The headlines say the durable goods new orders improved. The unadjusted three month rolling average also improved.

Analyst Opinion of the Durable Goods Situation

Defense aircraft was main driver this month. This series has wide swings monthly so our primary metric is the three month rolling average which marginally improved. The real issue here is that inflation is starting to grab in this sector making real growth much less than appears at face value – and this month if we inflation adjust the rolling averages they decline. The trends on this series are indicating marginal economic improvement.

What should be concerning to analysts is the continuing contraction of backlog (unfilled orders) which have been contracting year-over-year since mid 2015.

.Econintersect Analysis:

Year-over-Year Change of 3 Month Rolling Average – Unadjusted (blue line) and Inflation Adjusted (red line)

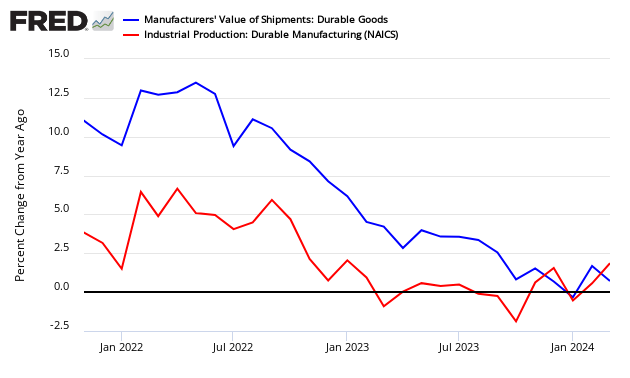

Comparing Seasonally Adjusted Durable Goods Shipments (blue line) to Industrial Production Durable Goods (red line)

Leave A Comment