With each passing week, month and year, Volatility ETPs have become more and more popular. This was no more greatly evidenced than with last week’s volume indicator for certain of these ETPs, especially those offering double-leverage. But I’ll get back to this point in a moment as there are more pressing matters to discuss.

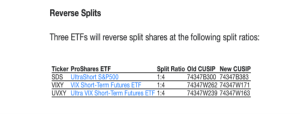

It’s coming, again. Last week ProShares announced yet another forward and reverse split for several of its ETFs.

As it pertains to the maintenance of these instruments, the funds will trade at their post-split prices on July 17, 2017. The ticker symbols and CUSIP numbers for the funds will not change. I tend only to concern myself and Golden Capital Portfolio fund with ProShares Ultra VIX Short-Term Futures ETF (UVXY), as this will mark the ETFs 8th reverse split since it came to the market in 2011. This will also be the second reverse split for UVXY in 2017. As a volatility short participant with Golden Capital Portfolio, I’ve remained short shares of UVXY since 2012, adding and eliminating shares within the fund once they achieve a 99.99% return on invested capital (ROIC).

With a reverse split approaching I often offer caution for those participating with UVXY and like VIX-leveraged ETPs from the long side. In an article I authored earlier this year titled UVXY: Pre-Split Caution Being Raised, I offer the following warnings for any long volatility participants within the context noted below:

UVXY Shares at $12.50 X 1,000 shares long = $12,500. Now, $12,500-40% = loss of $5,000. Take reverse split of 5:1 from $7 a share to $35 a share: Your 1,000 shares split become 200 shares. $35 X 40% gain X 200 shares = $2,800 gain. You still have another $2,200 to make up from original loss and pre-split.

The verbiage/warning for going long or remaining long into a reverse split for VIX-leveraged ETPs that express long-term decay can be eye opening for newcomers to the instruments. If you hold a long position through a reverse split you’ll require a greater percentage move to break even or find the desired profit outcome. The percentage gain won’t equal the dollar gain on a lesser share count post a reverse split that one previously modeled. Furthermore, long participants will need to allocate more capital due to the higher share price post a reverse split if they so choose to dollar cost average in an attempt to mitigate potential losses. With the caution being articulated, the logic provided and even an equation to work off, investors and traders may better understand why I refer to these VIX-leveraged ETPs that decay in price as “short instruments”. They maintain an intrinsic design to be best utilized short.

Leave A Comment