The European Central Bank currently buys 60 billion euros a month of debt, of which about 50 billion euros is from the public sector and 7 billion euros is corporate. Covered bonds and asset-backed securities make up the rest.

Monthly purchases are scheduled to drop to 30 billion euros in January, opening the prospect of allowing corporate purchases to make up a larger share.

Central bank policy rates in the Zone are expected to remain on hold well past the end of asset purchases and until inflation is clearly and persistently escalating. The euro area fiscal stance is also expected to be slightly expansionary in 2018 and 2019.

There has been considerable criticism of the ECB’s corporate buying program, since some critics have argued that large companies, which have the greatest access to bond markets, are using cheap cash to finance share buybacks rather than boost investment spending.

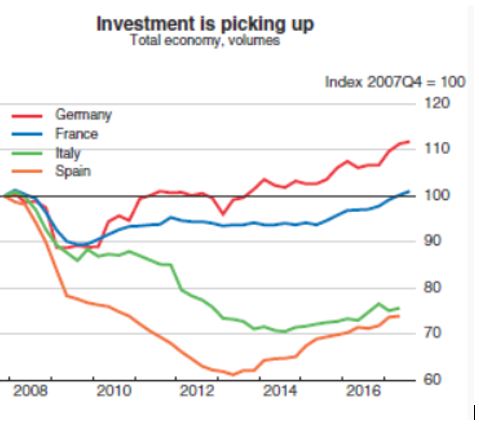

Capital expenditure among European companies is expected to remain flat in 2017, though grow modestly in 2018 for the first expansion in five years.

Euro Area Investment Spending

Source: OECD Economic Forecast, November 2017

Leave A Comment