Last week, JNJ had the highest RSI reading of any stock in the Dow Jones Index. The stock pulled back a little on Monday but I was looking at a trade idea with the thesis that bullish momentum might propel the stock a little higher, but not too much higher.

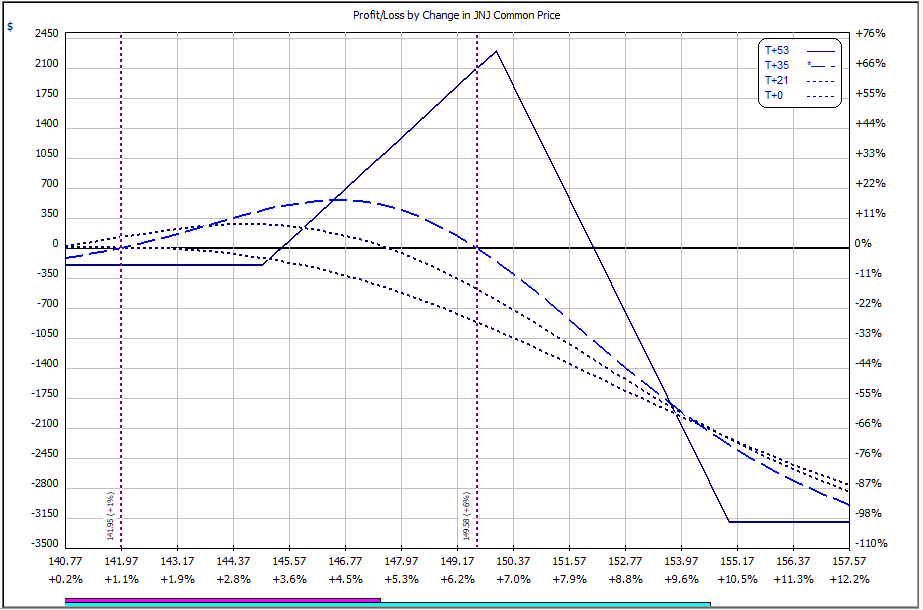

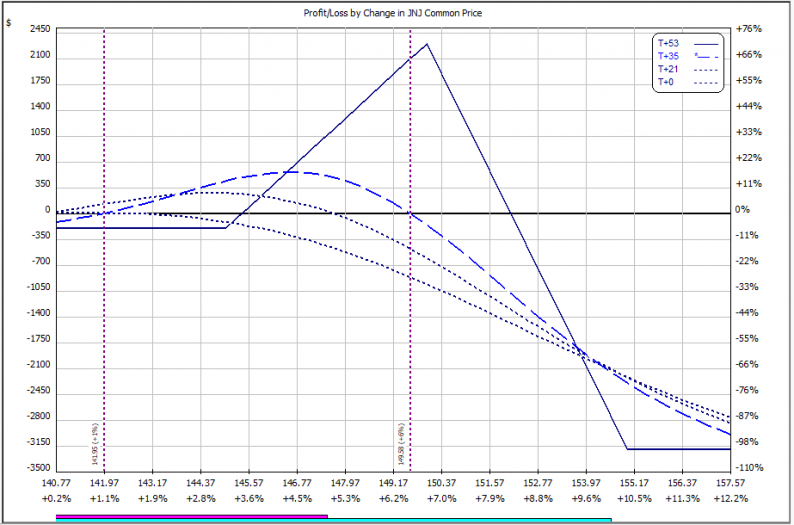

The trade involved buying 5 November 145 calls, selling 16 November 150 calls and buying 11 November 155 calls.

The risk on the downside is limited to $200 and $3,200 on the upside. The maximum profit is $2,300 if JNJ closes at $150 at expiration.

Traders would want the stock to rally, but not too quickly. Going out 35 days from now, the trade would experience profits in the range between $141.95 and $149.58.

JNJ’s earnings are scheduled for October 16th, so traders would need to consider if they want exposure to the stock over earnings. After the last six earnings announcements, JNJ has moved between -4.3% and +3.5%.

Butterfly spreads are an incredibly versatile option strategy that can be tailored to suit an investor view point.

Leave A Comment