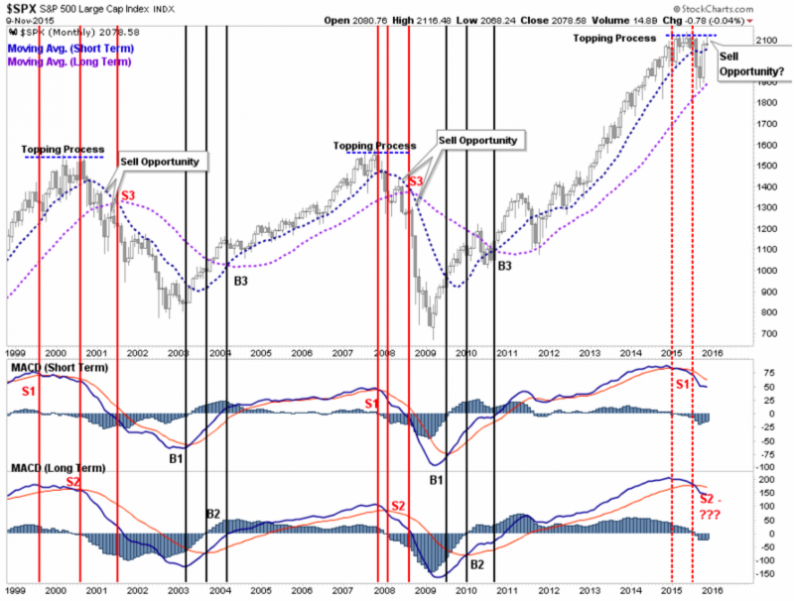

A ‘rolling Bear Market’ – has been a hallmark of technical indicators revealing internal (and insider) distribution, virtually throughout most of 2015. Starting in the 1st Quarter, when the market ran-into a projected ‘brick-wall of resistance’; dropped and rebounded into the Spring in-line with our S&P pattern calls; and then gradually saw greater pockets of selling, while they rationalized optimism.

We called-out this market as an historic distribution masked by a ‘rearranging of deck chairs’ on a potential Titanic; and expected the most notable correction to commence after early-mid July, while I would be cruising the Mediterranean (and not on the White Star Line.. operator of Titanic). The market complied in late July and August; projected to decline more aggressive upon my return (it was kind to wait, though I did regular daily commentary while traveling); result: a superb series of downside gains; despite encountering stronger than typical rebounds I called ‘automatic rally’ in September and October. That bolstered a feeling of market immortality which became even more ‘reckless abandon’ by the Bulls in recent weeks; so we forewarned November wouldn’t be October.

It was not ‘sudden onset’ of North Atlantic chills near ice floes; this was clearly telegraphed as an ‘SOS’ from the narrower universe of stocks (one momentum favorite after another falling overboard) all through the recent so-called upward thrust. Why are people acting ‘as if’ this is a surprise or something new? The rolling Bear is at least 8 months old; perhaps why many frigid funds melted.

That iceberg ahead was shielded by ‘pretending’ a solid domestic growth rate (in earnings and USA GDP) was coming; which never materialized. And just incidentally, all year we pointed-out no factual basis existed for the outlandish bullish guidance many relied upon. The charts (like the Atlanta Fed GDP Now) warned for many months that strong growth was the mirage, not the iceberg. I shared all this not as an ‘opinion’ but as evidence that the illusive big recovery wasn’t there; any more than last week’s Jobs number was ‘really’ bullish.

That’s because the largest leveraged advance in history, unaccompanied by a comparable advance in ‘real’ profitability; had an associated ‘canine aroma’, as a bull market in buybacks, often leveraging shareholders with indirect debt by the associated bond offerings, reducing floating supply or enhancing earnings superficially (often even if top-line revenue was mediocre), in many cases just saw sector-by-sector the market lose it’s ‘mojo’ as we had assessed all along.

As the year evolved, through a series of ‘range-bound’ up and down moves (a lot of them around 2100 S&P close to where we are now), we primarily tended to short spikes rather than buy for them; and surprise, it worked superbly most of the time. Yes we maintained a bias, but a bias based on facts, not fiction. Of course markets without valid underpinnings, but with ‘controlled’ institutional or banking support, won’t turn on a dime, but historically do so in time.

Leave A Comment