Greetings,

Let us begin with emerging markets.

1. South Africa’s mining production dropped by 18% from a year ago – a record decline. This report sent some analysts back to the drawing board, with growth projections downgraded again.

h/t Jonathan

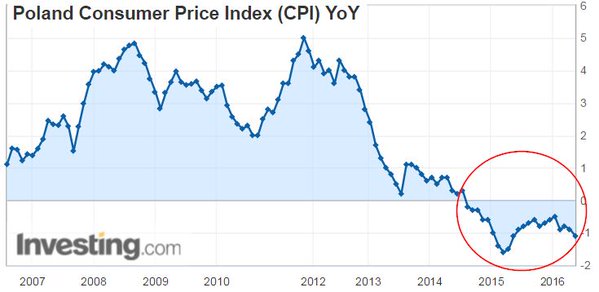

2. Romania and Poland remain in deflation. Will both see stabilization as energy prices move higher?

Source: Investing.com

3. Dilma Rousseff’s impeachment is moving forward as Brazil’s interim President Michel Temer takes over. While many can point to Rousseff’s poor leadership and populist tactics, proving that her actions were criminal in nature may be challenging. Rousseff’ will continue to fight to regain power which will add to economic uncertainty.

Source: NYTimes

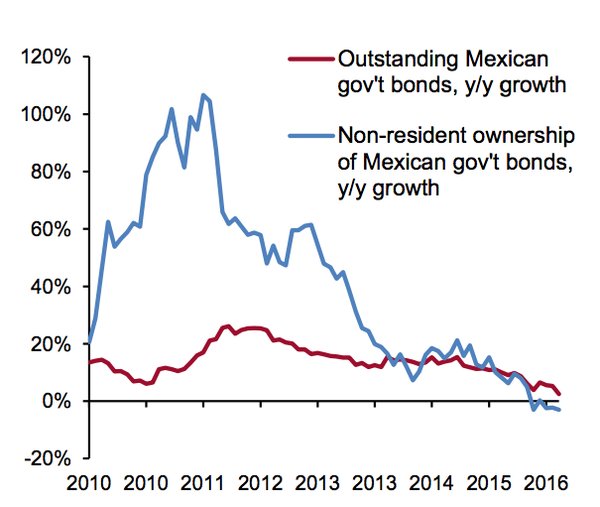

4. Mexican government debt growth slows significantly and so do the bond holdings by foreigners. If the peso remains stable for some time, will foreigners return?

Source: ?@joshdigga

5. The Philippine stock market surges as the transition to the newly elected government seems to be going well.

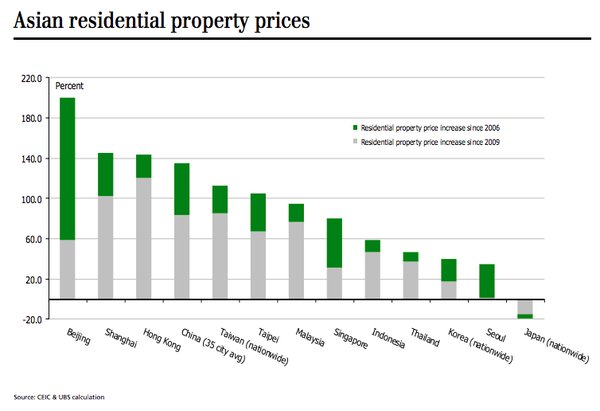

6. This last chart shows Asian residential property price changes since 2006 and since 2009.

Source: UBS, @joshdigga

Switching to China, here are some observations.

1. The onshore-offshore renminbi spread is starting to widen again. More capital outflows?

2. Stuff from China coming into the US is getting progressively cheaper. A portion of this is steel dumping.

3. Speaking of steel dumping, some are predicting more cheap imports coming into the US. This sent US Steel shares sharply lower.

Source: Bloomberg.com

Source: Google

4. Below is a comment from Credit Suisse on the collapse of speculative activity in China’s steel markets. This has been a spectacular shift in sentiment.

Source: Credit Suisse

Source: @barchart

Source: @barchart

Japan’s April service sector sentiment fell to the weakest level since 2014. This is the Economy Watchers Survey which targets individuals working at consumer-oriented firms (barbers, taxi drivers, waiters, etc.)

Leave A Comment