The financial future enters a ‘gray’ area given the green bombardment many central banks contemplate; in the form of so-called ‘helicopter’ money. There is a carefree attitude of ‘why not stimulate’ everything further at such low interest rate times, without a bit of concern about how this rolls over in the future. Or perhaps a worse fate for monetarists; the impossibility of hiking rates with the extent debt levels have, or will have reached. They may view this as plausible; but there’s a problem: that’s the history of markets often moving rates irrespective of ‘official’ policy intentions (look, for instance, at some European default spreads of late).

Thursday morning the post-Alcoa (AA) results euphoria continues, with JPMorgan’s (JPM) results topping estimates, and with BlackRock (BLK) Q2 results at least meeting them. So on the surface things ‘appear’ sunnier while the forward risk of gasoline being thrown on the monetary fires seems to be subordinated to the ‘here-and-now’.

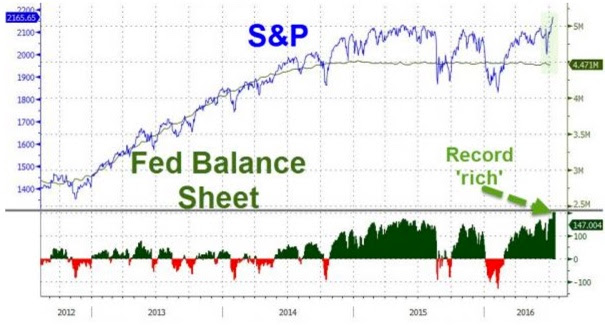

Technically – the type of thrust we just had, especially as ‘helicopter money’ plans were either leaked or rumored (clarity remains to be determined as to which has occurred), gradually sucked in more money and improved basic participation. In a market like that with breadth improving as money comes in, you don’t presume it’s a final blow-off; though one should be aware of the possibility.

The combination of money flows in essentially a parabolic thrust with breadth is a sign of a mature (to say the least) up move; but also one unwise to be fighting aggressively; and we are not. While I have doubts that this move (and with some adjustments or corrections) can hold together through the rest of my journey, I’d like that to be the case as noted before. Perhaps it will settle into a high-level sort of range, rather than reverse straightaway; leaving open ‘hope’ for more upside thereafter; and (for once) avoid either a V bottom or spike-top kind of resolution, of which the market has had a series of over the course of many months. To wit: a market that spikes here a bit, corrects, but then tests the highs before roll-over risk becomes more evident is one that will leave more traders and investors just confused as to what comes next. We suspect it’s more dangerous than realized.

Thus; If circumstances unfold differently than optimists envision, you get another huge ‘house of cards’ being constructed. Reaching mid-July in an overbought, as well as technically unsustainable, move that reflects an extended yield-chasing mania, we expect this blow-off to simmer down within the next few days; but not collapse unless there’s an exogenous event of some type.

Leave A Comment