Greetings,

We start the week with the United States where we continue to see signs of economic improvement in the second quarter.

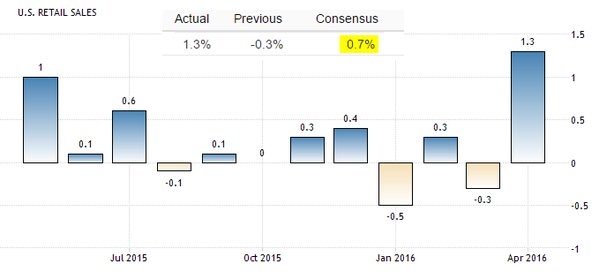

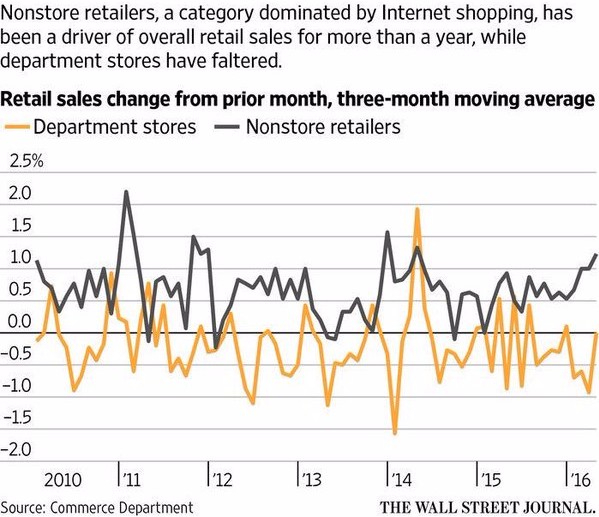

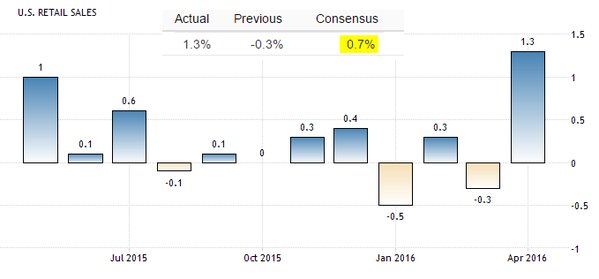

1. US retail sales in April grew at the fastest rate in over a year, beating economists’ forecasts. Note that much of that improvement was driven by online sales.

Source: @WSJ, h/t Jake

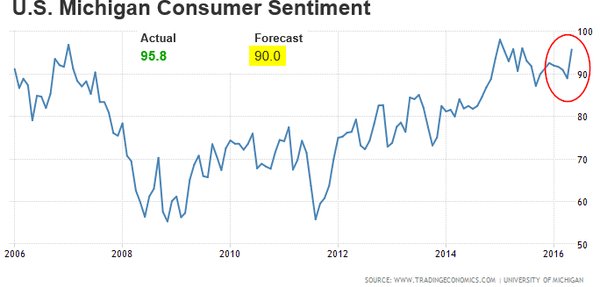

2. Consumer sentiment also unexpectedly rose to the highest level in a year.

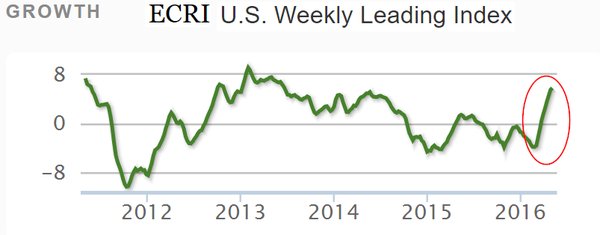

3. The ECRI index of leading indicators has been rising at the fastest rate in about two years.

Source: ECRI

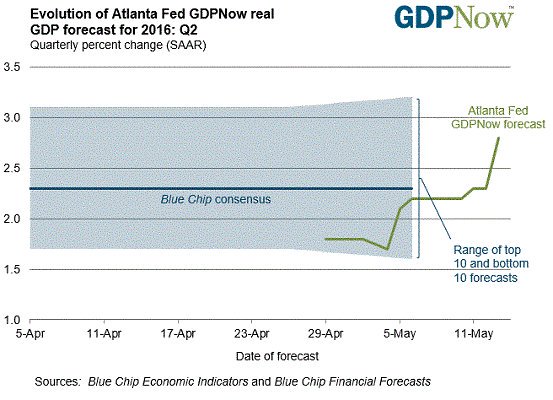

4. The AtlantaFed GDPNow Q2 GDP tracker also rose sharply. At this point, it seems to be on the high side although not nearly as bad of an overshoot as we had in early Q1.

Source: @AtlantaFed, h/t @MarathonWealth

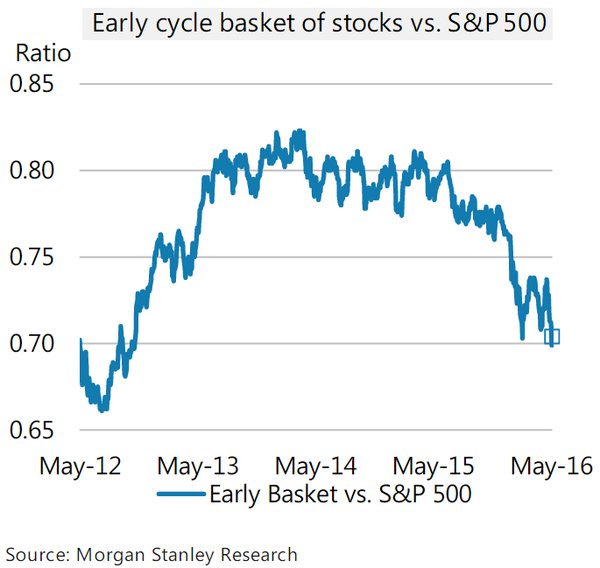

Morgan Stanley, however, is warning that these positive economic surprises in the US may be short-lived. Here is why.

Source: Morgan Stanley

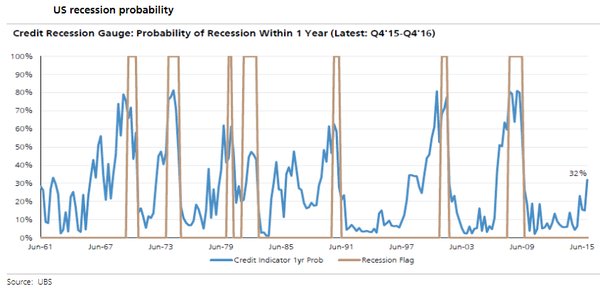

Moreover, the UBS credit-based US recession probability indicator has risen significantly.

Source: UBS

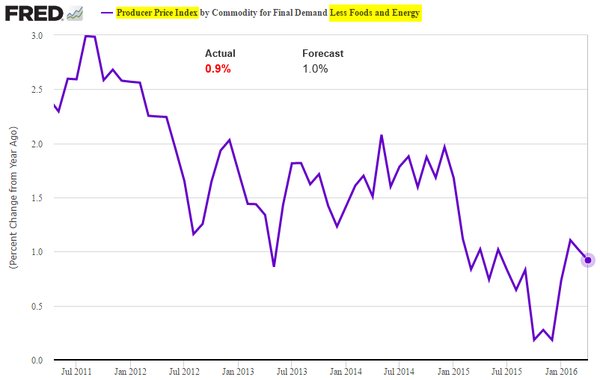

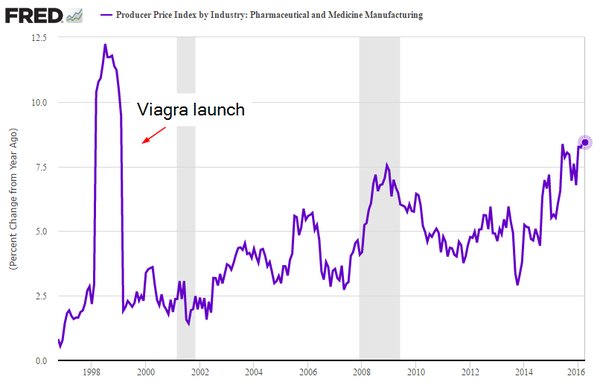

Continuing with data out of the US, the PPI was softer than expected. Pricing power at the wholesale level remains elusive and margins are often under pressure.

One area where wholesale prices are surging is pharmaceuticals. The last time drug prices rose this quickly was after Viagra’s initial introduction. This next chart got a few chuckles on Twitter.

h/t @MarketWatch

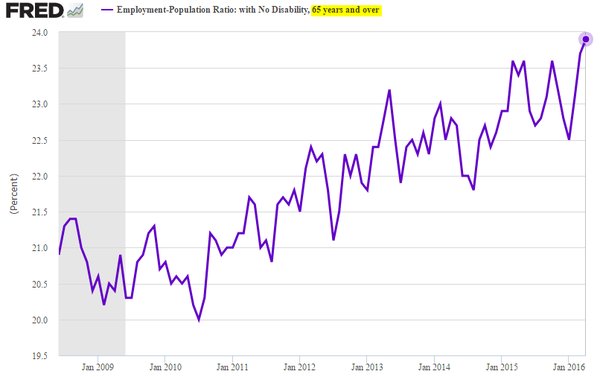

The last chart on the US shows an increasing percentage of older Americans still working.

h/t Bloomberg

Separately, if you have a moment, please click on our 2-question survey about the Fed asking “if” and “when.” The results will be published here in a couple of days.

Next, let’s take a look at a few developments in the US equity markets.

1. Here is the S&P retail index vs. the S&P500 relative performance. US retail firms have been hammered.

Leave A Comment