Miners performed well today and confirmed yesterday’s gap reversals. We should see (at least) a 1-2 week rebound. I’ll adjust my portfolio back to net-long sometime tomorrow unless prices mysteriously collapse overnight. Several individual miners formed bullish reversal patterns (see below).

Gold closed above $1210 and the short-term trendline. However, it needs to close progressively above the 50-day EMA ($1222) to support a secondary cycle advance. Note: The June cycle failed at the 50-day.

Silver prices formed a swing low. Now we need progressive closes above the 10-day EMA to register a low.

GG – Bullish morning star candle pattern on a positive MACD divergence.

NEM – Large bullish engulfing candle.

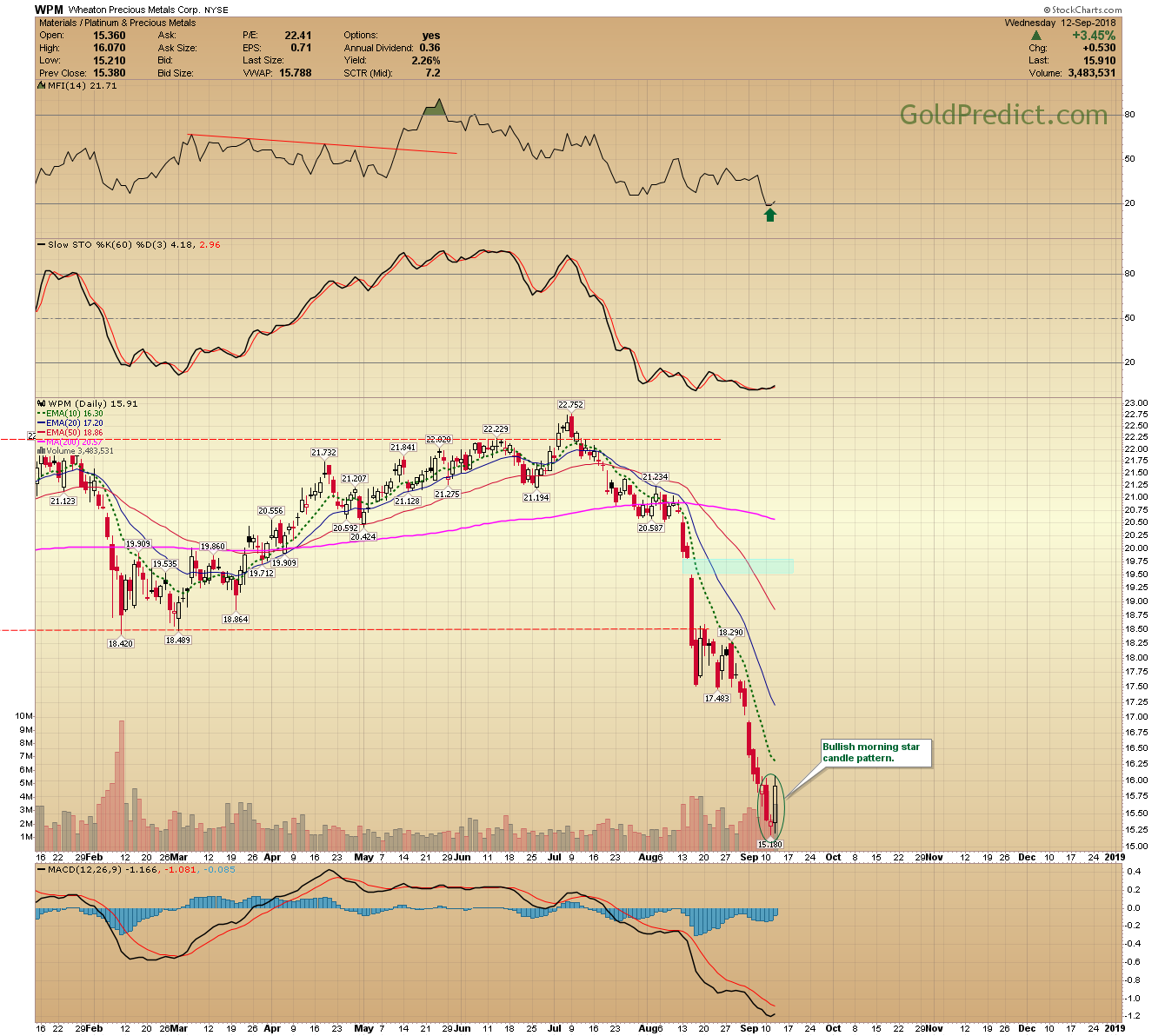

WPM – Bullish morning star candle pattern.

ABX – Bullish morning star candle pattern on a positive MACD divergence.

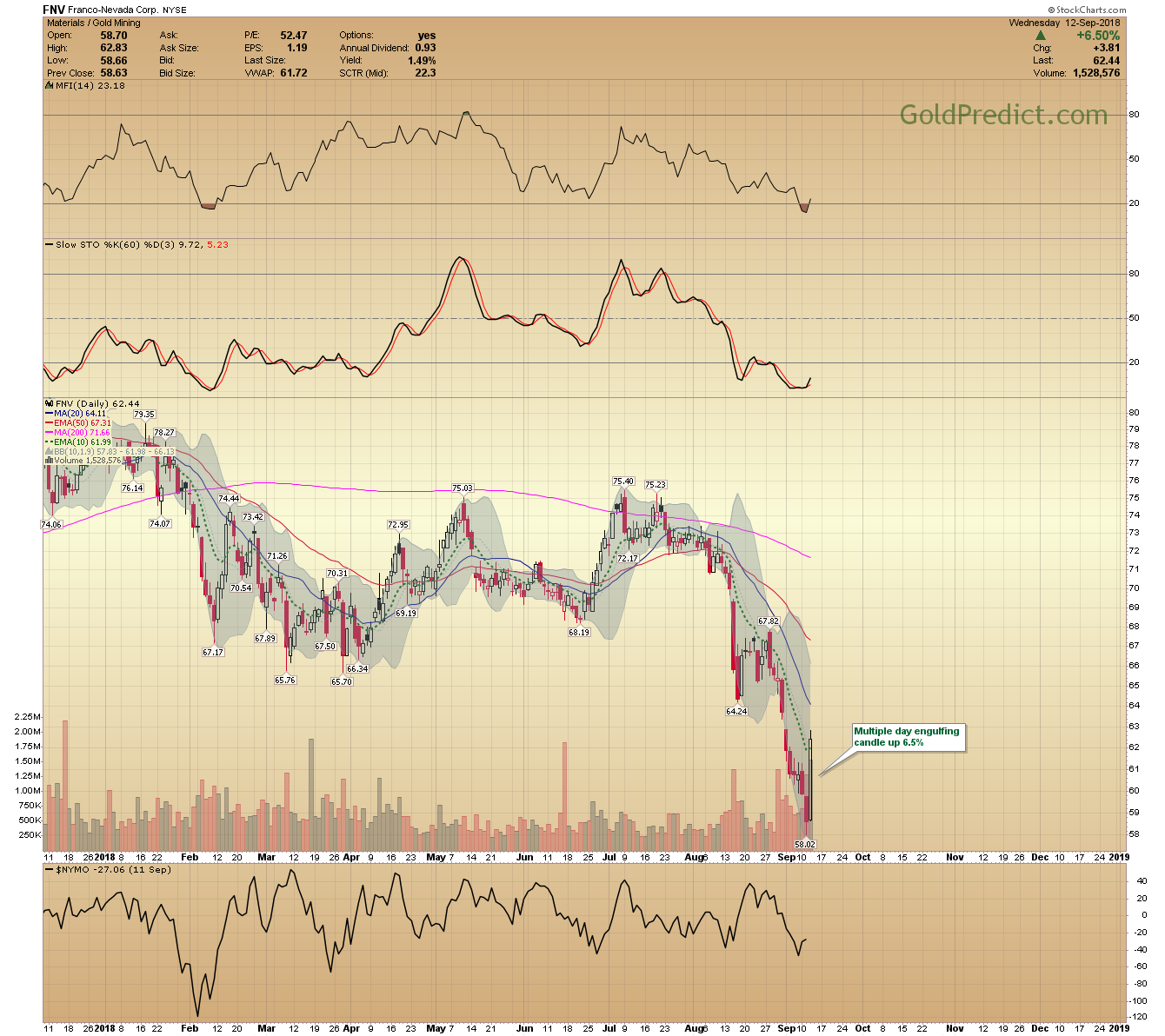

FNV – Multiple day engulfing candle up 6.5%.

GDX – Prices slipped below the $18.15 level into the close. Nevertheless, I think we should see a move back to the gap at $19.75, maybe more.

GDXJ – Juniors closed well above the $26.78 level, and it looks like we have an undercut low. Prices should retest the $29.14 high or perhaps even the August 13th gap at $30.50.

Leave A Comment