One of the most consistent, easiest to understand and easiest to implement option strategies is covered calls.

Investor sell or write a call options over stocks they own in exchange for collecting a premium. 1 call option contract represents 100 shares, so investors can sell multiple call options if they have a particularly large stock holding.

Over time, covered calls have the potential to add extra returns while also decreasing the volatility of a portfolio.

I like to trade this strategy on blue chip, low volatile stocks. This way you can generate a tidy sum from selling the call options and also receive a healthy dividend while you own the stock.

Here are two stocks that meet that criteria:

THE KRAFT HEINZ COMPANY

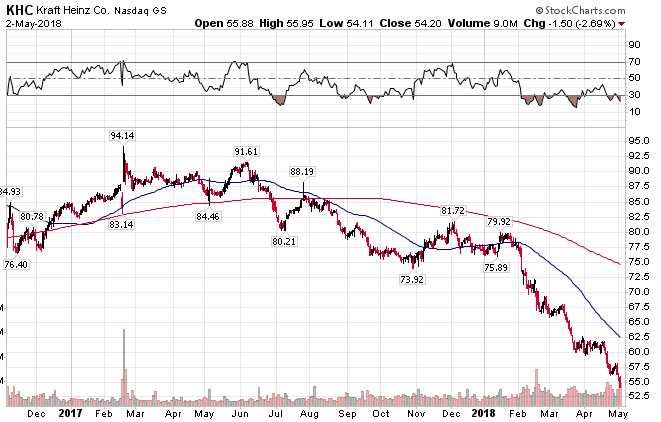

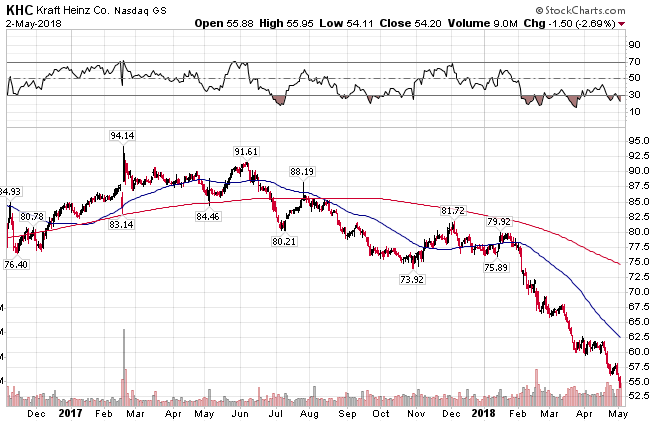

Since hitting a high of $94.14 back in early 2017, KHC stock has been well and truly pummelled, closing at $54.20 on May 2nd.

That’s a falling knife in anyone’s books and it can be dangerous to try and catch those, but after such a torrid run, perhaps value investors are going to step in soon.

KHC is a defensive play that should hold up well in the event the US economy heads into a recession. If so, it could be time to start looking at defensive stocks again.

Add that to the fact the stock pays a chunky 4.10% dividend it can be a worthy addition to any portfolio.

Despite the stock decline, the company has continued to increase the dividend payout.

By combining stock ownership with covered call trading, investors can further boost the income potential from this packaged food giant.

With the stock currently trading at $54.20, traders could sell a July 20th $57.50 Call for $1.15.

Such a trade would provide potential for a little bit of capital growth and would increase the income potential by another 9.93% per annum.

PROCTOR AND GAMBLE

PG is another stock that has had a tough time of it lately falling 23% from $92.40 to $70.94.

This is another stock with defensive qualities that pays a nice dividend – currently around 3.94%.

Leave A Comment