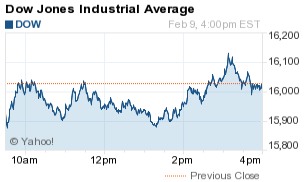

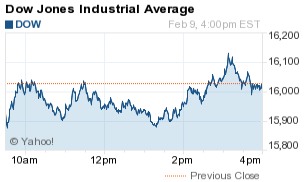

How Did the Stock Market Do Today?

Dow Jones: 16,014.38; -12.67; -0.08%

S&P 500: 1,852.21; -1.23; -0.07%

Nasdaq: 4,268.76; -14.99; -0.35%

The Dow Jones Industrial Average today (Tuesday) lost 12 points as oil prices fell again on supply concerns and traders prepared for U.S. Federal Reserve Chairwoman Janet Yellen’s appearance before Congress on Wednesday. The markets received a late-session boost from biotech stocks after the Nasdaq Biotech Index added 0.1%. Shares of Gilead Sciences Inc. (Nasdaq: GILD) added 2.3%, while Allergan Plc. (NYSE: AGN) gained 2.3%.

The CBOE Volatility Index (VIX) – Wall Street’s fear gauge – was up 1.9%.

On the economic front, the U.S. Commerce Department announced domestic wholesale inventories fell for the third straight month in December. According to the agency’s report, U.S. companies aimed to reduce unsold products, news that could signal another downward revision of fourth-quarter economic growth. Meanwhile, the JOLTS survey indicated job openings increased during the month of December.

Top Stock Market News Today

Stock Market Today: Six of the 10 major S&P sectors declined, with financial stocks and technology stocks raising new alarms for investors. Shares of JPMorgan Chase & Co. (NYSE: JPM) and Citigroup Inc. (NYSE: C) both slipped more than 0.5%. Meanwhile, shares of Facebook Inc. (Nasdaq: FB), Alphabet Inc. (Nasdaq: GOOGL), and Microsoft Corp. (Nasdaq: MSFT) were all down during today’s trading session.

Oil Prices: Crude oil prices fell as investors anticipate a large buildup in domestic crude inventories. WTI crude oil – priced in New York – slipped 5.9% to hit $27.94 per barrel. Meanwhile, Brent crude – priced in London – dipped 7.8% to hit $30.32 per barrel. Shares of Exxon Mobil Corp. (NYSE: XOM) dipped 0.4%, while shares of Chevron Corp. (NYSE: CVX) plunged 3.6%.

On Tap Tomorrow: On Wednesday, Federal Reserve Chairwoman Janet Yellen will present the central bank’s semi-annual monetary report to the House Financial Services Committee. Later in the morning, expect the monthly petroleum status report from the U.S. Energy Information Administration. Companies set to report quarterly earnings include Tesla Motors Inc. (Nasdaq: TSLA), Twitter Inc. (NYSE: TWTR), Cisco Systems Inc. (Nasdaq: CSCO), Whole Foods Market Inc. (Nasdaq: WFM), Zynga Inc. (Nasdaq: ZNGA), Expedia Inc. (Nasdaq: EXPE), Humana Inc. (NYSE: HUM), Time Warner Inc.(NYSE: TWX), and Flowers Foods Inc. (NYSE: FLO).

Leave A Comment