Greetings,

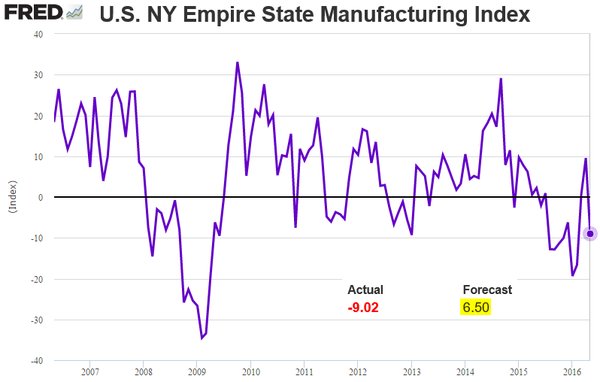

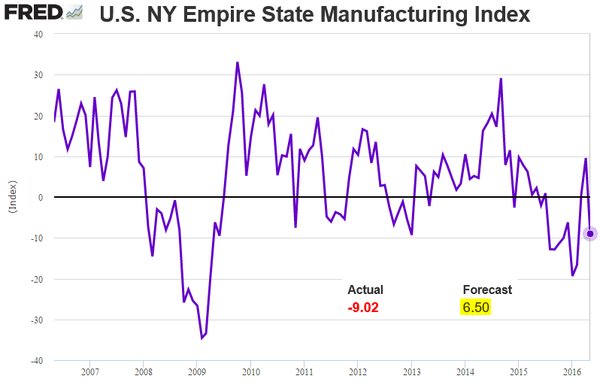

1. Once again, let’s start with the United States where the New York area (Empire) manufacturing activity fell back into contraction mode

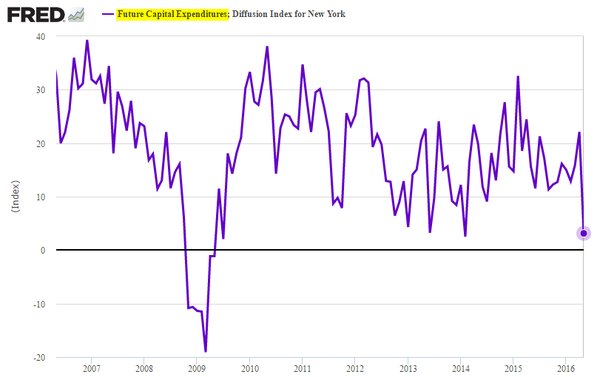

The survey showed CAPEX expectations falling sharply. If we see similar results from other Fed regions, the manufacturing recovery in the US may take significantly longer than some have been expecting.

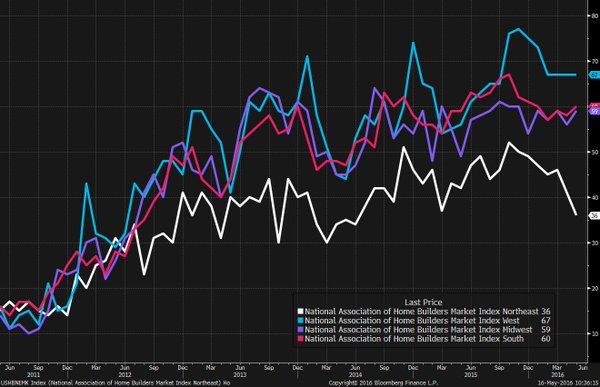

2. US homebuilder optimism remained unchanged in the latest report but the regional breakdown shows the Northeast sentiment deteriorating (while stable elsewhere).

Source: ?@TheStalwart

3. The Atlanta Fed wage growth tracker is approaching 3.5% (year-over-year growth). Are we finally seeing evidence of improving wage growth?

Source: Atlanta Fed

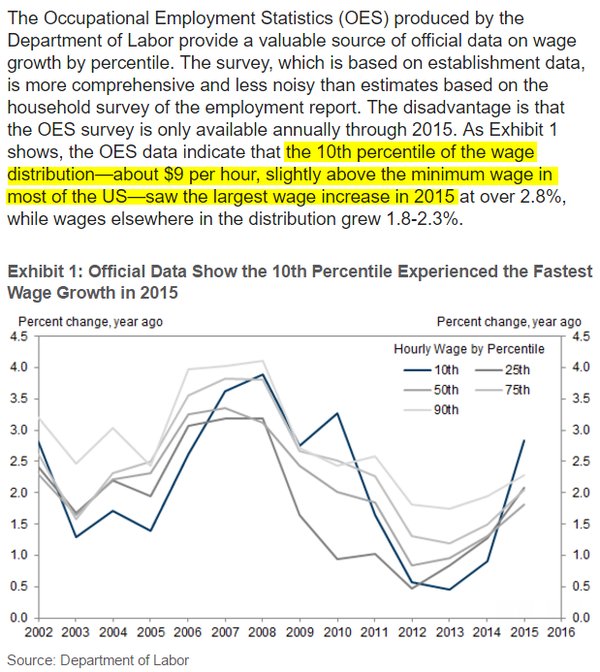

4. Related to the above, wage growth in the US has been the fastest for the lowest paid workers in 2015. Here is a summary from Goldman Sachs.

Source: Goldman Sachs

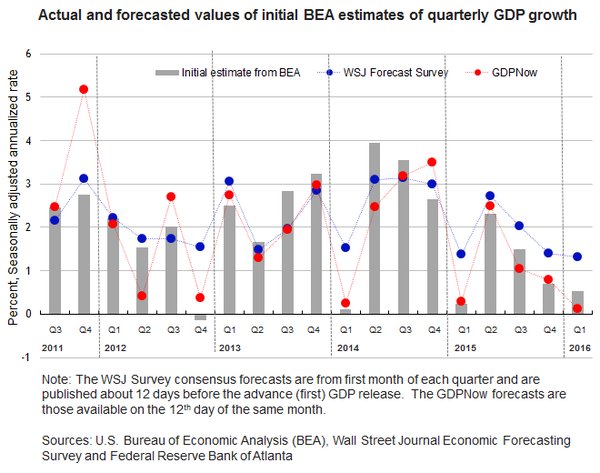

5. We often discuss the Atlanta Fed GDP tracker called GDPNow. How accurate is it relative to economists’ forecasts? Apparently GDPNow is no worse than the forecasters’ survey average.

Source: @MarathonWealth, @BobBrinker

6. The treasury curve (10y – 2y) is now the flattest it has been since 2007. Markets are discounting improvements in the nation’s growth rate.

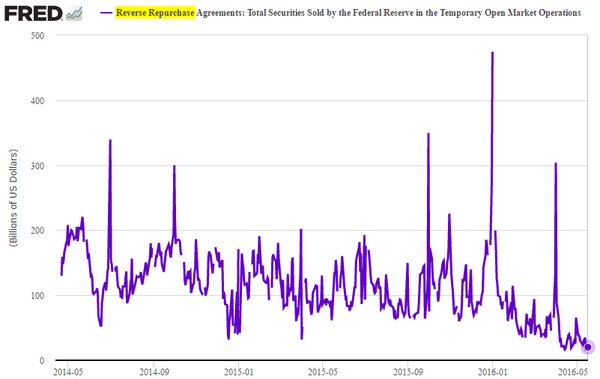

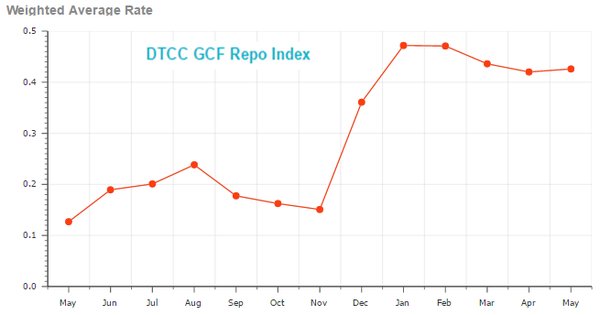

7. Demand for the Fed’s RRP (reverse repo program – paying 25bp) remains weak, as the private sector repo rates stay above 40bp.

Source: DTCC

1. Turning to the Eurozone, Moody’s upgraded Ireland’s sovereign debt, projecting a better-than-expected economic outlook for the nation. Bond yields fell in response.

Source: @fastFT

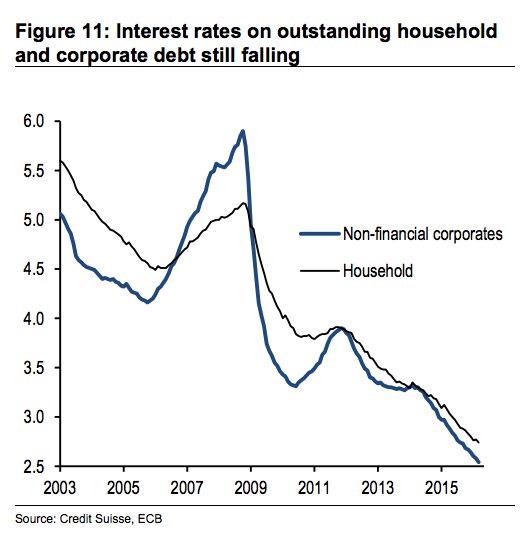

2. The ECB’s monetary transmission, while having taken a while to materialize, seems to be working now as debt cost for the “real economy” is falling.

Source: Credit Suisse, @joshdigga

3. Greek 10y government debt yield is back below 7.5%. Amazing.

Leave A Comment