Another day of lackluster news but with a myriad of central bank speakers. Their palaver dominates into the FOMC. Rates may not yet matter but they are higher and this will glacially move the mountains of risk capital. Just as talking eventually makes forward guidance less powerful, so too, higher rates makes debt less acceptable. The key turning point for markets wasn’t last night but yesterday with ECB Draghi hawkish enough to push up yields in Europe. His 2% CPI target sounded at risk – and given the rise of oil – perhaps justified. Of course, today appeared to also be about the number 2:

The biggest talking today will be at the UN where US President Trump tries to convince world leaders that America First doesn’t mean America Alone. He has penned a free-trade deal with Korea and hopes to do the same with Japan after his Abe meetings. This is a market that isn’t impressed with talking but will pay attention to rates and oil. So with 3.12% key for 10-year US rates, one has to watch oil at $72.50 for more trouble.

Question for the Day: Will higher oil prices mean trouble for growth? The US relationship to oil changed post-2008 with QE spurring shale oil efforts and supply. Now the US is mixed when oil prices rise as the energy sector supports the economy while consumers and some business suffer. For Europe, this is less obvious. Energy has always been a difficult issue for the ECB. Pass-through inflation matters everywhere but seems more inelastic there. A new article on oil and its effect on the EU economy from the ECB is worth considering today ahead of the US data and the ECB speakers.

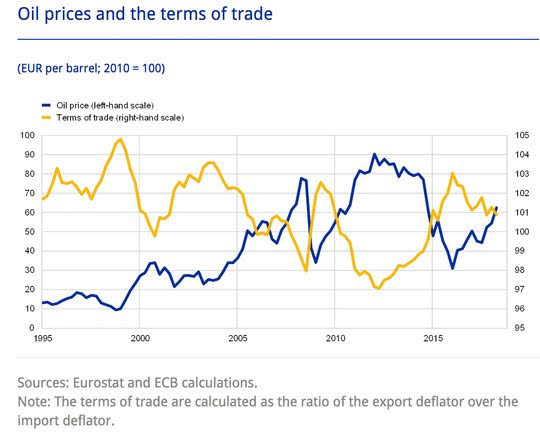

Here are a few of the main points – 1) Most of EU energy use is in production of goods. In the euro area, about one-third of the economy’s total oil use is in the form of final consumption….The other two-thirds comes from oil being used in the production of non-energy goods. A rise in oil prices implies an increase in the production costs of these sectors. If these costs cannot be passed on to the final prices of these goods, there will be an indirect impact on households’ purchasing power, since either wages or profits received from these sectors will be lower. 2) Terms of trade matters. When oil prices rise, the terms of trade deteriorate and household purchasing power falls. The strong correlation between oil prices and the terms of trade is widespread globally.3) Oil prices already moved up. While the drop in oil prices in 2014 and 2015 certainly supported the expansion of private consumption, the overall growth of real disposable income since 2013 has been largely driven by labor income (Chart C). From mid?2017 to mid?2018 oil prices increased from about USD 50 to about USD 75 per barrel. If they remain at their present level, the increase is unlikely to significantly dent the growth of real disposable income and private consumption.

Leave A Comment