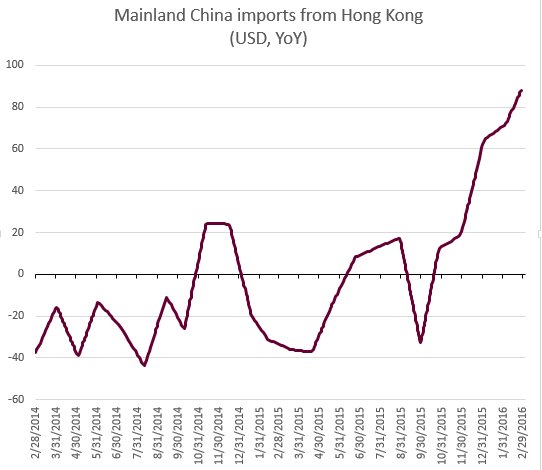

Yesterday’s weak report on China’s trade dampened the risk-on sentiment in the markets. The spike in China mainland’s “imports” from Hong Kong, which exaggerated the size of transactions to skirt capital controls, indicates that capital outflows from China continue. It seems that companies and some well-off households are bracing for more RMB devaluation.

Source: @SoberLook

Copper fell 3% on the day as risk-on sentiment dissipated.

Source: Investing.com

Iron ore gave up nearly 5% and other commodities retreated.

Source: barchart

By the way, analysts are scratching their heads trying to figure out the reasons behind the massive iron ore rally (followed by the large decline). While most believe it has to do with China stimulus expectations, here is an alternative (rather bizarre) explanation. It has to do with the 2016 International Horticultural Exposition to be held in the province of Hebei, from late April to October.

Source: ?Bloomberg.com

Crude oil fell on renewed worries about the glut in the market and a caution from Goldman. The realization is setting in that the oil producers’ output freeze is not a done deal, as we heard from Kuwait.

Source: Al Arabiya

Goldman pointed out that while US production is indeed declining (“green shoots”), the market remains oversupplied.

Source: Goldman Sachs

Continuing with the energy markets, a US bankruptcy judge allowed an oil company to walk away from it pipeline contracts. This is a big deal.

Source: @FT

This ruling could be a disaster for some “midstream” MLPs who rely on lucrative long-term pipeline contracts to pay their dividends (MLP index chart shown below). That won’t work well if producers begin walking away from these agreements.

Source: Google

It seems that there is much more natural gas in the US than previously thought – which does not help prices.

Leave A Comment