A good prosecutor aims to interrogate the witness with the goal of finding a hole in the story, by asking the same question in many different ways, until he gets a different story. This is what the market does daily, asking the same question, and looking for a different story.

Children from an early age are the best at this – asking “why?” until they get the answer they want. Sometimes they get stuck on the same fairy tale until it makes sense, and then they ask for a different story.

The Summer market believed in “Goldilocks” where the FOMC and other central banks were easy, where inflation was not a problem, where blow-ups in EM were idiosyncratic, where tariffs had no effect on growth. The global economy was not too-hot nor too-cold. However, this all seems to be changing in September, like the weather.

The FOMC removal of “accommodative” from its policy statement shifted the storyline of “Goldilocks” into something else. Just what that is was the key topic of debate for the September Track Idea dinner where a number of key portfolio managers, strategists and traders joined together to share their views on the markets, their best trading ideas, and their worst fears.

Out of the dinner we have the usual geopolitical list of concerns and questions including – 1) US Trade Policy– tariffs and sanctions; 2) Trump foreign policy– Iran, North Korea, China, Turkey, Venezuela, Russia; 3) EU politics– the Italian budget deficit (is 2.4% of GDP too much?!), German coalition (is Merkel at risk again?); 4) US Current Account and USD weakness – do rates matter? 5) Brexit– is there an election risk in 1Q 2019 with a Stalinist Corbyn, is there a deal delay possible and does the mean more uncertainty; 6) EM meltdown– are markets too sanguine over the risk for an extended downturn and a more difficult FX/capital outflow story. 7) Global Trust– is this the peak of western democracy and global convergence? 8) China and growth– is there a risk to growth apart from the US tariffs/global trade hit? Is Xi more vulnerable than reported? Is the US too optimistic about tariffs hurting China.

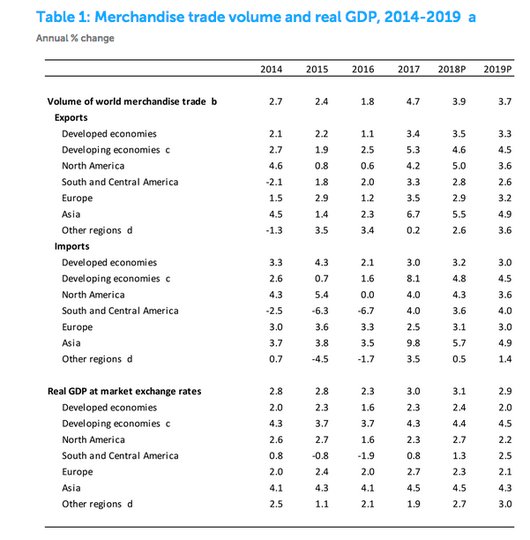

WTO downgrades outlook for global trade. Trade will continue to expand but at a more moderate pace than previously forecast. The WTO anticipates growth in merchandise trade volume of 3.9% in 2018, with trade expansion slowing further to 3.7% in 2019. The new forecast for 2018 is below the WTO’s 12 April estimate of 4.4% but falls within the 3.1% to 5.5% growth range indicated at that time. Trade growth in 2018 is now most likely to fall within a range from 3.4% to 4.4%.

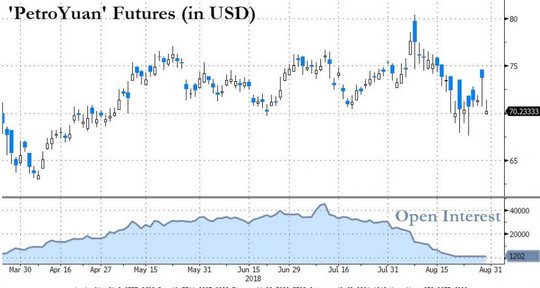

China and Oil. Since the start of the CNY Oil futures backed by gold, the role of gold, oil and USD correlations has changed. The first contracts settled this month without a hitch. The focus on CNY trade vs. USD trade is likely to heat up given Iran oil sanctions and the ongoing Russia issues with Ukraine and US election meddling. The risk of oil and China being a larger part of fragmentation of US foreign policy seems high. The Trump speeches and tweets tie the role of North Korea to China clearly and make the hope for future trade talks relate to this theme. The ongoing disputes over the South China Sea have heated up this week after the dinner and add to the view that China and its role as a large military presence in Asia isn’t going away.

Leave A Comment