Greetings,

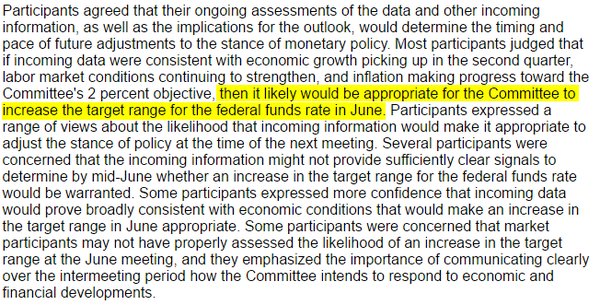

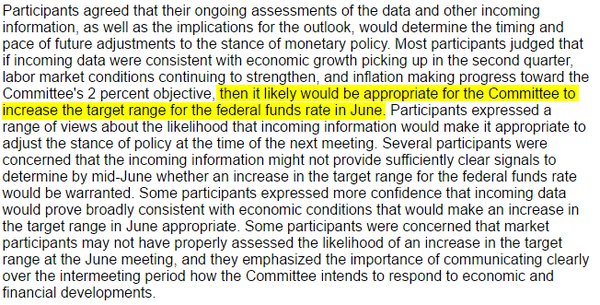

We start with the United States where the Federal Reserve struck a decisively hawkish tone. On Tuesday, we heard the Fed’s Dennis Lockhart and John Williams discuss the possibility of 2-3 rate hikes in 2016. On Wednesday, the FOMC minutes showed that the central bank has left a June rate hike possibility on the table. Here is the key paragraph.

Source: FOMC minutes

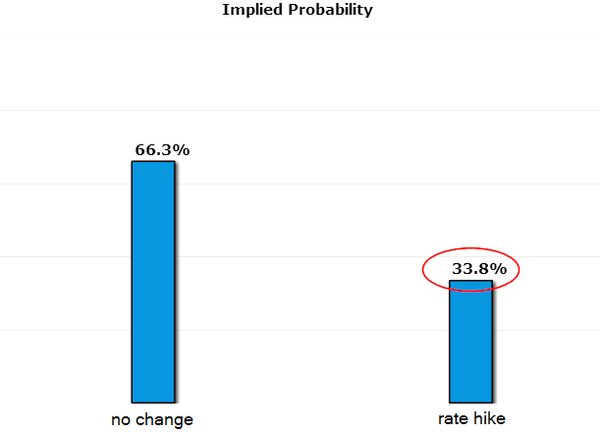

The markets started adjusting quickly to this new reality. The June rate hike odds implied by the futures markets rose above 1:3.

Source: CME

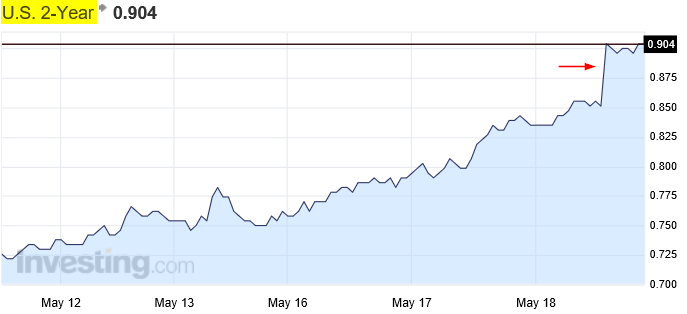

Source: @business

Treasuries sold off sharply – this time across the curve. The 2-year yield rose above 0.9%.

The 10-year yield is now approaching 1.9%.

Source: @barchart

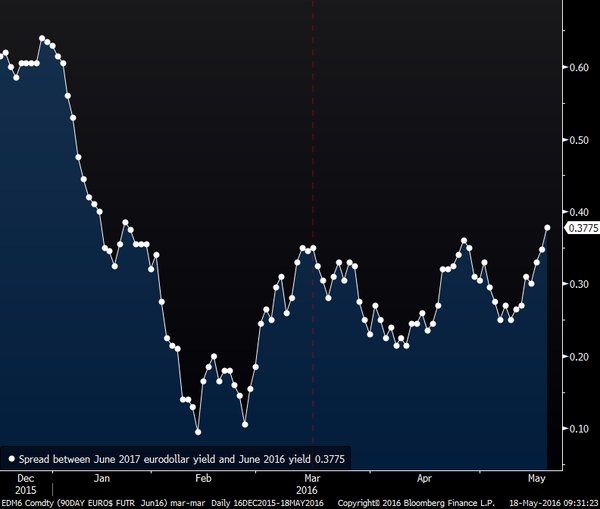

The yield curve steepened at the short end in response to the FOMC. The chart below shows June 2017 – June 2016 LIBOR futures spread.

Source: ?@boes_

US bank shares rose by over 4% on the day in response to a steeper curve (higher sloping yield curve usually improves banks’ interest margin).

Source: Ycharts.com

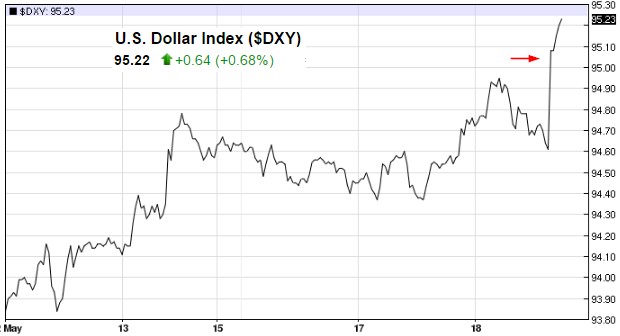

Volatility returned to the currency markets as the dollar index (DXY) shot past 95.

Source: @barchart

And dollar-yen broke through 110.

Source: @barchart

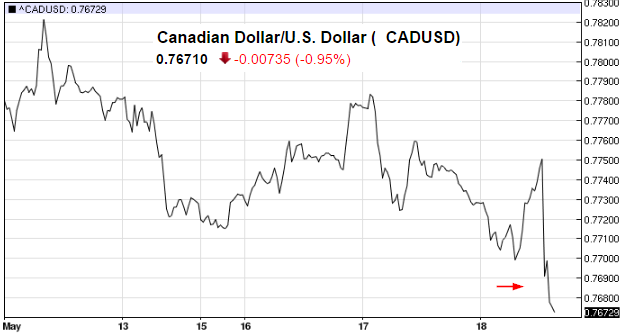

Both Canadian and Australian dollars fell sharply.

Source: @barchart

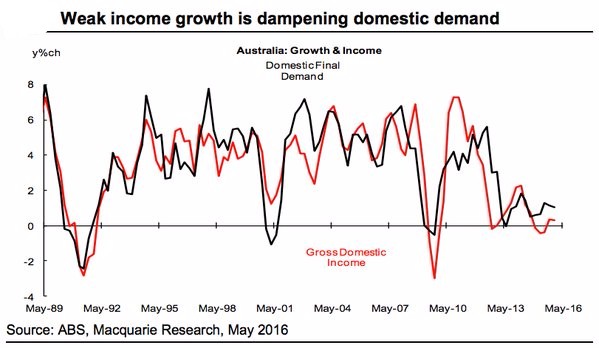

As an aside, Australia’s falling wage growth (discussed yesterday) and weakening domestic demand exacerbated the currency descent.

Source: Macquarie, ?@joshdigga

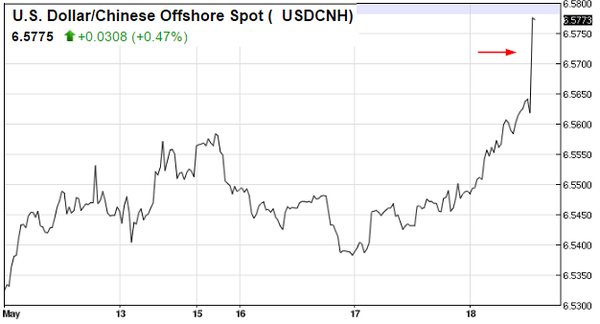

One of the more troubling currency moves in response to the FOMC minutes was the drop in the offshore yuan. Are the markets ready for more RMB depreciation and capital outflows from China?

Source: @barchart

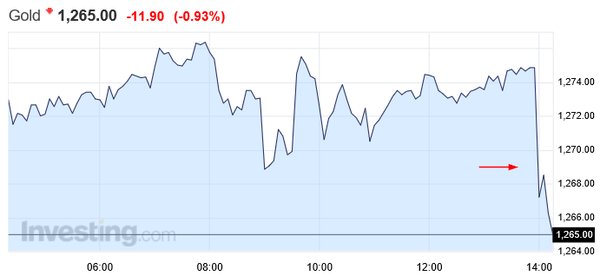

In commodities markets, we finally saw gold come under pressure.

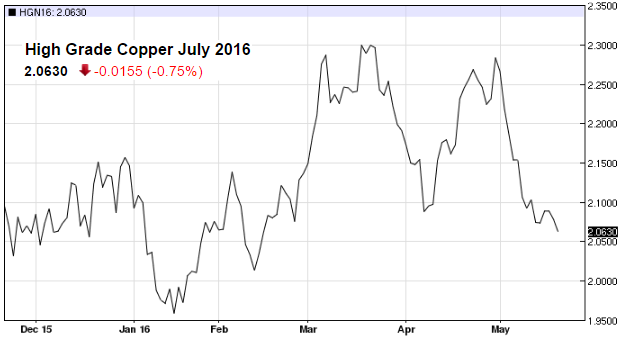

Copper which has been selling off for some time now fell further.

Source: @barchart

Metals & mining shares gave up 6% on the day in response (gold miners were down 7%).

Leave A Comment