Greetings,

We begin with the latest yen decline caused by several intervention hints from Japanese officials. The improved risk appetite and the big net long yen exposure of speculative accounts added to the yen selloff (dollar rally shown below).

Source: Investing.com

The strengthening US dollar (above) caused a sharp correction in metals and mining shares. Here is the chart over the past 5 days – down 14.5%.

Source: Ycharts.com

Morgan Stanley, however, sees this dollar-yen rally as being short-lived, capped by the lower real yield differential between the US and Japan. Note that while the absolute rate differential between US and Japanese bond yields is quite large, when adjusted for the respective inflation rates, the spread is much tighter.

Source: Morgan Stanley, h/t Jake

Below are several other observations related to Japan.

1. The BoJ balance sheet continues to expand in a linear fashion.

2. The BoJ’s inflation forecasts have been consistently optimistic. Here are the projections over time.

Source: Citi

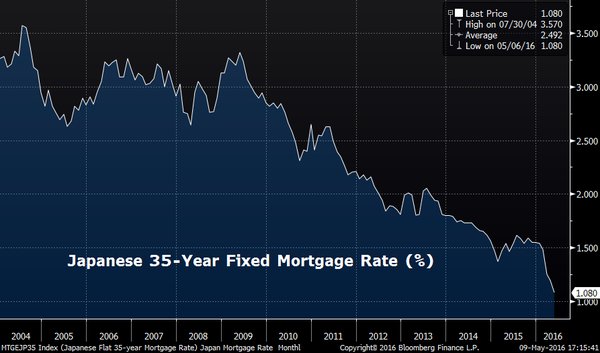

3. Japanese longer-dated mortgage rates are hitting new lows. Presumably, this is an indication of improved monetary transmission (negative policy/bond rates impacting household and corporate lending rates).

Source: ?@MktOutperform

We now turn to China where (as discussed earlier) stimulus has been conducted via policy banks (notably the Agricultural Development Bank of China). The PBoC has no need to expand its balance sheet because (unlike in the West) it can force banks, especially state-controlled institutions to do so.

Source: @business

Source: @business

Here are several other developments in China.

1. Steel prices in Shanghai continue to fall.

Source: barchart

2. Speculative activity, particularly in steel and iron ore, has been tremendous. This trading is evidenced by the unusually short holding periods (chart below) for some commodities. With Beijing imposing restrictions (and with the US dollar a bit stronger), the selloff ensued (above).

Leave A Comment