Greetings,

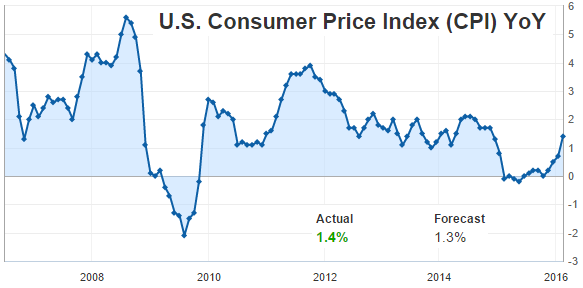

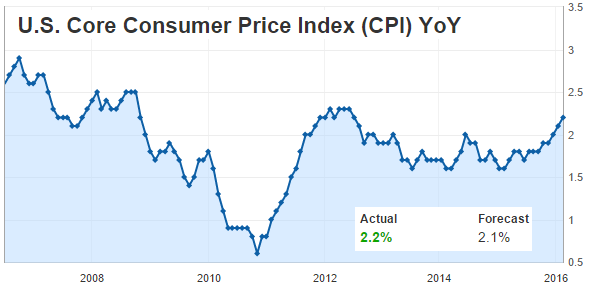

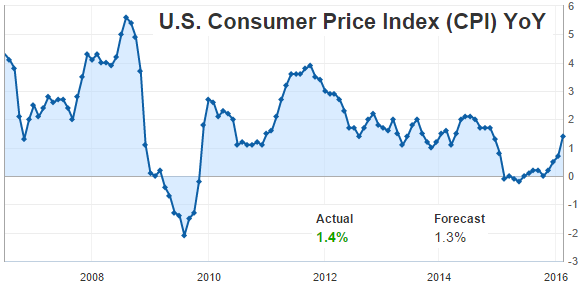

We begin with the United States where inflation in January surprised to the upside, with the core CPI now firmly above 2%.

Source: Investing.com

Source: Investing.com

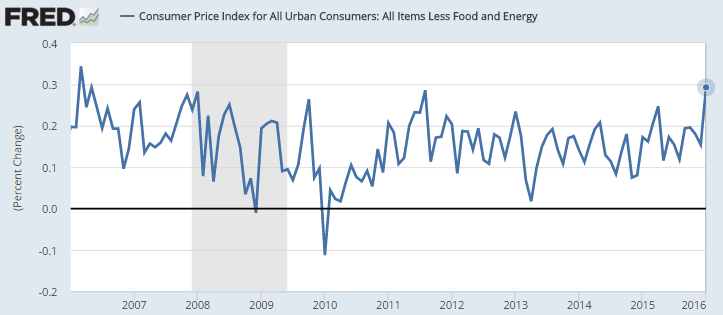

Here is the month-over-month change in the core CPI.

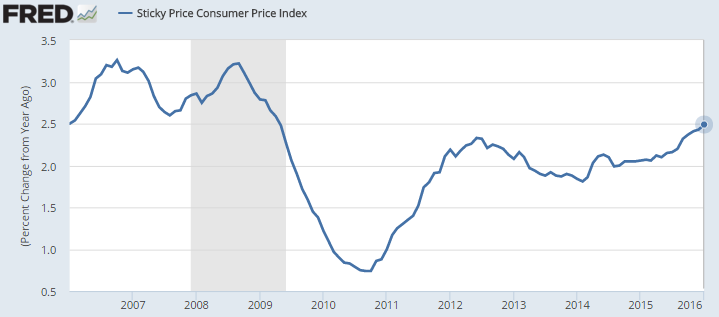

Additionally, the so-called “sticky” CPI, representing the less volatile components of the CPI index, is at the highest level since 2009.

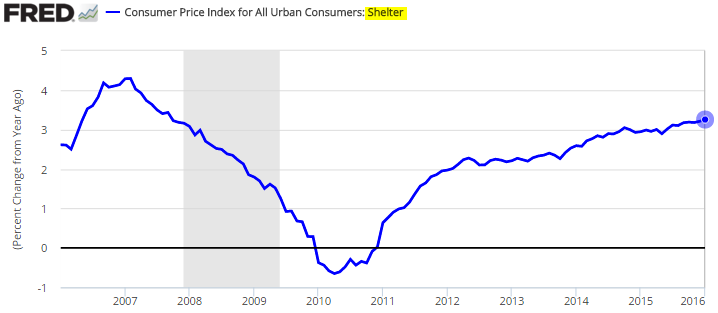

Cost of shelter continues to grow at over 3% per year – an unwelcome development given the modest wage growth.

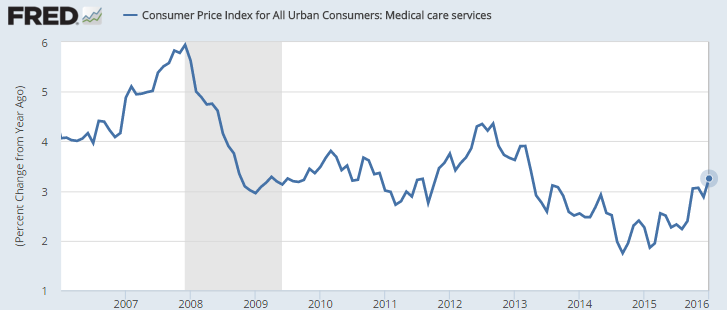

Also, the medical care component of the CPI rate is on the rise again.

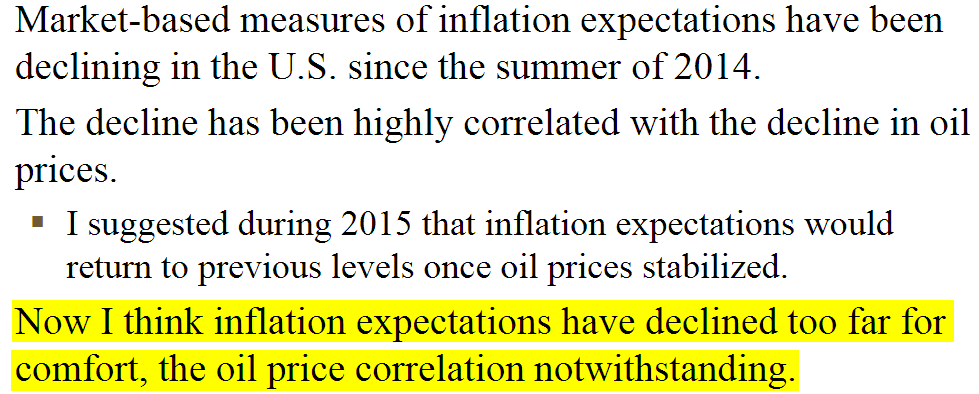

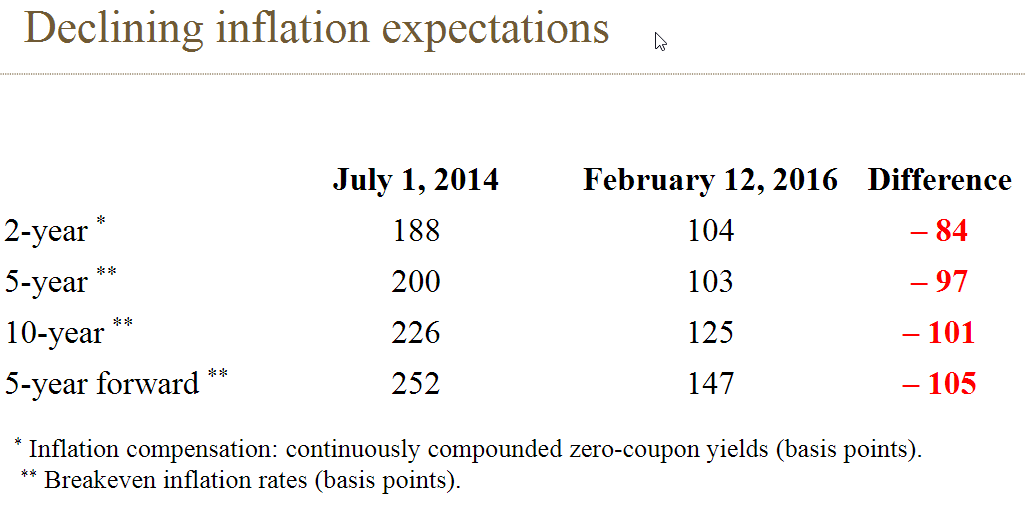

This tells us that so far there is no evidence of deflation which some have been predicting for quite some time. Moreover, this puts the Federal Reserve in a bit of a bind as this CPI stabilization coincides with sharp declines in inflation expectations. Here is a quote from James Bullard (FRB-St. Louis) on inflation expectations. He is clearly not comfortable raising rates for now.

Source: FRB – St. Louis

Source: FRB – St. Louis

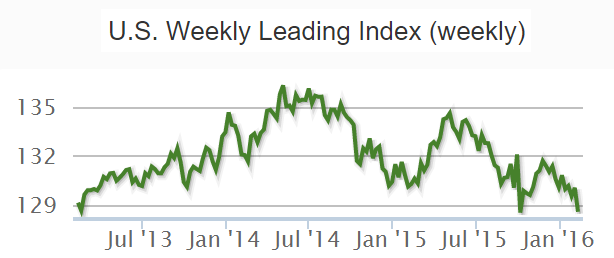

In other US economic news, here is the Economic Cycle Research Institute (ECRI) leading index. A number of economists track this index closely and thus far it’s not painting a good picture for the US economy.

Source: ECRI

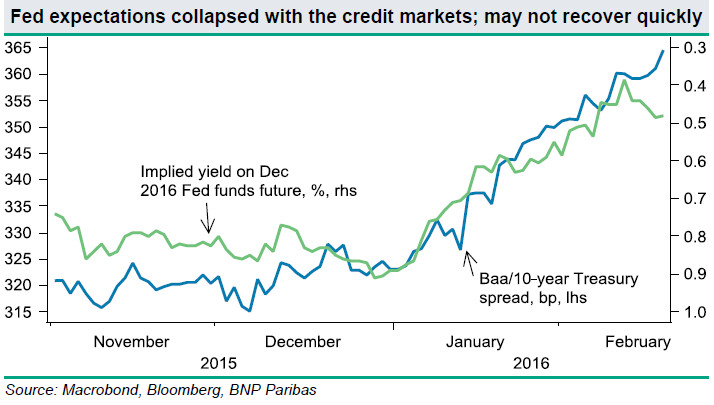

Turning to US credit markets, …

1. … it is interesting to see that in spite of the diminishing rate hike expectations in 2016, credit spreads remain near multi-year highs.

Source: BNP Paribas

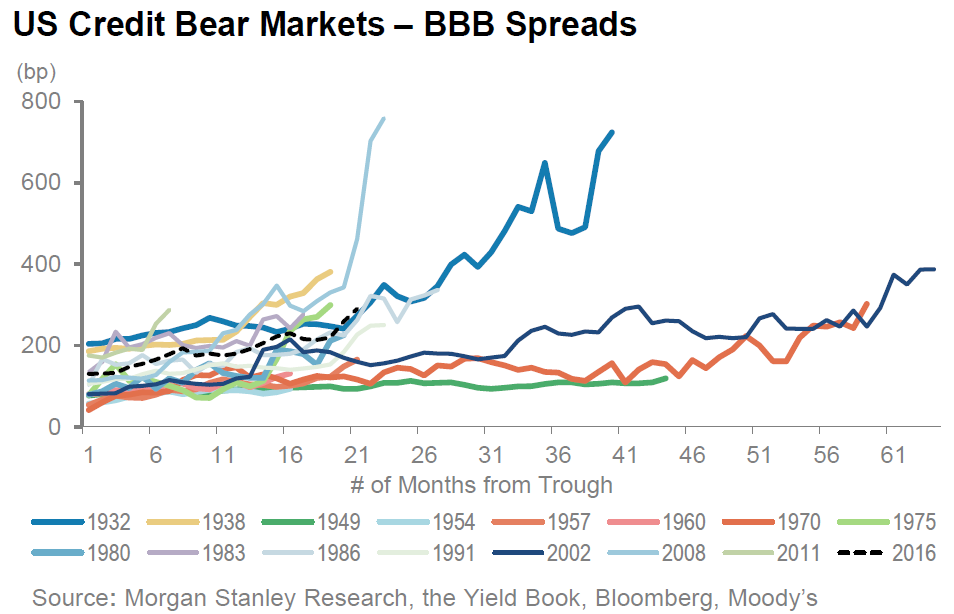

2. Here is how the BBB corporate spreads have risen during this credit bear market cycle vs. a number of the previous ones.

Source: Morgan Stanley

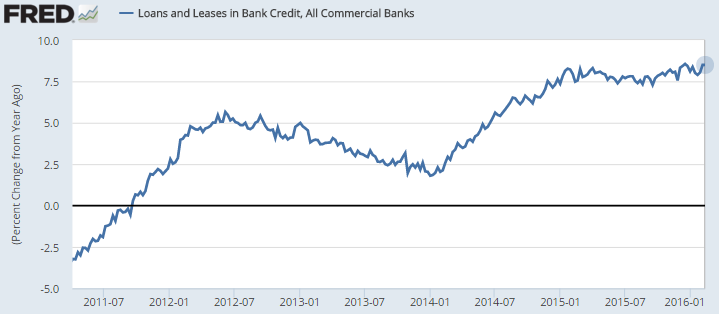

3. So far we don’t have a great deal of evidence of tighter bank lending in the United States, as loans on banks’ balance sheets grow at 8.5% per year.

Source: barchart

US corporate loans are growing at 11% per year. Most expect this to slow, but at this point it doesn’t look much like a credit crunch.

Leave A Comment