Market ‘fragility’ anticipated for September’s second half unfolds, while it is pretty clear what happens next relies initially on trade negotiations (or lack of), and then Midterm Elections. That, aside what it portends for Pres. Trump, may have lots to do with the perception of future trade policies and actually whether or not the reform and trend of lower regulation persists for years. Regardless of political views; that’s where Midterms come in.

Thus, if you recall that our super-bullishness ‘if Trump won’ was predicated in 2016, on how much business wanted his economic agenda, do imagine how much business will freak, if it looks light that agenda may be reversed. Now, this has nothing to do with his persona (many Republics are beside themselves and afraid of losses in November because of it in-fact); nor his social manners or stance on many issues (or perceived biases). They are strictly related to tax and regulatory issues, and even there some disdain a portion of the regulatory moves (such as regarding the environment).

The point is however that this market would not be here if not for Trump’s win; and be prepared for what happens if things turn in another direction. I realize it may not be so. For-instance, his ‘Order’ for all text messages of a slew of people related to the Russia Investigation might turn things around if they make it clear he was shanghaied (no pun on the China dealings) on that issue; but again let’s see.

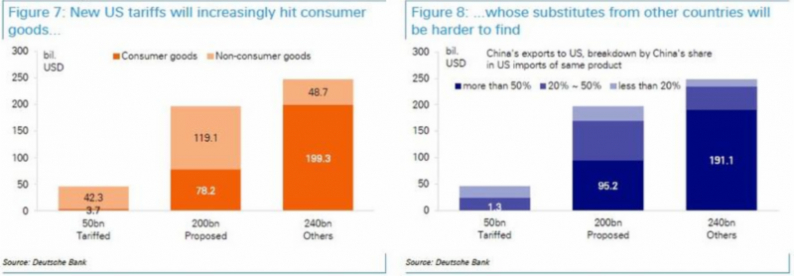

Meanwhile this focus we have had on ‘trade’ is correct; but since media is now well-aware of the dual-postures of the two countries on the issues; a further discussion of China’s ‘resolve’ not to give in that some believe, will not be needed for now. A respected member of this Service has decades of experience dealing with Chinese issues (he is in Asia presently) and I’m grateful for the permission to share his views; but they boil-down to China not trusting or yielding to President Trump. (Again, since many have today tossed this topic around, we won’t expand upon it, at least not tonight.)

Leave A Comment