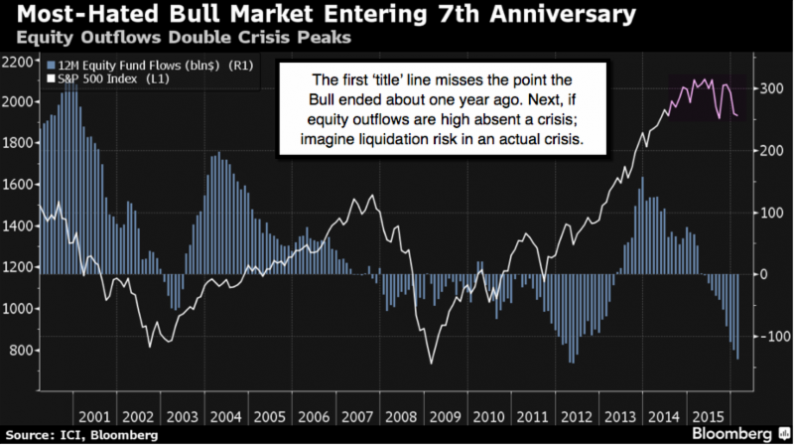

Contrasting this stock market to ‘tidal charts’ is dominating meaningless discussion in my view; as some ‘pretend’ this year the 7th Anniversary of an old Bull Market. This market is not only highly-correlated with Oil (which can lift the stock market in some sectors, temporarily); but has been in the midst of cyclical distribution for just about a year (actually a bit longer); with even a recession or something bordering on it, likely tracking from approximately last July.

Not only that, but the basic upside masking that distribution was concentration in the FANG stocks, a handful of most-shorted S&P components, while broader market indexes generally lagged, except for the then-favorable impact of oil or other energy-related stocks, until Oil topped and later cracked, after achieving our upside goal of 100 / bbl; a time we forewarned that ‘only’ geopolitical risk at the time was holding oil up; as supply/demand imbalances weren’t favorable.

None of this has changed; although gasoline consumption is picking up, though is not the key to the current energy, nor the current currency market prospects. A lot of that depends on Russia, which is in the catbird seat with it’s leadership role (usurped from a US lack of clear direction even while providing some fight against terrorists) in the Middle East, as pressure on oil producers to get in-line with a production freeze or possibly even a cut, mounts. The resistance Kuwait (and before that Iran) showed is indicative of how complex this is becoming. It’s not to say there’s no OPEC, and more than one can say problems in Europe for that matter means there’s no EU; but it is to say there’s huge pressures to join a program; just as there’s pressure in Europe to accept policies that work for a few members, but not for others.

Why mention both topics? Because these are keys to the very short-term. Right now we begin an ECB meeting and statement that most market players ‘hope’ is going to be supportive to Quantitative Easing (more counterproductive for all periphery members; while not harmful (or less so) to core members Germany and France. The indebtedness that’s created can’t be sustained by the smaller exporters (Spain comes to mind too); and NIRP (Negative Interest Rate Policy) is just creating a financial minefield for European banks, while governments do pretend it’s sustainable, which it’s not (central banks love the idea of somehow compelling bond purchasers while they avoid paying much interest on debt). It’s not a proven approach; it’s not only risky, but experimental. And likely creates a lot more problems than it temporarily solves; not to mention higher overall debt.

Leave A Comment