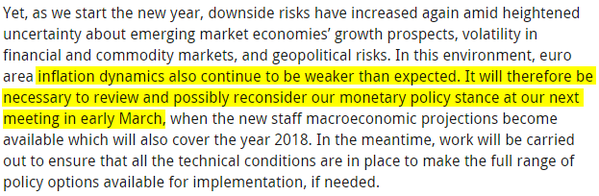

Global equity and other “risk” markets remain addicted to stimulus without which all the ugly “withdrawal symptoms” kick in. The market “dysfunction” created in part by the Fed’s drip withdrawal has been quite violent, and many would argue irrational. However on Thursday, Mr. Draghi gave the markets a bit of what they’ve been craving.

Source: Mario Draghi (press conference)

Crude oil, which is now the key driver behind equity and credit markers, bounced on the news. It’s now some 11% off the lows as short-covering kicked into gear.

Source: barchart

Global equity markets followed, with the Nikkei up 5.5% in Friday trading.

While this bounce is impressive, the near-term fundamentals behind WTI remain terrible.

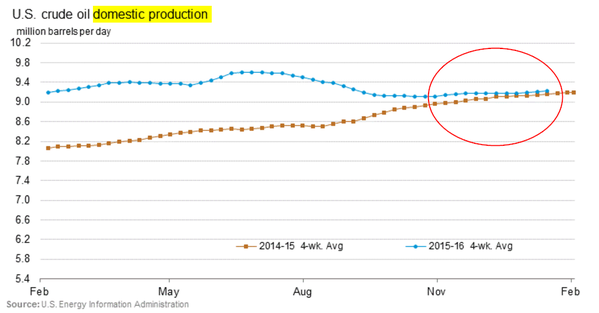

1. US production shows no signs of cracking.

2. US crude oil imports are elevated – this is the last thing US crude producers need now.

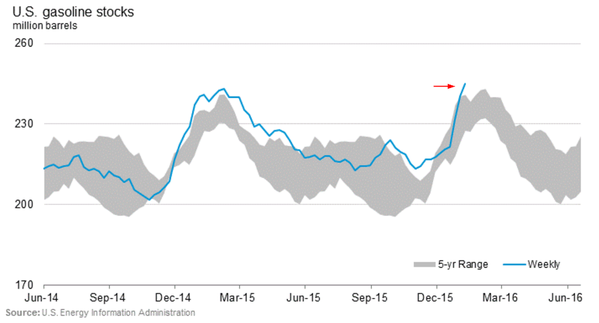

3. Gasoline inventories in the US are at record highs.

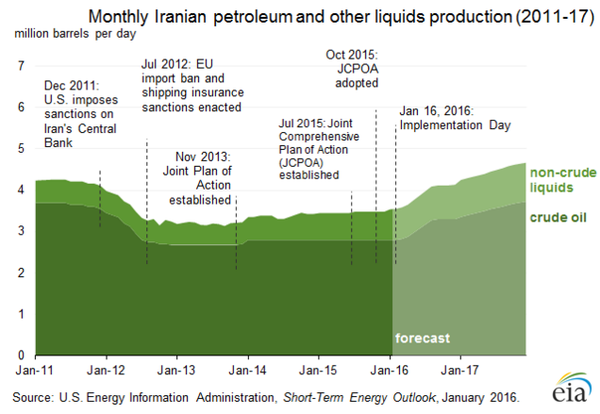

4. Iran is gearing up …

If the equity markets remain tied to crude oil (a correlation which defies logic), the rally is likely to be short-lived.

There has been some debate regarding the parabolic rise in shares outstanding of USO – an ETN that tracks crude oil.

Source: Tyler Neville

A couple of observations regarding this increase.

1. In dollar terms the growth hasn’t been nearly as sharp. If someone wanted for example to keep a fixed dollar exposure to crude oil (and this is a terrible instrument for that), she would be forced to buy more shares as prices fall. 2. At least a portion of the share creation seems to be driven by the demand from short-sellers (who borrow the shares to short). Therefore the unwind may not be as dramatic as some have suggested.

In spite of the bounce in crude and the equity markets, several EM currencies remained under pressure.

1. The ruble hit another record low.

Source: Investing.com

Leave A Comment