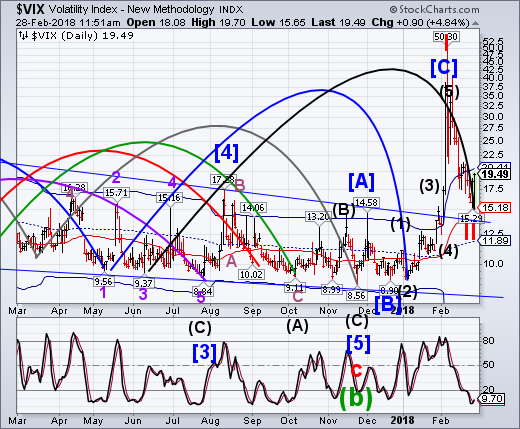

VIX made an 83% retracement of its rally on Tuesday while making its Master Cycle low. Today it challenged Cycle Top support at 20.41, but closed beneath it. A close above it implies a VIX buy signal may have occurred. The Cycles Model now indicates that the rally may continue for up to three weeks. That implies the next wave higher may have started today.

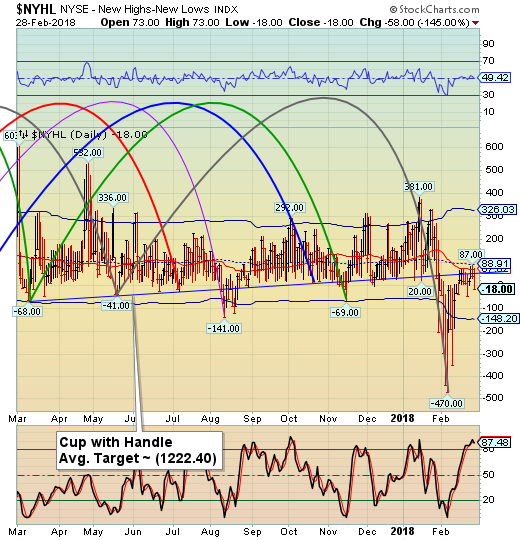

— The NYSE Hi-Lo Index has tested mid-Cycle resistance today but has closed beneath it, reactivating a NYSE sell signal. The Cycles Model suggests that much lower lows may be imminent. The pundits still have no clue.

(ZeroHedge) Confused by today’s whipsawed market action, which as much about month-end flows, as it is about newsflow, post-Powell jitters, breakevens, inflationary fears, and of course, whatever it is that Gartman may be doing? You are not alone: in its intraday macro update, the bank that is also the world’s largest ZeroHedge, had some (very) simple advice for its clients: “Don’t try to make sense of this.”

It then clarifies, and we use the term loosely: “Price action today has been messy to say the least. The shortest explanation is, it’s month end and so there is little point in making sense of the move.”

— SPX made a made a key reversal yesterday by rallying to the upper trendline of the Broadening Wedge formation, then closing beneath the prior day’s low. Today it closed beneath the 50-day Moving Average. This puts the SPX back on a confirmed sell signal. Fractal analysis and the Broadening Wedge formation both suggest proposed targets beneath Cycle Bottom support at 2328.63. However, crossing the blue trendline at 2675.00 implies a larger decline to 1800.00.

(Bloomberg) It’s testament to how rough stocks had it in February that the last two days, a stretch that would’ve Bloomberg as the worst selloff in all of 2017, barely shows up in a monthly graph.

Not that it wasn’t painful. The S&P 500 Index slid 2.4 percent over Tuesday and Wednesday to cap the biggest monthly retreat since January 2016, as concerns about Federal Reserve policy brought out sellers and briefly pushed the Cboe Volatility Index back above 20. Breadth, a concern even as stocks rallied nine of 11 days starting Feb. 9, evaporated Wednesday, with only 15 percent of the S&P 500 managing gains.

— NDX rallied within 20 points of its all-time high before reversing back down on Wednesday. A close beneath Intermediate-term support at 6773.65 and the Ending Diagonal trendline at 6750.00 may reinstate the sell signal.

(ZeroHedge) Bulls are back to dining at the “V”, the magic quick dip correction that never happened. The price action appears massively bullish, yet the data underneath is not at all. Instead it appears more associated with ZeroHedge end-times.

The final thrashing about which we’ve seen several times before. After all the tops of 2000 and 2007 were marked by a sudden acceleration in volatility and sudden corrective moves exceeding 10% followed by rallies of the similar magnitude. The underlying theme of these subsequent rallies: Narrowing of leadership, negative divergences and a renewed bullishness breathing a sigh of relief at precisely the wrong time.

This is exactly what we are witnessing now and let me highlight the Nasdaq in particular as there are cracks appearing amidst this aggressive rally back to highs.

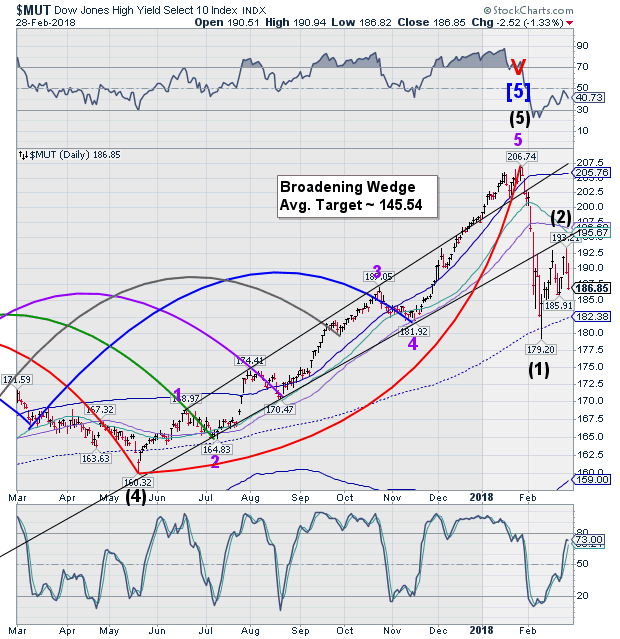

— The High Yield Bond Index attempted another run at the Broadening Wedge trendline, only to stop short, making nearly a 51% retracement. A decline beneath mid-Cycle support at 182.38 may result in a panic, since it has retested its 2-year trendline a third time and failed.

(Bloomberg) The Bloomberg in high-yield bonds is on thin ice, according to Bloomberg pack of investors willing to make a hefty wager on their conviction.

Leave A Comment