By the time Shinzo Abe had been elected, he already had the wind at his back. At least it could have been described that way by Economists. While Abe was given a second chance at being Japan’s Prime Minister in the middle of December 2012, his government found the yen and stock market moving in his direction. These are called “tailwinds”.

But are they?

Japan’s an interesting case study in whichever factor you might research. Been there, done that. And yet, it’s as if in the mainstream of Economics the island nation is some far off, desolate island. Japan’s economy may be mired in a thirty-year slump as if that could somehow ever be normal, but it’s not been completely disconnected to everything going on around it.

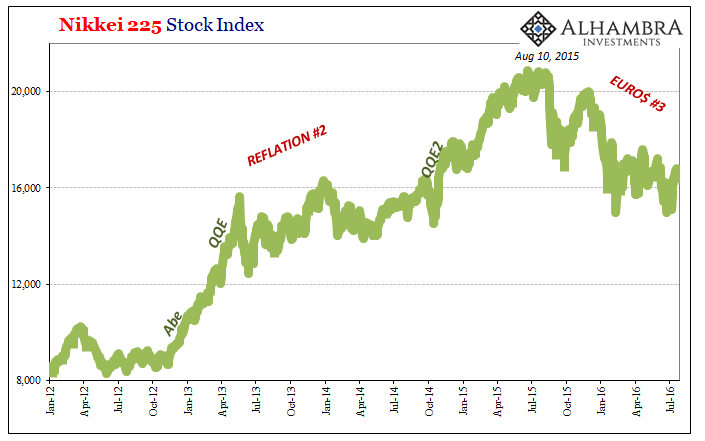

By the time Prime Minister Abe officially put forward the three arrows of his Abenomics, the Nikkei 225 was on fire. With polls prior to the election showing the inevitable, and the yen already moving lower in anticipation, stocks had been up sharply for more than a month before any votes had been cast.

And that was six months or so before QQE, the first so-called arrow would begin. Thus, once again, quantitative easing isn’t money printing; but, as I often write, central bankers are delighted if you think it is. In other words, stocks are portfolio assets, meaning that they are bid out of savings far more than any new money additions.

In the central bank paradigm, it is all about expectations. These are assumed rational, but these kinds of stock market reviews make you wonder.

It wasn’t QQE and “money printing” that pushed the Nikkei off its low levels. Rather, investors were bidding (reallocating savings) in anticipation of it. Whether or not people believed it was going to be that is debatable, for many it wasn’t about the level of bank reserves specifically but the clear commitment from the Bank of Japan to, borrowing from Mario Draghi, do whatever it took to get Japan’s economy moving again.

Therefore, things started to move in that direction long before anything could move at the BoJ.

That specific stock rally was exhausted by the time QQE actually began (apparently, it didn’t the “money” that QQE would “print”). It wouldn’t be until October 2014 that the Nikkei would make a second push up to and above 20,000.

Leave A Comment