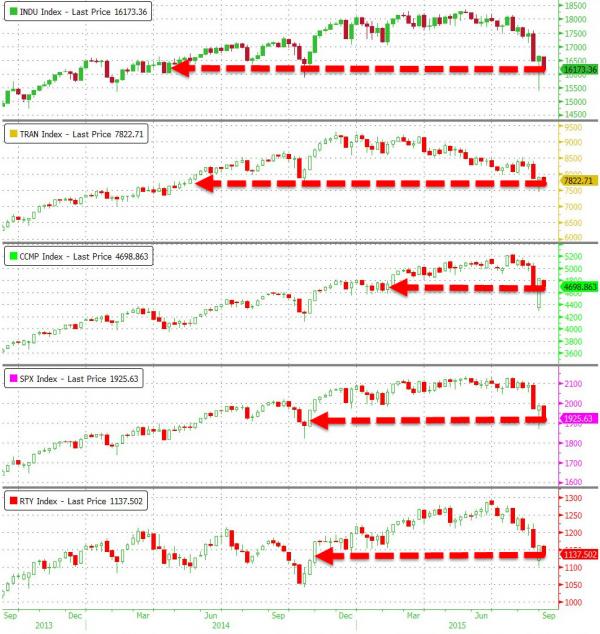

And some context for the US equity index drops…

With everything red year-to-date… (and since the end of QE3, only Nasdaq is clinging to the green)

A quiet Friday before Labor Day weekend provided no juice for momo ignition and apart from a brief algo-driven pop on payrolls, stocks were a one-way-street lower…until the late-day VIX-smash ramp which closed ugly…

And Futures show an ugly night turned even uglier…

On the week, evereything is red…

Dow Futures give us some context for the last 2 week’s moves. Bounce dies at Fib61.8% retracement, breaks through 50% and makes lower high as today tested post Black-Monday lows…

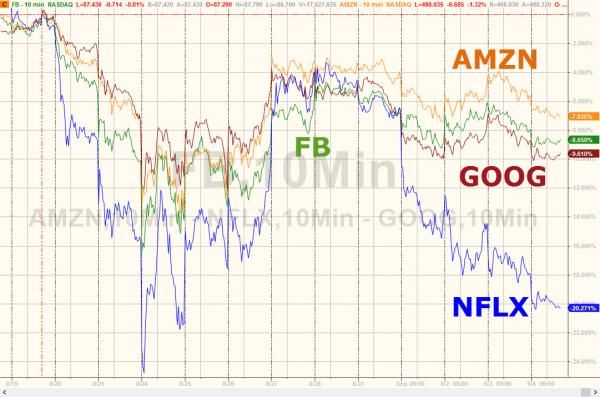

FANG is FUBAR… (post FOMC Minutes)

Financials continues to get hammered (as investors rushed to the safety of Homebuilders this week!?!) – but the panic-buying in the last hour saved it from being a lot worse…

Leave A Comment