VIX made its final swing low at weekly mid-Cycle support at 15.93 on Friday morning, making it the last support before its reversal. An aggressive buy signal (NYSE sell signal) may be confirmed with a rise above Long-term support/resistance at 18.30. A breakout above the neckline suggests a very robust follow-through rally that may last up to a month.

SPX retraces to the 4.3-year trendline.

The SPX rallied back to its 4.3-year trendline at 2009.13 before closing at the Fibonacci 61.8% retracement level at 1999.44 and just above it mid-Cycle support/resistance at 1993.04. This trendline was originally broken on January 6, in the decline to the January 20 low. Trendlines are important support areas that often attract, then repel the markets. Now that the attraction was satisfied, the reversal may begin.

(USAToday) U.S. stocks rallied Friday to log a third straight week of gains after the February jobs report came in stronger than expected, signaling that the economy continues to grow despite slowing growth overseas and early-year financial turbulence.

The Dow Jones industrial average also notched its first four-session winning streak since October. The blue chips ended up 63 points, or 0.4%. to 17,006.77, rising above 17,000 for the first time since Jan. 6. The broader Standard & Poor’s 500 stock index gained 0.3% to 1999.99 and the Nasdaq composite climbed 0.2% to 4717.12.

The S&P has also not been above 2000 — a level it passed in intraday trading Friday — since Jan. 6.

NDX ends week beneath Intermediate-term resistance.

NDX challenged weekly Intermediate-term resistance at 4386.86 this week, closing just beneath it. Its retracement was a weaker 55% of its decline. Should it decline beneath weekly mid-cycle support at 4161.67, NDX may continue its decline to 3000 or lower.

(LATimes) Even in the volatile world of technology stocks, it was a stunning moment for investors.

Shares of the tech companies LinkedIn Corp. and Tableau Software Inc. dropped like an anvil from a cliff early this month after the firms reported disappointing growth forecasts. Their stocks plunged more than 40% in a single day and sparked a sell-off in other tech stocks as well.

“I don’t remember seeing a reaction as violent as that since the dot-com bubble burst” in 2000, said Pat O’Hare, chief market analyst at Briefing.com, an investment research site.

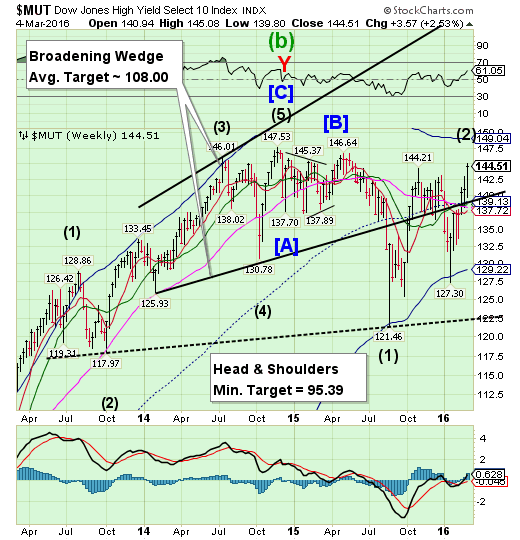

High Yield Bond Index may have completed its rally.

The High Yield Index took over 6 months to complete its 94% retracement of the August low. The retracement appears to be over and the decline about to resume. The next retracement will not be as generous..

(ZeroHedge) Two days ago, Credit Suisse reported something which had been rather visible in the markets: an onslaught of retail buying had entered the junk bond market in which institutions were delighted to sell to retail bagholders, in the process repricing the entire HY space if only briefly.

Overnight, fund flow tracking service EPFR confirmed this when it reported that US high yield funds recognized a $5.27bn (+2.8%) inflow for the week ended March 2nd, the largest ever in terms of $AUM and the 2nd largest on a percentage basis.

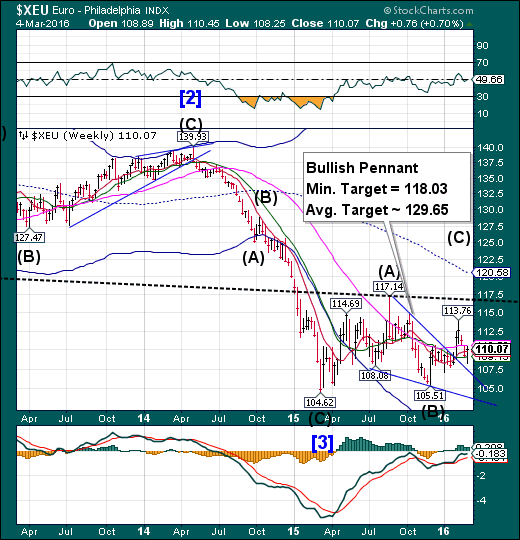

The Euro reverses course.

The Euro challenged Intermediate-term support at 109.15but bounced back, closing short of Long-term resistance at 110.52. The Cycles Model suggests a period of strength has begun and may last approximately three weeks with the minimum Pennant target in reach.

(ZeroHedge) The nominal trade-weighted dollar index, against major currencies, is now just 4% higher year-over-year as the index has recently fallen from an approximately 13-year high of 95.6 to 92.4. The slow down in the rate of change is important since at one point in 2015 the nominal trade-weighted dollar index was increasing at a 22% year-over-year pace. While we still think its early to call the end of the dollar bull market that has been in place since July 2011, its apparent that the world is currently not in as broad of a dollar bull market as we were in last year.

Leave A Comment