I am going to double de-risk here ahead of the May nonfarm payroll on Friday and the flip-flopping Fed on June 14.

Taking small profits has been the lesson of May. At the $2.82 price, we are capturing 45.45% of the maximum potential profit in this position.

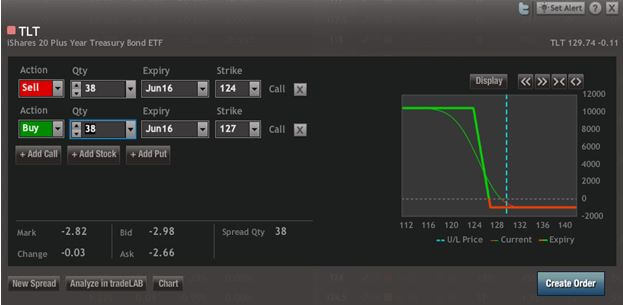

This morning’s twin data disappointments give us a nice pop in the (TLT) for an exit point in our iShares 20+ Year Treasury Bond Fund ETF (TLT) June 2016 $124-$127 in-the-money vertical bull call spread.

May Consumer Confidence came in at 92.6 versus the 96.0 that was expected.

May Chicago Purchasing Managers Index printed at 49.3 as opposed to the hoped for 50.5

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

SELL 38 June, 2016 (TLT) $124 calls at………….….……$5.30

Buy to cover short 38 June, 2016 (TLT) $127 calls at……$2.48

Net Cost:………………………………………..……..…..$2.82

Profit: $2.82 – $2.67 = $0.15

(38 X 100 X $0.15) = $570 or 5.62% profit in 5 trading days

Expect The Fed to Flip Flop Again

Leave A Comment