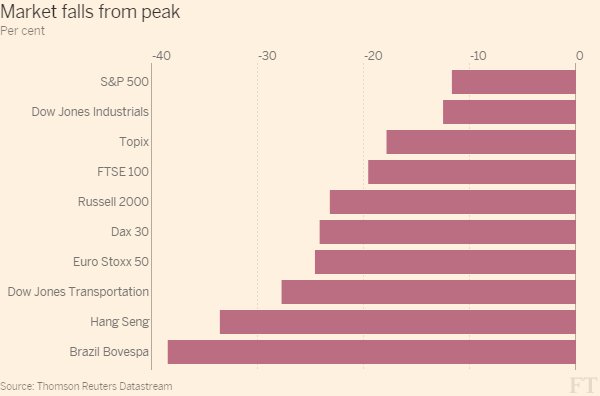

What a day! At some point in NY trading on Wednesday we were confronted with this chart of WTI crude oil, as the March contract traded below $27.50/bbl. That’s right, oil was down nearly 7% on the day.

Source: barchart

For some reason US equities are now trading in lockstep with crude oil. As a result the S&P500 was down over 3% (2-year low) during the day before recovering sharply later.

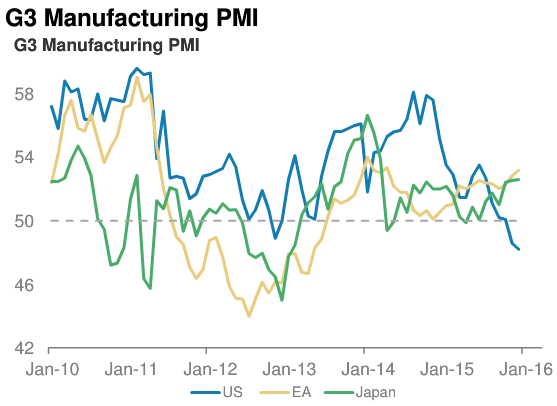

The S&P500 is actually one of the better performers among the major indices. Here are some others (a number are in “bear market”).

Source: @FTMarkets

The reason behind this oil-induced fear in the equity markets remains a mystery. Here is a simple summary from the WSJ (Alan Blinder’s article called “Markets Are Scaring Themselves”) questioning this relationship.

Source: @BrattleStCapm, WSJ

So was there something else besides oil spooking US equity investors, pushing this CNN “fear & greed” gauge deep into the red?

Source: CNN

The real concern should be around the Fed driving US dollar higher. The currency of one of these economies (in the chart below) has strengthened sharply in the past 2 years; can you tell which one?

Source: Morgan Stanley

However the Fed-related concerns should be easing. The January 2017 Fed Funds futures are now pricing in only a 23bp increase in rates by year-end (that means a high probability of one rate hike and a much lower probability of two).

Source: barchart

In fact according to the CME, there is now only a 22.4% probability of 2 or more hikes this year and a 37.8% chance of “one and done” (no hikes). This dovish view from the markets should in theory arrest the dollar appreciation. Will it?

Source: CME

We have a one-question survey on the Fed at the end.

Given such extraordinary volatility let’s take a look at a few recent trends in US equity and credit markets.

1. Banks and homebuilders came under increasing pressure with the markets seemingly pricing in a severe economic slowdown in the US.

Leave A Comment