For most investors and traders with grey hair, the phrase “history repeats itself or at least rhymes” dominates risk and portfolio management. The hope that started last week was that the crisis in Turkey was idiosyncratic and a buying opportunity for the divergent emerging markets.

The move beyond 7.20 TRY led to a contagion trade on banks in Europe and further pains elsewhere in emerging markets. Buying the dip didn’t work so well last week but it remains the siren call for next week with light data.

There is a bigger philosophical story behind how to trade markets in August with light volumes and light news – and that goes back to Tolstoy’s “War and Peace” where he uses the phrase “strange lightness of being” for Prince Andrew’s death. The heavy market moods that history repeats clashed with the view that life is fragile and only lived once. There is no means testing for past decisions in the present world because each moment is different.

The YOLO movement risk for markets next week seems significant as Turkey is breaking out of the traditional fixes for an economy suffering from an unwanted FX devaluation spurred by its battle over a US pastor held in house arrest for treason. Not going to the IMF, not raising rates to fight inflation, not pulling back the government budget – all are expected to lead to more trouble ahead with money flight ongoing.

Against this dire view, we have a defiance against US hegemony and the new phase of economic war. The reworking of the global world order with NATO battling the former Soviet Union and China seems a throwback to history and, also something scary as the hope for a multi-polar world becomes real and makes risk taking more difficult. The weight of heavy decisions pressing on the present against historical standards fights against this brave new world of relativism.

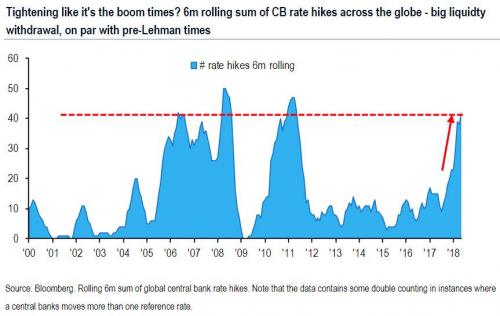

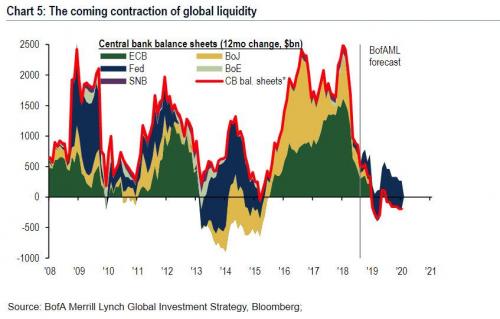

The push for change isn’t new, the reactions to such, however, are unique. The coordinated global easing efforts post 2009 that supported markets is in reversal. The effects on investor returns has been notable so far in 2018 with the divergence trades obvious as the US returns to just 0.8% away from its S&P 500 highs while EM shares trade in a bear market.

The Question for the Week Ahead: What are factors telling us about the market?

There is always a search for a bigger picture underway in August. Call this the summer vacation effect if you must, call it the natural shift for active managers to push for beating the market into September. There is no easy way to find “alpha” in a quiet, illiquid market. However, there is a way to identify the “beta,” and so spending time in August watching factors maybe the best exercise for the Autumn shifts.

Last week in US markets, value beat growth. Carry trades continued to fail and short volatility worked in the US for bonds and stocks. This didn’t work so well elsewhere and that divergence maybe another key place to study as US safe-haven status drives money flows given US trade policy pains abroad, mixed with foreign policy sanctions, and the ongoing growth spurts from US fiscal policy changes. Over the long-haul value beats growth by 3.5% while of late this hasn’t been the case it may be returning and reflecting the opportunities for value abroad in particular.

Some see the last 30 years as a great convergence trade coming to an ignoble end. The buying of EM risks at the expense of the G7 has been most obvious in FX. But the rising volatility in EM as shown by TRY, ARS, BRL and others highlights the pain of carry and this convergence nearing a sharp and painful turn. The risks for markets in the Autumn revolve around how central bankers view this shift and whether rate hikes in G7 space mean an end to this game and a shift from buying growth stories abroad to searching for value at home.

The sense of a larger crisis is in play because of this – as rate hikes in EM to defend one’s currency and battle inflation prove a heavy load against the push for normalization of zero rates and QE.The feedback loop of EM pain to DM will be a key focus for the markets as they listen to the ECB, Fed and others in the weeks ahead.

Market Recap:

The key fears last week – US Trade policy, Turkey and China dominated. The drop of the TRY and the unorthodox response from the government set the tone for weakness with many fears of contagion. Slowing growth in China was also a concern, and disappointing results from Chinese Internet giant Tencent Holdings appeared to play a large role in Wednesday’s sell-off. China/US trade talks offset some of the worst fears Thursday and Friday as did a good recovery in the TRY from 7.48 lows to 5.68. The new Turkey FinMin Albayrak said that Turkey would use fiscal measures to slow the economy, reduce its current account deficit, and lower the inflation rate, which is now about 16%. Qatar’s pledge of $15 billion in direct investment to Turkey also supported the TRY recovery.

Leave A Comment