The Eurozone

Once again, we start with the Eurozone where economic activity has picked up momentum (based on Markit PMI reports).

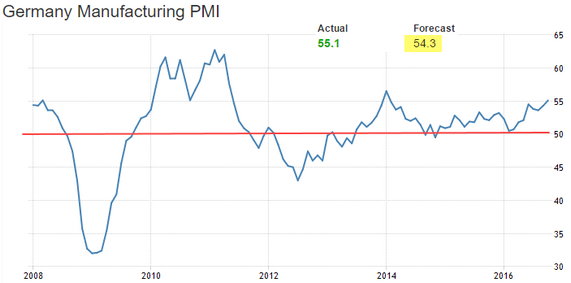

German manufacturing sector is expanding at the fastest pace since early 2014.

Source: @MarkitEconomics, @tEconomics

Moreover, German service business activity unexpectedly bounced from a three-year low.

Source: @MarkitEconomics, @tEconomics

At the Eurozone level, the composite PMI (both manufacturing and services) also surprised to the upside.

It’s worth noting that the ECB pays close attention to these reports, which would suggest that the next major policy announcement from Mr. Draghi will be some details of the QE taper.

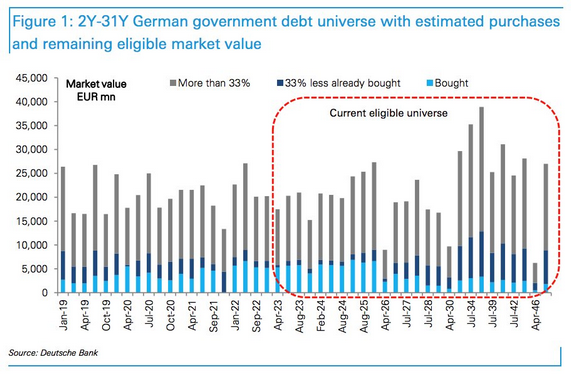

Even if the ECB wanted to change the securities purchases strategy from the capital key ratio to the amount outstanding by country, the deficit of QE-eligible German bonds would persist. Balance sheet expansion at the current pace can not be sustained for much longer.

Source: Deutsche Bank, @joshdigga

Source: Deutsche Bank, @joshdigga

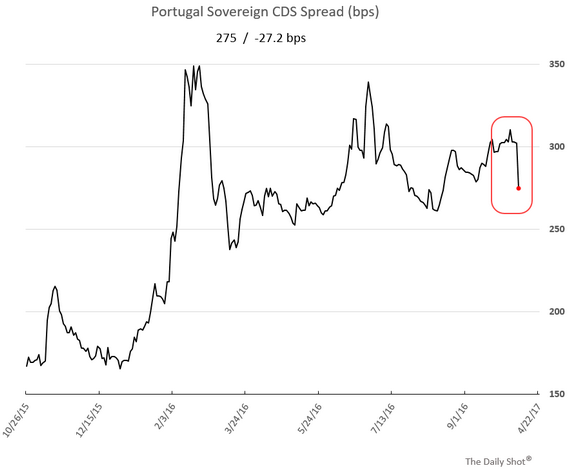

1. In other Eurozone developments, DBRS’ maintaining of Portugal’s rating not only brought down bond yields but also resulted in a lower sovereign CDS spread.

Source: Bloomberg

2. Meanwhile, here is Portugal’s banking system nonperforming loan ratio by sector.

Source: DBRS, @joshdigga

3. As Banca Monte dei Paschi’s management prepares to announce the “plan” to save the bank, shares continue to rally. That “+31%” is not a typo. Seems a bit overdone.

In fact, banks across Europe continue to rally – up seven days in a row.

4. Is the euro too weak? The 2yr real rate differential between the US and the Eurozone is close to zero, while the euro continues to move lower against the dollar.

Source: @auaurelija

The United Kingdom

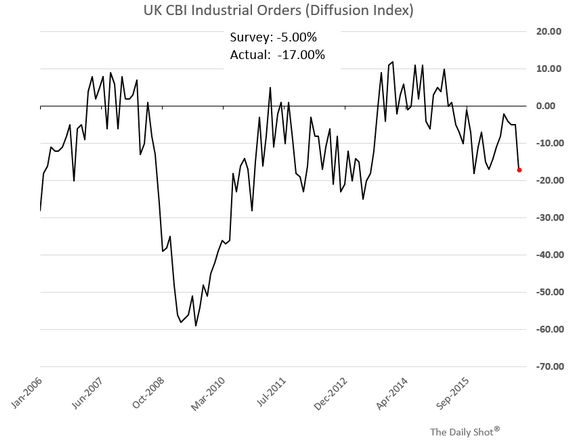

1. The UK’s industrial orders index came in well below consensus.

2. On the other hand, UK exporters are becoming more hopeful that the weak pound will give them an edge.

Leave A Comment