Greetings,

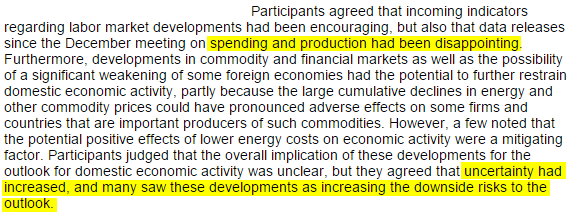

We begin with the United States where the latest FOMC minutes suggest at least some unease with the current economic trends and market conditions.

Source: FRB

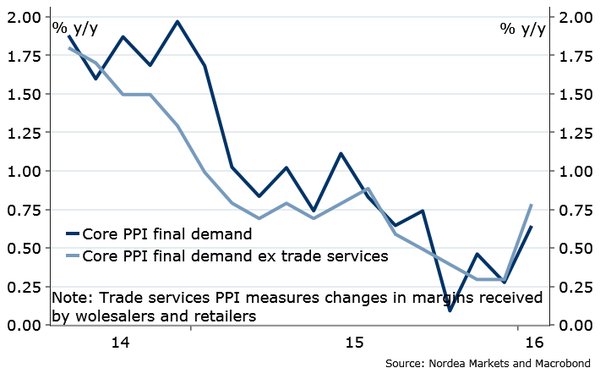

The decision to stay put on rates however is not going to be an easy one for the FOMC. The PPI (wholesale inflation) seems to have bottomed out and should oil prices stabilize, it will continue to climb higher.

Source: ?@auaurelija

Moreover, cash metals prices seem to have bottomed as well.

Source: barchart

By the way, related to the above, here are the metals & mining shares over the past week.

Source: Ycharts.com

Many other commodities show similar patterns. For example, we’ve had a 20% recovery since November in hog futures. WHO’s warning seems to have been forgotten and bacon is back in demand.

Source: barchart

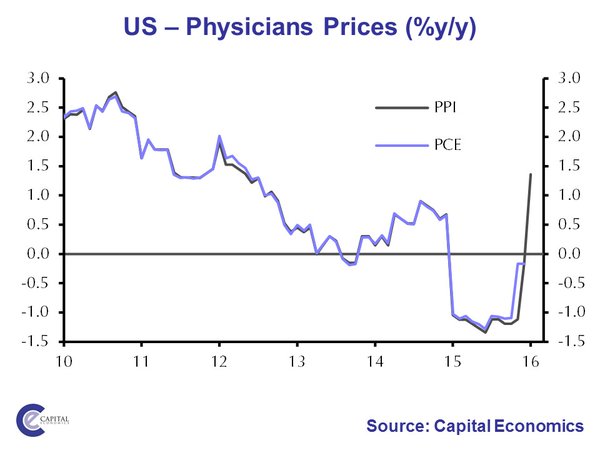

Based on the latest US PPI report, Capital Economics is projecting a pop in the core PCE inflation measure – an index the Fed watches closely.

Source: ? ?@CapEconUS

The physicians component of the PPI for example is at a 4-year high.

Source: ? ?@CapEconUS

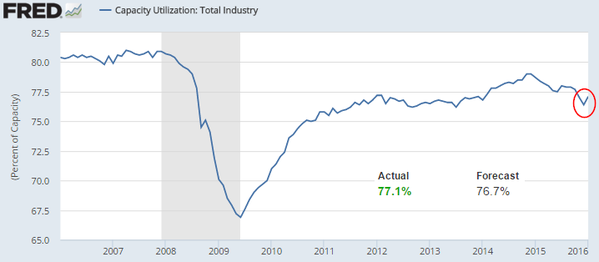

There are also indications that US industrial production (including manufacturing) and capacity utilization have stabilized.

On the other hand, tighter credit conditions will be a cause for concern, making the above improvements less relevant.

Source: @business

Additionally, some financial conditions indicators, such as the Cleveland Financial Stress Index still show significant unease.

Related to the above, here is JPMorgan’s recession probability – which should also give the FOMC some pause.

Source: @NickTimiraos

And in spite of the selloff, the trade-weighted US dollar index remains near cycle highs.

Some point to the GDPNow US GDP tracker projecting some 2.7% growth for Q1 (discussed yesterday). Such growth would certainly justify another move toward rate “normalization”. However, just take a look at the services sector activity (below) and consider the fact that the Q4 GDP growth was 0.7%.

Leave A Comment