Draghi, of the ECB, and Germany must have a secret plan to save the Eurozone. One cannot make sense of their actions without contemplating this plan.

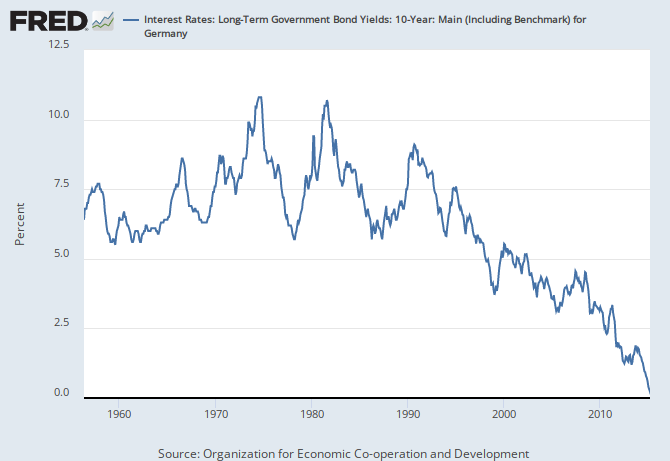

After all, Germany introduced a plan to weigh bonds, with bondholders potentially taking a haircut before bailout money can be approved for periphery banks. On the surface that would seem to indicate that Germany and the central bank are seeking to weaken bond prices in the weaker nations and destroy the Eurozone. This is causing a flight to safety, with German bonds being the primary beneficiary. See articles regarding this plan here and here. The chart is a bit out of date but trust me, yields are even lower after a short bump, and are going to go negative even on the long term bond:

Main Economic Indicators – complete database”, Main Economic Indicators (database),http://dx.doi.org/10.1787/data-00052-en (Accessed on date)

Copyright, 2014, OECD. Reprinted with permission.

So, yields are even closer to negative now. Draghi is buying German bonds, making the scarcity of these bonds that are already in massive demand even more scarce. That will push yields down even more.

So, what is going on? Surely Germany and the ECB do not want the Eurozone to fall apart. I believe that there is a plan, and that secret plan is the goal to fund Germany through getting people to buy German bonds for safety, even if they have to pay the ECB and ultimately the German government for those bonds.

So, why would Germany and the ECB want to weaken the periphery? Well, it is all about discipline. The Germans want two things, 1) they want discipline in the periphery (formerly known as PIIGS), and 2) they want the ability to bail out nations with a large war chest of cash derived from getting people to pay them to hold their bonds!

Germany must appear to be at least as safe, and probably more safe, than the United States. With growth stumbling in Germany, that is becoming hard to do. Yet converting Treasury bonds into Euros can mean a loss for investors. They may as well hold German bunds, at negative rates. Why not? Return of capital is becoming crucial to these bond buyers.

Leave A Comment