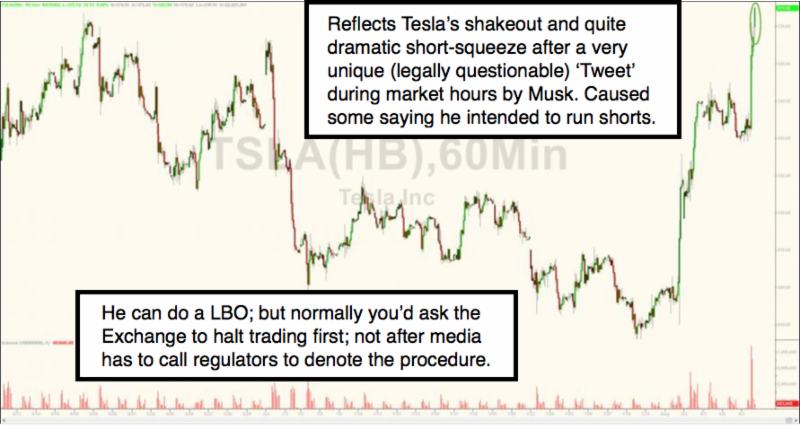

Sentiment remains skeptical and that’s contributed to ‘worry wall’ S&P climbing, which as noted last night, ‘can’ (but needn’t) extend much higher. I ponder whether moves like the Saudis investing in Tesla is somehow an effort to offset their immorality ‘reveal’ with implied threats against Canada, or for that matter contradictory swings in their oil price pronouncements. It was exciting; as a Leveraged Buyout (proposal in-theory) came from an airborne ‘Tweet’ by Elon Musk himself. At first few believed it was him. And we speculated it wasn’t naivete as Musk often moaned of share price.

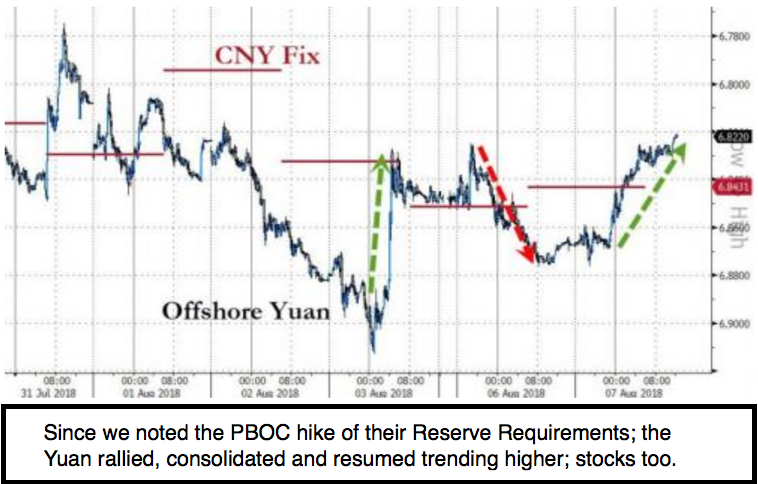

Aside Tesla, much of the market’s focus still rotates around China trade of course (and I touched on the implicit threats against Apple in video); giddy optimism about new S&P or tech highs; or even an occasional reminder of Federal Reserve monetary policy ‘QT‘ (perhaps the most significant); for sure you have a ‘worry wall syndrome’ helping technicals lift stocks along what is essentially working into overbought challenging a rising-tops line.

What you have are ‘standard deviation bands’ narrowing and thus upward action in the S&P persists bumping-along the high-end of the banks; but I should point-out, ‘not quite’ against an extension of the rising tops trend. It is ‘presumed’ by many that we get new highs; that S&P 3000 is ‘in the bag’ soon; and that China will come around. Perhaps. But not necessarily. That is a reason we think those who haven’t done so are trimming a bit into this strength as it has prevailed.

(The idea of the S&P shortly declining because I’m traveling tomorrow to Brussels is sort of kidding; but the risks are growing as the complacency returns; ironically as it combats an existing ‘worry wall’. In fact it’s been Oil not so much tech helping on Tuesday; and broadening small caps gains.)

Leave A Comment