It seems that inflation has returned in many parts of the world. The Eurozone countries have pulled themselves out of a deflationary cycle of recent years and now are recording modest consumer price increases. The ECB is under some pressure from the Germans to prepare to exit from QE—- deflation has been vanquished so it seems. Japan, beset by falling prices for more than two decades, is now showing some glimmer of rising prices. The recovery in global commodities and the weakness in the yen have given the Abe government a shot in the arm in meeting its inflation goals. Lastly, the United States is now coming closer to meeting the Fed’s 2 per cent target. The Fed feels more confident that it can continue to increase the funds rate in an orderly fashion this year.

Certainly, the equity markets concur with the view that growth and inflation will pick up considerably in 2017 and 2018. The so-called “reflation” trade —- the belief that deflation is dead and the world economies are growing again—has been touted by equity analysts as they position their clients to take advantage of greater profits.

The question is just how sustainable is inflation?

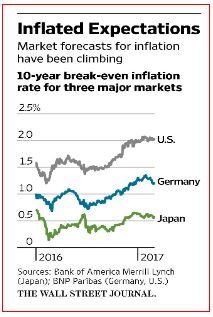

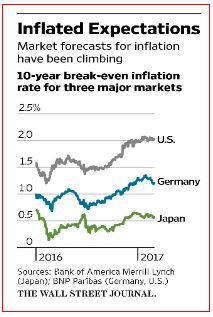

Inflationary expectations are clearly on the rise. A good measure of expectations is the 10 –year breakeven inflation rate. Since the U.S. presidential elections, inflationary expectations have risen ever where (Chart 1).

Chart 1 Inflationary Expectations

Actual inflation numbers have been influenced greatly by the higher prices for oil. Oil hit a 13 –year low in January 2016 and is now nearly doubled. Hence, the year-over-year comparisons are greatly influenced by this low starting point. If inflation is to accelerate it is not likely to be the fault of rising oil prices, since that market appears to be settling in at the current prices of $52-55 /bbl. The source of future inflation must come from other arenas.

Inflation, especially if it is persistent, usually has a strong wage pressure component. Worker’s compensation can reach as much as 80 per cent of the cost of production. Any sustained increase in wages will eventually work its way into the overall cost of production and ultimately into higher final sale prices.

Leave A Comment