Greetings,

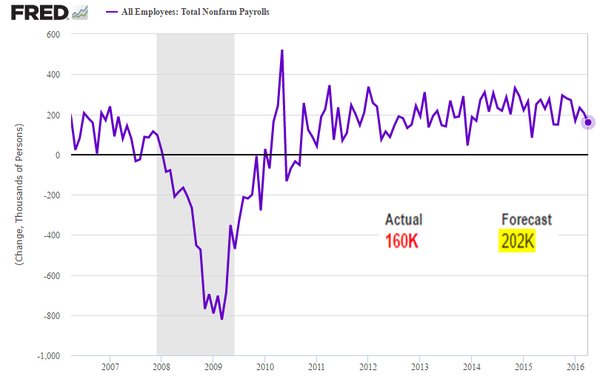

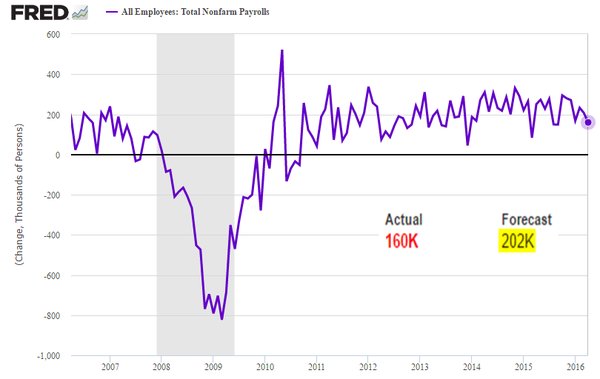

We begin with the United States, where weaker than expected jobs report resulted in Barclays, Merrill Lynch, and others to revise forecasts for the number of Fed rate hikes in 2016. Most economists now expect only one hike in 2016 (in September) – down from two.

Below are a few other observations on the payrolls report that weren’t covered by the financial media.

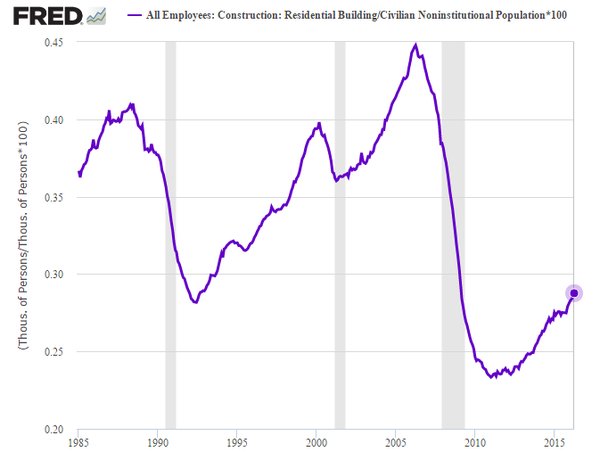

1. The percentage of Americans employed in residential construction is rising but remains at pre-recession lows.

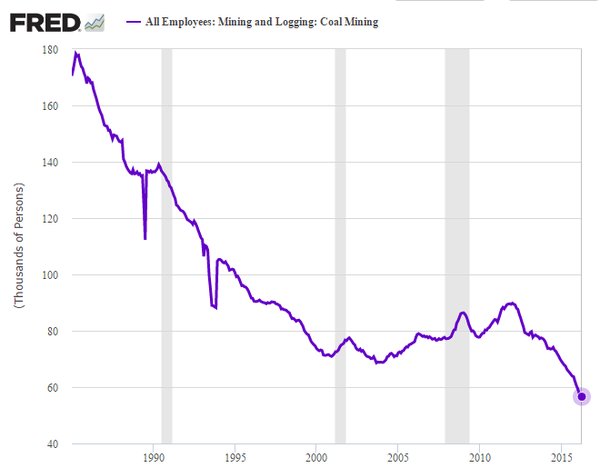

2. Coal mining jobs in the United States are quickly disappearing.

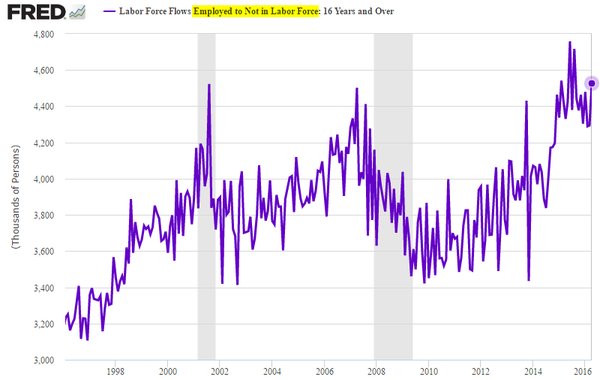

3. Americans are still leaving the labor force in large numbers. Much of this is retirement and stay-home parents. It is important to point out that many Americans who have the ability to leave the labor force find that salaries and small business earnings are too low to make it worthwhile for them to stay.

Next, we look at some developments in US credit.

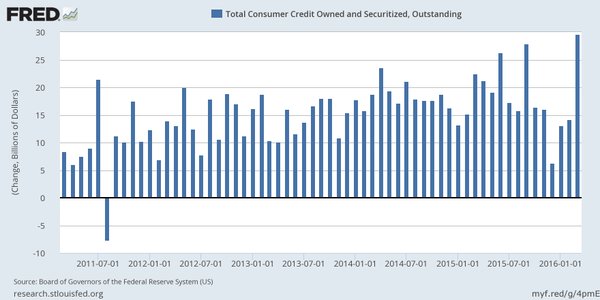

1. According to the Fed, “outstanding US consumer credit rises by almost $30 billion in a month to $3.59 trillion”.

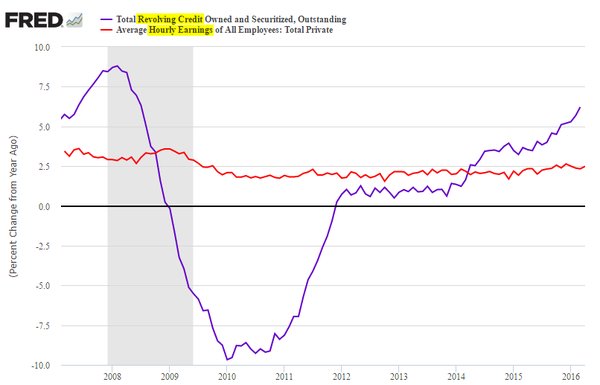

2. Some of this spike in consumer credit comes from rising credit card debt which now far exceeds growth in US wages (year-over-year).

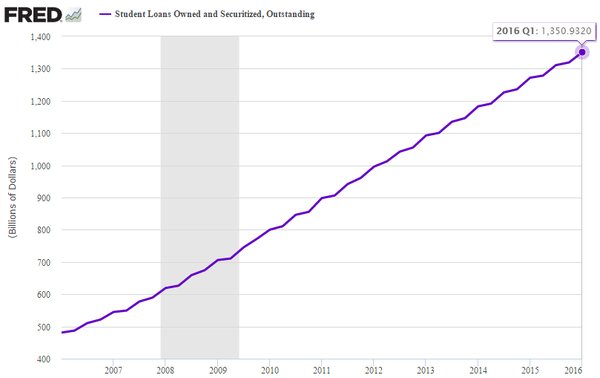

3. Of course the pace of US student debt growth continues on its unsustainable path.

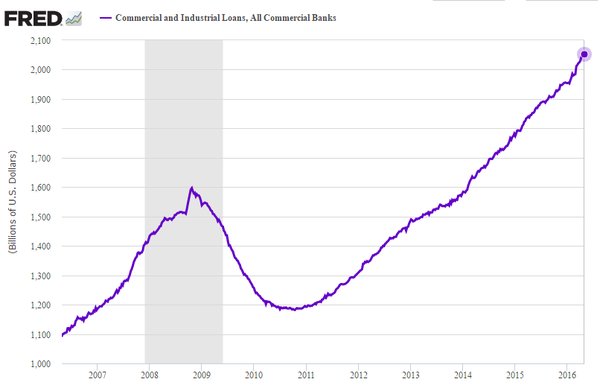

4. Corporate loans on US banks’ balance sheets are still hitting new records. Once again, as of now there doesn’t seem to be much of an impact (broadly) from tighter corporate lending conditions.

Below are two other interesting trends in the US.

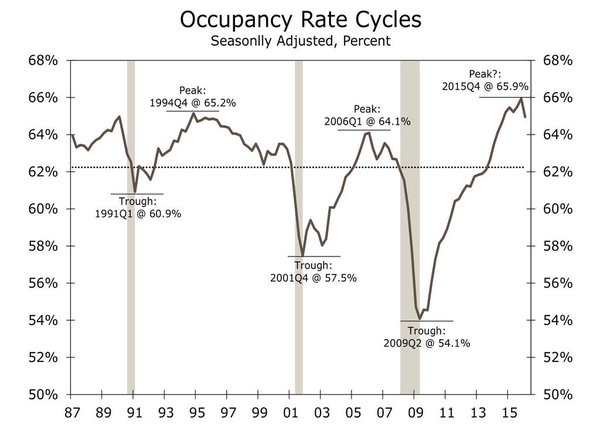

1. Has the US hotel occupancy peaked?

Source: @PlanMaestro, h/t Jake

2. The ECRI US index of leading indicators is rising, suggesting that Q2 growth should be materially stronger than Q1.

Source: ECRI

The last item on the US economy comes from Goldman Sachs who has cut its forecast for rate hikes by two. GS expects the next hike to be in July rather than September. The explanation for the change in the forecast is important. It has to do with the increased sensitivity of the financial conditions index to rate hikes.

Leave A Comment