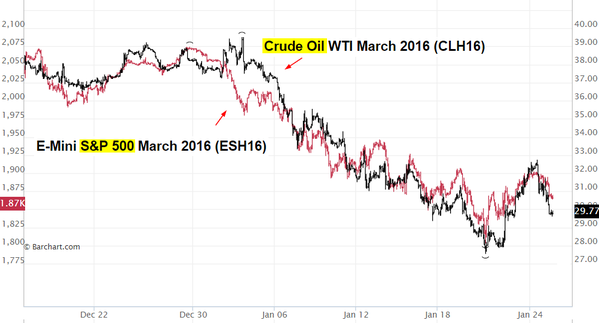

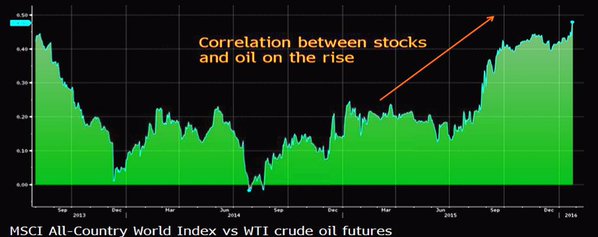

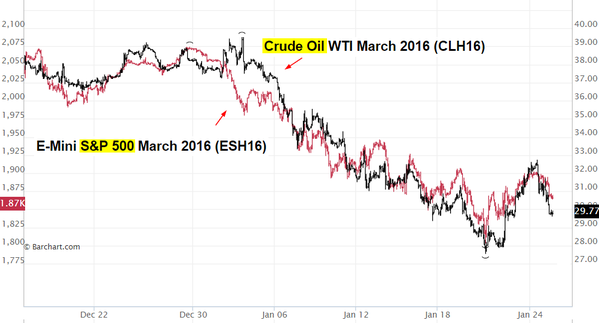

Oil markets continue to drive global risk sentiment as the correlation between crude and equities rises. For all the yapping going on in Davos, those (supposedly) top finance/economics minds do not seem to have a good explanation for this.

Source: barchart

Source: @Schuldensuehner

No worries. The latest Daily Shot survey will get to the bottom of this. Thanks everyone for your suggestions.

Crude oil is indeed under pressure again, having given up a big portion of Friday’s rally. WTI is down almost 3% in after-hours trading (back below $30/bbl).

And as expected, global equity markets are under pressure again. China’s Shanghai Composite gave up over 6% in Tuesday trading.

Source: Google

Continuing with China, we have the following developments.

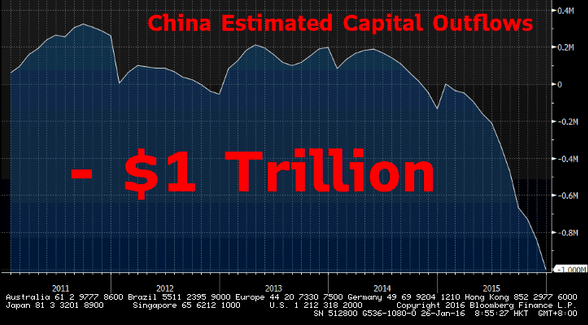

1. According to Bloomberg Intelligence, the latest estimates of capital outflows from China exceeded $1 trillion in 2015.

Source: @DavidInglesTV, @TomOrlik, @timocraighead

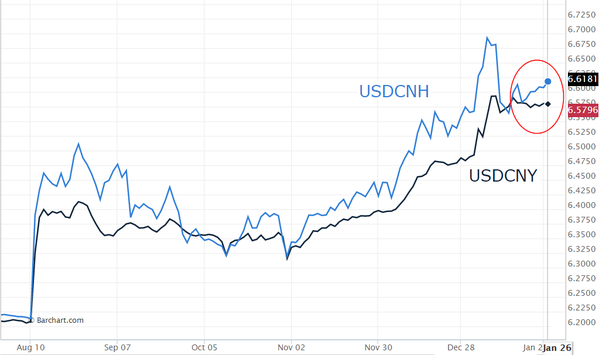

2. This trend of outflows seems to continue this week, as the onshore-offshore RMB spread widens again.

3. Here is the latest survey of high-frequency China economy watchers on the nation’s GDP growth (and evolution over time).

Source: @TomOrlik, @CapEconChina, @OxfordEconomics, @choyleva

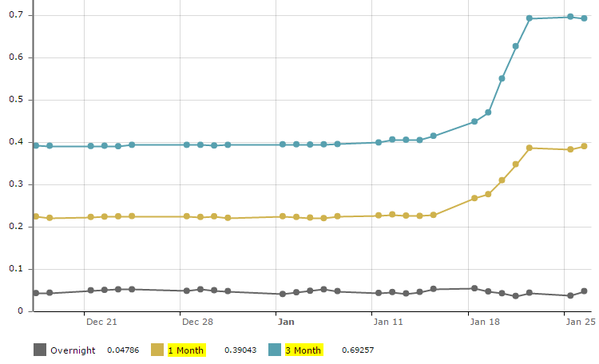

4. Related to the capital outflows, the Hong Kong term interbank rates (HIBOR) remain elevated as liquidity tightens.

5. Hong Kong’s equity markets are trading at distressed levels with price-to-book ratio at around 1x. A buying opportunity or a liquidity trap?

Source: @DavidInglesTV

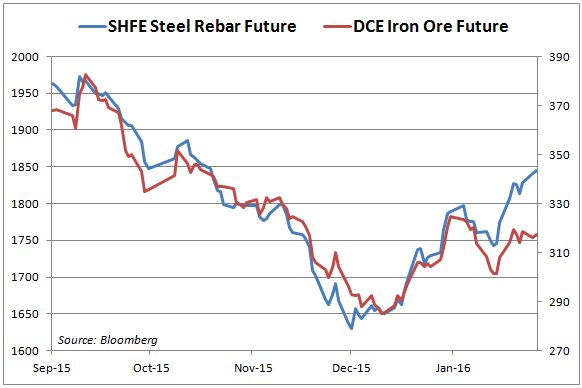

6. One surprising development (discussed last week) is China’s steel prices, which continue to rise (even in dollar terms). In fact steel prices are now outperforming iron ore. Is the new fiscal stimulus (particularly rail and infrastructure projects) stimulating demand?

Source: barchart

Source: @IlyaSpivak

Leave A Comment