We begin with Japan where the recent Abenomics efforts are about to face some headwinds after the yen has risen to 2014 levels (chart below shows the dollar falling vs. the yen). As a result, the two-day drop in the equity markets resembles what we saw after the Fukushima Accident in 2011.

The 10-year Japanese government bond yield pushed deeper into negative territory.

As expected, the negative 10y JGB yield takes us to $6 trillion of total negative-yielding government bonds outstanding. Amazing.

Source: @fastFT

Switching to the Eurozone, here are several developments we are tracking.

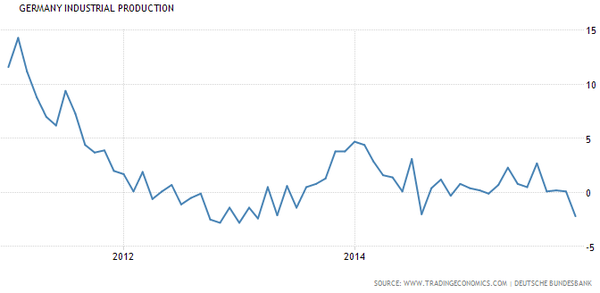

1. German industrial production disappointed, with the decline that was larger than expected. This gives Draghi another reason to pull the trigger on increased stimulus.

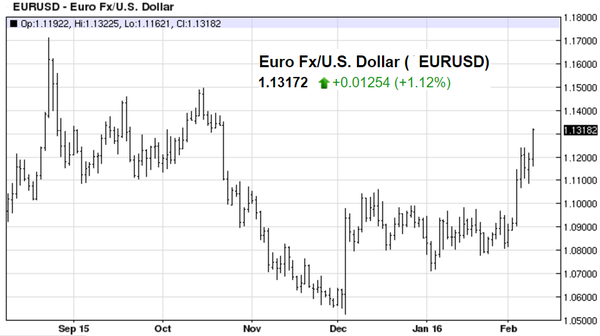

2. The euro continues to grind higher, presenting significant challenges for the ECB. Once again, Mario Draghi will attempt to jawbone the euro lower but given the recent unease with the US economy, talking the euro lower may no longer be as effective.

Separately, there is also some concern that the banking sector profitability could be damaged by deeper negative rates on reserves (which is likely the next step in ECB’s easing program).

Source: barchart

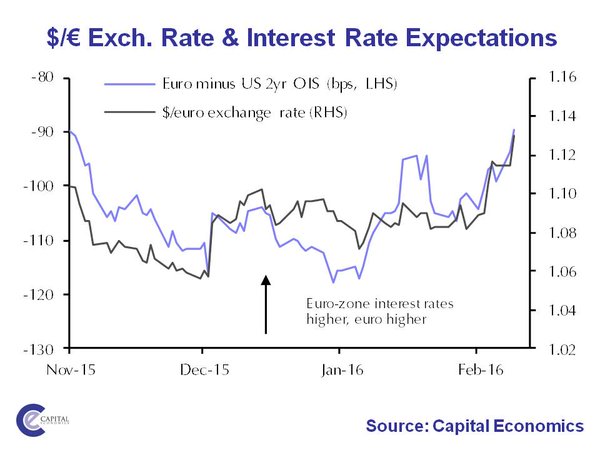

Note that the decline in US short-term rates in recent weeks is a major driver behind this euro recovery.

Source: ?@CapEconEurope

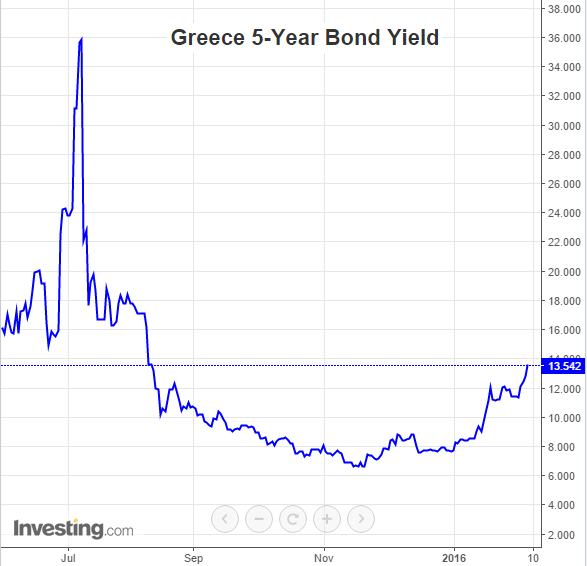

3. Greek government bond yields rose again on questions around the viability of the nation’s financial system (even after restructuring). How long before Greek banks will be able to raise equity in the private markets?

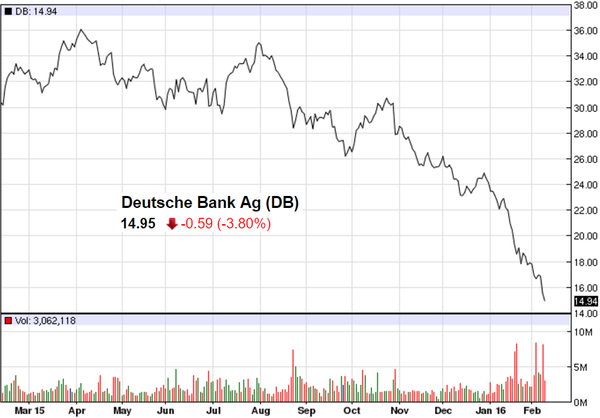

4. Deutsche Bank shares continued to fall even as the management tried to convince the markets that the bank’s balance sheet is solid. CDS spreads remain elevated.

Source: barchart (US-listed shares shown here).

Source: @Ian_Fraser

DB needs to focus on improving its returns on capital, which may require shedding some large businesses.

Source: @FT

DB’s CoCo prices (discussed yesterday) declined as well. Deutsche is threatening to buy back some of its bonds to shake out short-sellers. Whatever happens, the CoCo market has been severely damaged and raising capital for European institutions may be more challenging going forward.

Leave A Comment